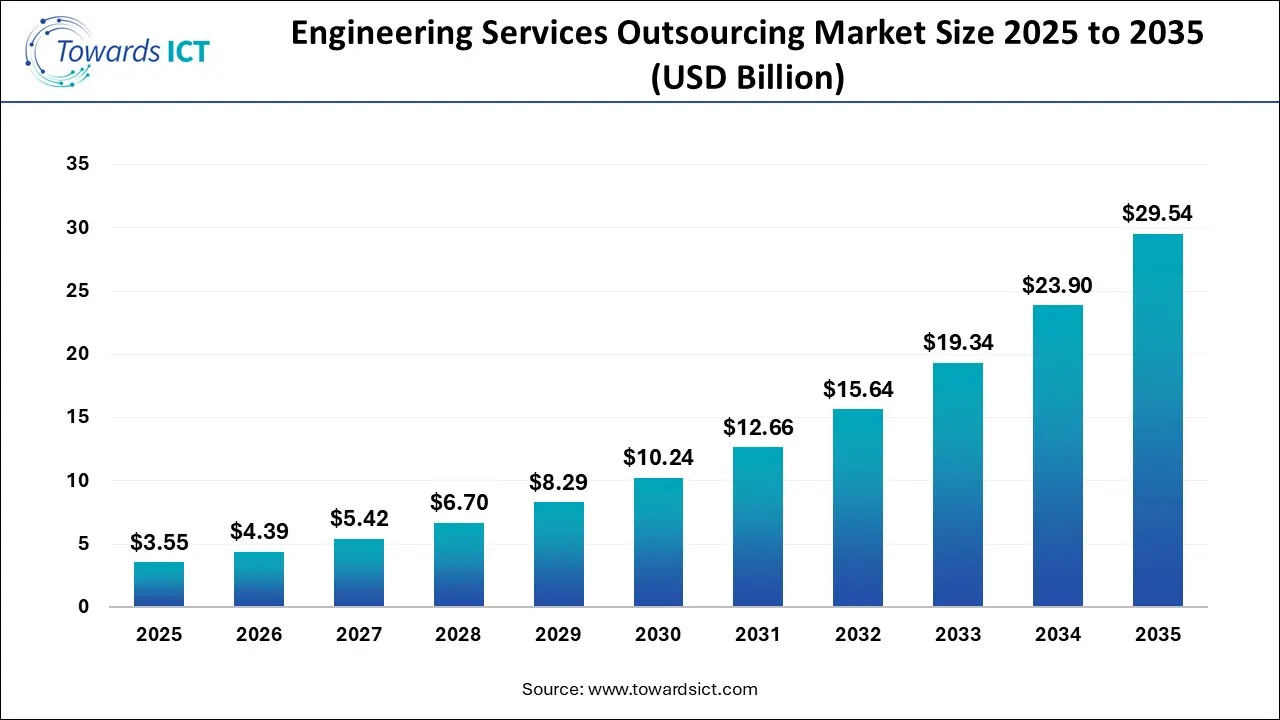

The global engineering services outsourcing market size was estimated at USD 3.55 billion in 2025 and is predicted to increase from USD 4.39 billion in 2026 to approximately USD 29.54 billion by 2035, expanding at a CAGR of 23.6% from 2026 to 2035. The rapid expansion of the aerospace sector is expected to drive the growth of the engineering services outsourcing market.

The Engineering Services Outsourcing (ESO) market is undergoing strong and sustained growth as companies across industries seek to accelerate innovation, reduce operational costs, and access specialized engineering expertise. Demand is being driven by rapid digital transformation, growing adoption of Industry 4.0 technologies, and increased complexity in product development across sectors such as automotive, aerospace, manufacturing, energy, telecom, and healthcare. Organizations are increasingly outsourcing functions including product design, simulation, testing, prototyping, embedded systems, and engineering analytics to global service providers that offer advanced capabilities, scalable talent pools, and shorter development cycles.

AI has played a crucial role in the engineering services outsourcing industry. The integration of AI in engineering services outsourcing helps in automating routine tasks, enhancing efficiency, cost cutting, and improving quality by handling data-heavy processes, enabling fast design cycles, optimizing infrastructure and some others.

| Report Coverage | Details |

| Market Size in 2026 | USD 4.39 Billion |

| Market Size by 2035 | USD 29.54 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 23.6% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Services, By Location, By Application, By Regional |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

Numerous engineering companies have collaborated with aircraft brands to provide engineering services. For instance, in October 2025, Expleo collaborated with Deutsche Aircraft. This collaboration is done for providing engineering services to the aircraft brands.

The market players have started launching numerous outsourcing services to the cater the needs of the end-users. For instance, in November 2025, Easy H Trade launched an outsourced export management service. This service is designed for the end-user industries of Egypt.

The growing development in the defence sector is expected to create growth opportunities for the market players in the future.

The advancements in several technologies such as IoT and generative AI associated with the manufacturing sector is likely to reshape the industry in the upcoming years.

