The simulation software market size is calculated at USD 27.45 billion in 2025, grew to USD 31.25 billion in 2026, and is projected to reach around USD 100.34 billion by 2035. The market is expanding at a CAGR of 13.84 % between 2026 and 2035.

The U.S. simulation software market size is calculated at USD 7.41 billion in 2025 and is expected to reach nearly USD 27.09 billion in 2035, accelerating at a strong CAGR of 12.51% between 2026 and 2035.

The market is growing rapidly, driven by demand in engineering, manufacturing, automotive, aerospace, healthcare, and training applications, alongside advances in AI, digital twins, and high-performance computing. The growing demand for advanced gaming software from the youths is expected to drive the growth of the simulation software market.

The rise of Industry 4.0 and virtual prototyping is accelerating adoption across global enterprises. Increasing integration of cloud-based platforms is also making simulation tools more accessible and scalable for organizations of all sizes.

AI has contributed significantly to the simulation software industry. The integration of AI is in simulation software helps in accelerating and enhancing the simulation process by enabling faster innovation and development of realistic models.

| Report Coverage | Details |

| Market Size in 2026 | USD 31.25 Billion |

| Market Size by 2035 | USD 100.34 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 13.84% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Component, By Deployment, By Application, By End Use, By Geography |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

Collaborations

Numerous software companies have collaborated with semiconductor companies to develop advanced simulation software for the end-users. For instance, in September 2025, Siemens collaborated with TSMC. This collaboration is done for designing simulation software for the semiconductor industry.

Opening of New Innovation Centres

The software brands are opening up new innovation centres for the accelerating the research and development of simulation software. For instance, in September 2025, Uneekor inaugurated a new innovation center in Dallas, Texas, U.S. This new center is opened to enhance the R&D of golf simulation software.

The popularity of cloud software has increased significantly due to its enhanced security and improved usability. For instance, in August 2025, KBC launched a cloud-based simulation software. This software is designed for the petrochemical industry across the APAC region.

The popularity of industry 4.0 has grown significantly in numerous countries to enhance the capabilities of the manufacturing sector. This trend is expected to create upcoming growth opportunities for the market players in the future.

The aerospace companies have started deploying cloud-based simulation software for deriving the outcomes of the real-flight experience, thereby driving the industry in the upcoming years.

The software segment led the market. The adoption of AI-based simulation software by the manufacturing sector for detecting faults in finished products has boosted the market expansion. Also, rapid investment by government of several nations for developing the software industry is playing a vital role in shaping the industrial landscape. Moreover, numerous advantages of simulation software including faster time-to-market, reduced costs and risks and improved product quality and efficiency is expected to accelerate the growth of the simulation software market.

The on-premise segment dominated the industry. The growing adoption of on-premises simulation software by the aerospace sector in several nations including Netherlands, Canada, Australia, and some others has boosted the industrial expansion. Also, partnerships among software development companies and automakers to deploy advanced simulation software in their testing centres is playing a vital role in shaping the industrial landscape. Moreover, several advantages of on-premises software such as enhanced security, superior customization, predictable performance and some others is expected to propel the growth of the simulation software market.

The engineering, research, modelling & simulated testing segment held the largest share of the simulation software industry. The growing demand for research software from the aerospace sector has boosted the market expansion. Also, technological advancements in the semiconductor manufacturing sector is playing a prominent role in shaping the industry in a positive manner. Moreover, the surging emphasis of oil and gas companies to deploy simulated testing software is expected to foster the growth of the simulation software market.

