December 2025

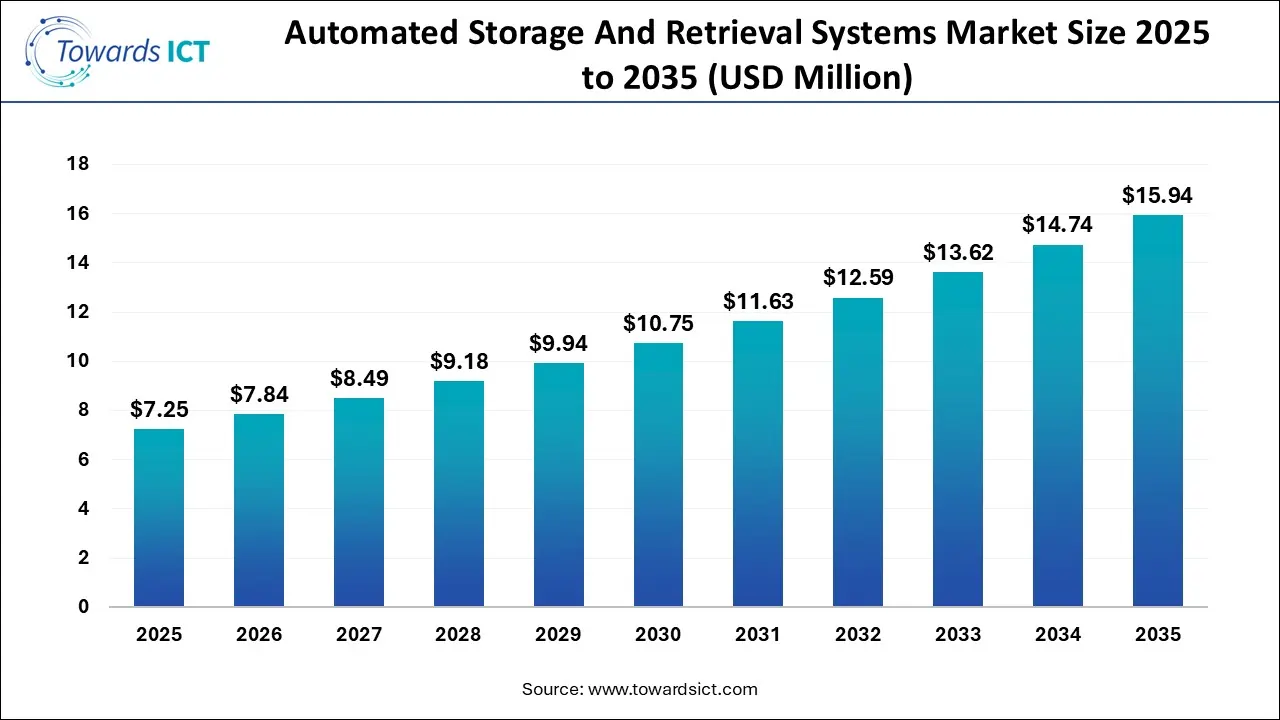

The automated storage and retrieval systems market size is expected to be worth around USD 15.94 billion by 2035, from USD 7.25 billion in 2025, growing at a CAGR of 8.2% during the forecast period from 2026 to 2035. The increasing popularity of warehouse automation in developed nations is expected to drive the growth of the automated storage and retrieval systems market.

The automated storage and retrieval systems market has advanced significantly, driven by the growing role of information and communication technologies in industrial automation and logistics. Modern ASRS solutions are increasingly software-defined, relying on intelligent control systems, connectivity, sensors, and data analytics to manage storage, retrieval, and inventory flows with high precision. The market includes a wide range of systems such as vertical lift modules, carousels, crane-based systems, vertical buffer modules, robotic shuttles, and autonomous floor robots, all of which are integrated with warehouse management systems, enterprise resource planning platforms, and industrial IoT networks.

AI is playing a prominent role in the automated storage and retrieval systems market. The integration of AI in ASRS solutions helps to optimise efficiency in predictive inventory management. Moreover, AI-enabled ASRS improves real-time decision-making by enhancing the supply chain capabilities in different parts of the globe.

Numerous market players have started partnering with warehousing companies to deploy advanced ASRS solutions in warehouses.

The ASRS developers are engaged in launching various types of ASRS solutions to cater for the needs of the e-commerce sector.

The logistics operators are investing heavily in opening new warehouses to store a wide range of products.

The rapid integration of generative AI in automated storage systems is expected to create ample growth opportunities for the market players in the upcoming years.