How did the Testing Segment Dominated the Engineering Services Outsourcing Market in 2024?

The testing segment led the engineering services outsourcing market. The growing emphasis of automotive brands to deploy third-party engineering solutions for enhancing product testing has boosted the market expansion. Moreover, collaborations among ESO providers and healthcare companies for delivering advanced testing solutions in different parts of the world is expected to propel the growth of the engineering services outsourcing market.

The designing segment is expected to grow with the highest CAGR during the forecast period. The increasing focus of semiconductor companies to deploy ESO solutions for enhancing designing capabilities has boosted the market expansion. Additionally, joint ventures among tech providers and aerospace companies to deploy advanced ESO solutions in the aircraft manufacturing sector is expected to drive the growth of the engineering services outsourcing market.

Why On-Shore Segment Led the Industry in 2024?

The on-shore segment dominated the industry. The growing emphasis of telecom operators to deploy third-party ESO solutions from other brands has boosted the market expansion. Moreover, numerous advantages of on-shore ESO including regulatory compliance, seamless communication, cultural alignment, increased control and some others is expected to drive the growth of the engineering services outsourcing market.

The off-shore segment is expected to expand with the fastest CAGR during the forecast period. The rising focus of automotive and aerospace brands to deploy engineering services from multinational companies has driven the market growth. Additionally, several advantages of off-shore ESO such as enhanced quality control, stronger IP protection, superior reliability and some others is expected to accelerate the growth of the engineering services outsourcing market.

What Made the Manufacturing Segment Dominant in the Engineering Services Outsourcing Market in 2024?

The manufacturing segment held the largest share of the engineering services outsourcing market. The growing emphasis of the manufacturing companies for outsourcing their testing activities to third-party service providers has boosted the market expansion. Moreover, partnerships among manufacturing brands and tech providers to deploy ESO solutions is expected to propel the growth of the engineering services outsourcing market.

The healthcare segment is expected to grow with the highest CAGR during the forecast period. The rapid expansion of the healthcare industry in several nations including the U.S., China, India, France and some others has boosted the market growth. Additionally, technological advancements in the healthcare sector is expected to boost the growth of the engineering services outsourcing market.

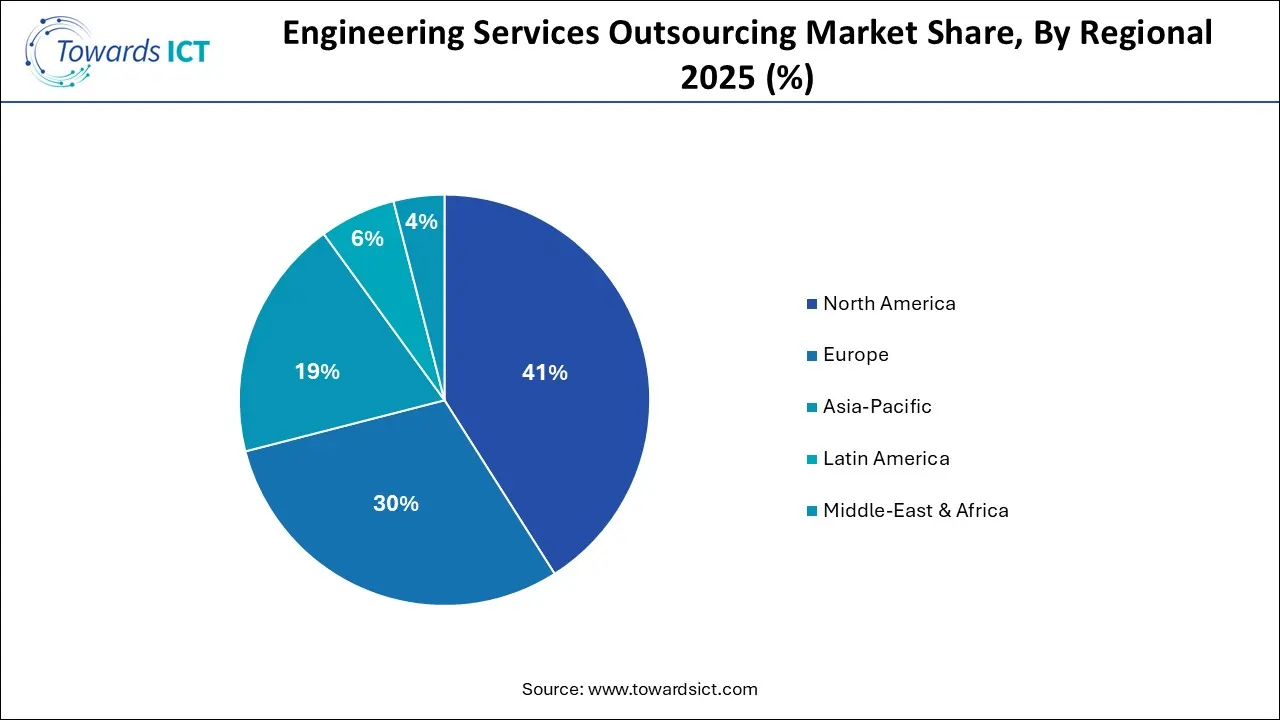

Asia Pacific led the engineering services outsourcing market. The rising demand for testing-based outsourcing from the electronics industry in different nations including China, India, Japan, South Korea and some others has driven the market expansion. Moreover, numerous government initiatives aimed at digitalizing the healthcare sector coupled with the presence of various market players such as TCS, Wipro, Tech Mahindra and some others is expected to drive the growth of the engineering services outsourcing market in this region.