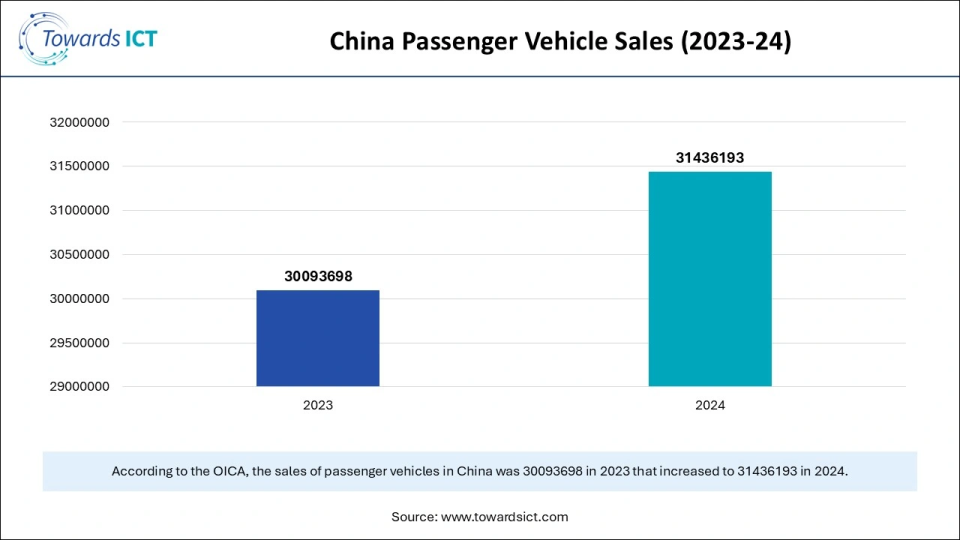

The automotive segment held the dominant share of the simulation software market. The rapid expansion of the automotive sector in several nations including the UK, Germany, U.S., China and some others has boosted the market growth. Additionally, several government initiatives aimed at developing the car manufacturing sector is playing a vital role in shaping the industrial landscape. Moreover, the surging sales of passenger vehicles in different parts of the world is expected to drive the growth of the simulation software market.

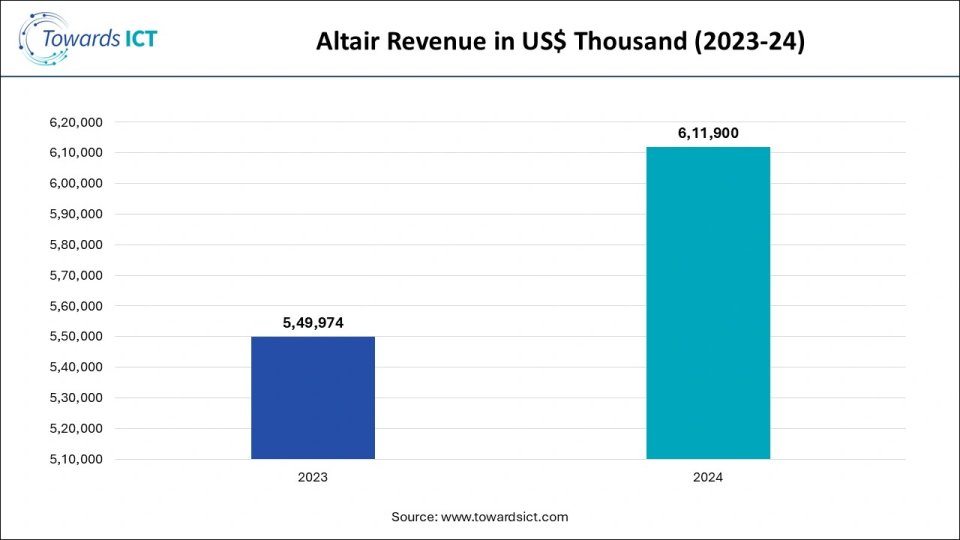

North America led the simulation software market. The growing adoption of cloud-based simulation software from the manufacturing sector in the U.S. and Canada has boosted the market expansion. Additionally, partnerships among software companies and automotive brands for deploying advanced software in the car manufacturing centres is playing a prominent role in shaping the industrial landscape. Moreover, the presence of numerous market players such as Altair Engineering, Inc., Autodesk Inc., Ansys, Inc., Simulations Plus and some others is expected to foster the growth of the simulation software market in this region.