The growing development in the aerospace industry is likely to reshape the industry in the future.

| Report Coverage | Details |

| Market Size in 2026 | USD 7.84 Billion |

| Market Size by 2035 | USD 15.94 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 8.2% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | Type, Function, Vertical, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Dematic (KION GROUP AG), Daifuku Co., Ltd., Kardex, Murata Machinery, Ltd., SSI SCHAEFER Group, TGW, Mecalux, S.A., KNAPP AG, BEUMER Group, KUKA AG, Bastian Solutions, LLC, System Logistics S.p.A. |

Why did the unit load crane segment lead the Automated Storage and Retrieval System Industry?

The unit load crane segment led the industry. The rising use of unit load cranes for storing bulky items such as containers and pallets has boosted the market expansion. Moreover, the growing adoption of unit load cranes by the food and beverage companies for transporting frozen food items is expected to drive the growth of the automated storage and retrieval systems market.

The robotic shuttle-based AS/RS segment is expected to expand with the highest CAGR during the forecast period. The increasing application of robotic shuttles in the e-commerce sector for automating high-density storage of goods has boosted the market growth. Additionally, numerous advantages of robotic shuttle-based AS/RS, such as enhancing storage density, surging throughput and speed, high accuracy and others, are expected to propel the growth of the automated storage and retrieval systems market.

What made the storage function segment dominate the Automated Storage and Retrieval Systems Market?

The storage function segment held the largest share of the market. The rising use of ASRS in warehouses for storing goods has boosted the market expansion. Additionally, the surging adoption of mini load cranes and unit load cranes in the e-commerce storage centres is expected to drive the growth of the automated storage and retrieval systems market.

The order-picking segment is expected to rise with the highest CAGR during the forecast period. The growing demand for robotic shuttles to pick orders in the e-commerce sector has driven the market growth. Also, the rapid deployment of advanced ASRS solutions in smart warehouses for enhancing order-picking capabilities is expected to accelerate the growth of the automated storage and retrieval systems market.

How did the retail and e-commerce segment dominate the Automated Storage and Retrieval Systems Market in 2025?

The retail and e-commerce segment dominated the industry. The rapid expansion of the e-commerce industry in several nations, including the U.S., Canada, India, China, and others, has boosted the market expansion. Additionally, rapid investment by e-commerce brands for opening new warehouses is expected to drive the growth of the automated storage and retrieval systems market.

The healthcare segment is expected to grow with the fastest CAGR during the forecast period. The rising development in the healthcare sector in several countries, such as India, South Korea, the U.S. and others has driven the market growth. Moreover, numerous government initiatives aimed at developing the healthcare industry are expected to accelerate the growth of the automated storage and retrieval systems market.

.webp)

Why has North America led the Automated Storage and Retrieval Systems Market?

North America dominated the market. The growing adoption of the automated storage and retrieval system by aerospace companies for managing the storage and transportation of costly goods has boosted the market expansion. Additionally, the presence of several market players such as Dematic, Bastian Solutions, White Systems and some others is expected to drive the growth of the automated storage and retrieval systems market in this region.

The U.S. leads the market in the North America region. The rising sales of carousel-based ASRS solutions, as well as numerous government initiatives aimed at strengthening the defence sector, have driven the market growth. Also, rapid investment by logistics companies for constructing smart warehouses to reduce the dependency on manual labour is playing a vital role in positively shaping the industry.

Why is Asia Pacific the Fastest-Growing Region in the Automated Storage and Retrieval Systems Market?

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The rising use of robotic shuttles in the e-commerce sector across numerous countries, such as China, Japan, South Korea, India and others, has driven the market growth. Also, rapid investment by e-commerce brands for opening new warehouses for storing large amounts of goods, as well as the presence of numerous ASRS companies such as Murata, Kuka AG, Daifuku and others, is expected to propel the growth of the automated storage and retrieval systems market in this region.

China is the major contributor to the market in the APAC region. The surging adoption of vertical lift by the electronics industry for storing goods in warehouses has driven the market expansion. Also, the rise in the number of automotive startups, along with numerous government initiatives aimed at strengthening the semiconductor industry, is driving the market growth.

What made Europe rise with a significant CAGR in the Industry?

Europe is expected to rise with a significant CAGR during the forecast period. The rapid deployment of AI-based ASRS solutions in the automotive sector in several nations, including Germany, France, Italy, the UK and some others, has driven the market expansion. Moreover, the growing consumer preference to purchase goods from the e-commerce sector, along with technological advancements in the healthcare industry, is expected to accelerate the growth of the automated storage and retrieval systems market in this region.