.jpg)

Japan is the major contributor in this region. The growing emphasis of the automakers to outsource prototyping services to third-party vendors has driven the market growth. Additionally, rapid expansion of the construction sector coupled with technological advancements in the utilities sector is playing a prominent role in shaping the industrial landscape.

North America is expected to rise with the fastest CAGR during the forecast period. The rapid expansion of the automotive industry in several countries including the U.S., Canada, Mexico and some others has boosted the market expansion. Moreover, rapid investment by government for developing the aerospace sector along with rise in number of electronic startups is expected to propel the growth of the engineering services outsourcing market in this region.

The U.S. is a significant contributor in this region. The rising adoption of ESO by telecom companies for testing and prototyping has driven the market growth. Additionally, rapid expansion of the energy and construction sector is contributing to the industry in a positive manner.

Europe held a significant share of the industry. The growing demand for ESO solutions from the manufacturing industry in several nations such as Germany, France, Italy, UK, Netherlands and some others has boosted the market expansion. Also, rapid expansion of the semiconductor and electronics industry coupled with the presence of several market players such as Capgemini, Alten Group and some others is expected to foster the growth of the engineering services outsourcing market in this region.

UK led the market in this region. The rising adoption of system integration solutions by the manufacturing companies along with rapid investment by government for developing the aerospace sector has driven the market expansion. Moreover, the growing emphasis of telecom companies for expanding the 5G infrastructure is playing a vital role in shaping the industrial landscape.

| Company | Headquarters | Offerings |

| AKKA Technologies | Belgium, Europe | AKKA Technologies is a leading European engineering & R&D consultancy, known for tech services in mobility (auto, aero, rail), life sciences, telecom, and energy, focusing on digital innovation (AI, IoT, Big Data) across product lifecycles. |

| Alten Group | France, Europe | The ALTEN Group is a multinational company specializing in engineering and technology consulting, supporting innovation and digital transformation for major clients in sectors including Aerospace, Automotive, Telecom, Energy, and Life Sciences. |

| Capgemini Engineering | France, Europe | Capgemini Engineering is Capgeminis dedicated brand for Engineering, Research & Development (ER&D), combining physical and digital expertise to help clients innovate and create smart products/services. It deals in several key sectors such as Automotive, Aerospace, Life Sciences, Energy, and Telecom. |

| Entelect | Johannesburg, South Africa | Entelect is a global technology company, founded in South Africa. It specializes in software engineering, digital transformation, and IT consulting. |

| HCL Technologies Limited | Uttar Pradesh, India | HCL Technologies (HCLTech) is a leading global IT services and consulting company, part of the HCL Group, focused on digital transformation, engineering, cloud, and AI, serving major industries like Finance, Manufacturing, Healthcare, and Telecom with tech solutions, software, and BPO. |

| Emerson Electric Co | St. Louis, USA | Emerson Electric Co. (EMR) is a global technology & software leader providing automation solutions and commercial/residential products for industrial, commercial, and consumer markets. It deals in digitalization, control systems, measurement, software, and services for process, hybrid, and discrete industries. |

| Infosys Limited | Bengaluru, India | Infosys Limited is a global leader in digital services and consulting. This company provides consulting, application development, maintenance, cloud & AI, digital transformation, enterprise solutions, and business process management. |

| Tata Elxsi | Bengaluru, India | Tata Elxsi is a global design and technology services leader, part of the Tata Group, specializing in Engineering Research & Design (ER&D) for industries such as Automotive, Media, Communications, and Healthcare, using digital tech (AI, IoT, Cloud, VR) to help companies innovate products and experiences, focusing on integrated design and digital transformation. |

| Tata Consultancy Services Limited | Mumbai, India | Tata Consultancy Services Limited (TCS) is a global leader in IT services, consulting, and digital solutions. It provides a wide range of services including IT, BPO, infrastructure, and engineering, delivered through its Global Network Delivery Model and Location Independent Agile delivery model. |

| Tech Mahindra Limited | Pune, India | Tech Mahindra is a global IT services and consulting giant, part of the Mahindra Group conglomerate, specializing in digital transformation with services in 5G, AI, Cloud, and IoT, serving diverse industries like telecom, banking, healthcare, and manufacturing. This company focuses on innovation and customer experience through cutting-edge tech. |

| Wipro Limited | Bengaluru, India | Wipro is an Indian multinational company providing IT, consulting, and business process services. It has a significant global footprint, with operations serving clients in many countries. |

By Services

By Location

By Application

By Regional