U.S. is the major contributor in this region. The increasing focus of software developers to design several types of simulation software for the healthcare sector has boosted the market expansion. Moreover, technological advancements in the logistics industry is playing a vital role in shaping the industry in a positive direction.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The rising demand for advanced simulation software from the mining sector in several nations including China, India, Japan, South Korea and some others has boosted the market growth. Additionally, the rise in number of software startups coupled with technological advancements in the energy and utilities industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous market players such as SIMCom Wireless Solutions, Beijing Sunm China Technology, Beijing Shuohe Technology and some others is expected to drive the growth of the simulation software market in this region.

China is the prominent contributor in this region. The rapid expansion of the oil and gas industry coupled with surging demand for advanced gaming experience has driven the market expansion. Additionally, numerous government initiatives aimed at developing the semiconductor industry is playing a vital role in shaping the industrial landscape.

Europe held a notable share of the industry. The surging adoption of simulation software by the aerospace sector in several countries including Germany, France, Italy, UK and some others has boosted the market expansion. Additionally, rapid investment by software development companies for developing simulation software coupled with rise in number of coal mines is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Siemens, Dassault Systèmes, COMSOL Multiphysics and some others is expected to propel the growth of the simulation software market in this region.

UK contributed significantly to the market in this region. The rising demand for AI-integrated simulation software from the electronics industry has driven the market growth. Also, technological advancements in the energy and utilities sector coupled with rise in number of logistics companies is playing a prominent role in shaping the industrial landscape.

| Company | Headquarters | Offerings |

| Altair Engineering, Inc. | Michigan, USA | Altair Engineering, Inc. is a global technology company that provides software and cloud solutions for simulation, high-performance computing (HPC), data analytics, and artificial intelligence (AI). |

| Autodesk Inc. | Califoia, USA | Autodesk, Inc. is a multinational software company that provides 3D design, engineering, and entertainment software, with a focus on architecture, engineering, construction, manufacturing, and media and entertainment industries. |

| Ansys, Inc. | Pennsylvania, United States | Ansys, Inc. is a global company that develops and markets engineering simulation software. This company provides tools for predicting how product designs will perform in real-world environments, across various industries such as automotive, aerospace, and healthcare |

| Bentley Systems, Incorporated | Pennsylvania, USA | Bentley Systems is a public software company headquartered in Exton, Pennsylvania, specializing in infrastructure engineering software. This company provides products that help professionals design, build, and operate infrastructure such as roads, bridges, and utilities |

| Dassault Systèmes | France | Dassault Systèmes is a French company that provides 3D design, virtual twin, and product lifecycle management (PLM) solutions. It provides software for 3D modeling, digital mockups, and product engineering. |

| The MathWorks, Inc. | Massachusetts, United States | MathWorks, Inc. is a privately held American company, founded in 1984, This develops mathematical computing software for engineers and scientists, |

| Rockwell Automation, Inc. | Milwaukee, U.S. | Rockwell Automation, Inc. is a global leader in industrial automation and digital transformation, headquartered in Milwaukee, Wisconsin. The company provides a wide range of products and services, including control systems, software such as FactoryTalk, and lifecycle services |

| Simulations Plus | Califoia, United States | Simulations Plus is a software company that develops and provides modelling and simulation tools for the pharmaceutical and biotechnology industries to accelerate drug discovery and development |

| ESI Group | Bagneux, France | ESI Group is a French company that specializes in Virtual Prototyping software and services, helping manufacturers to virtually test and certify products. |

| GSE Systems | Maryland, United States | GSE Systems (now known as GSE Solutions) is a provider of engineering services, expert staffing, and simulation software for the power and process industries. The company offers solutions for training, design, and operations to help clients improve performance and safety. |

By Component

By Deployment

By Application

By End Use

By Geography