Germany dominated the industry in the European region. The growing use of automated storage systems in automotive warehouses to lower dependency on labour forces has driven the market expansion. Moreover, technological advancements in the heavy industries, as well as rapid investment by the government for automating the postal sector, are positively contributing to the industry.

| Company | Headquarters | Offerings |

| Dematic | Georgia, USA | Dematic is a global leader in supply chain automation, designing and implementing integrated solutions (technology, software, services) for warehouses and distribution centres to optimise material and information flow from receiving to shipping, boosting efficiency, accuracy, and productivity using systems like conveyors, AS/RS, and advanced software. |

| Daifuku Co., Ltd. | Osaka, Japan | Daifuku Co., Ltd. is a global leader in automated material handling and logistics systems, providing integrated solutions from consulting, engineering, and manufacturing to installation and after-sales support for industries like e-commerce, automotive, food, and electronics (semiconductors). |

| Kardex | Zurich, Switzerland | Kardex provides automated storage & retrieval systems (AS/RS) and intralogistics solutions for efficient warehouse management, using technologies like vertical lifts, carousels, robotics, and software (Power Pick) for industries like e-commerce, automotive, and pharma, aiming to optimise space, speed up order picking, and improve accuracy. |

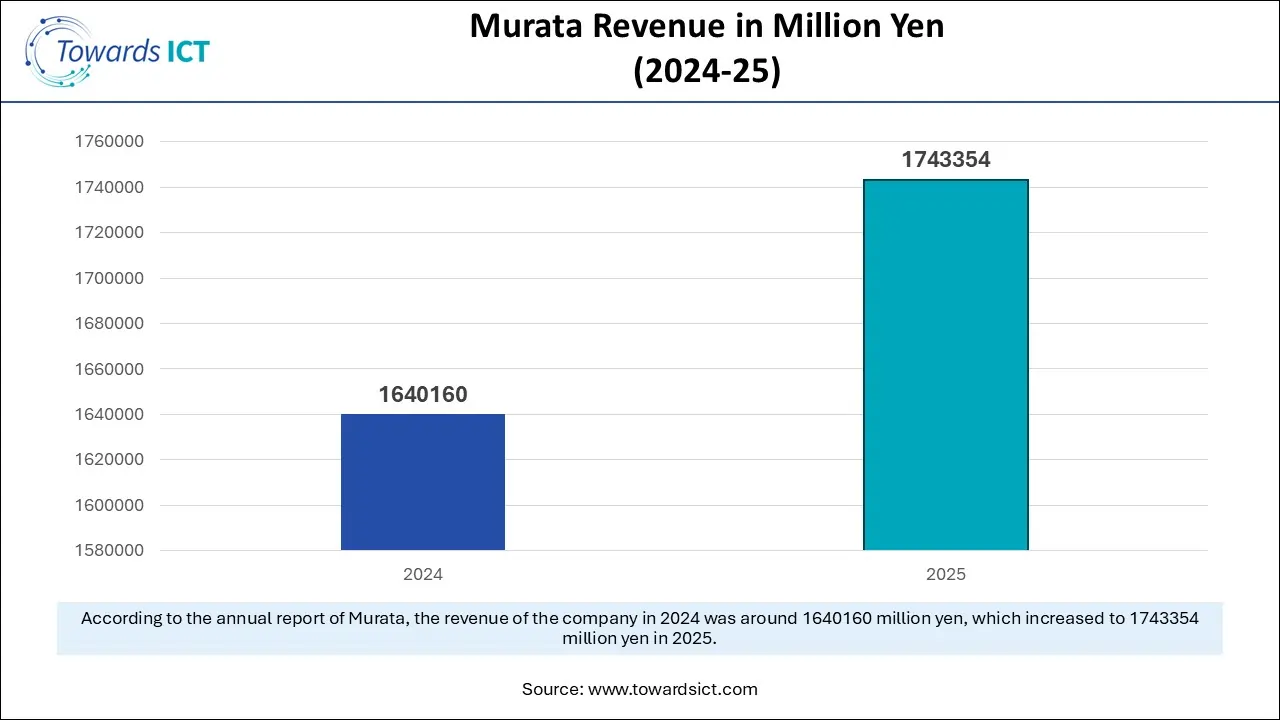

| Murata Machinery, Ltd. | Kyoto, Japan | Murata Machinery, Ltd. (Muratec) is a Japanese industrial machinery manufacturer, founded in 1935 in Kyoto, specialising in Textile Machinery, Machine Tools, Sheet Metal Machinery, Factory Automation (FA), and Logistics Systems, offering solutions for smart manufacturing, automation, and information technology in various sectors, including automotive, electronics (semiconductors), and textiles. |

| SSI SCHAEFER Group | Neunkirchen, Germany | The SSI SCHAEFER Group is a leading global, family-owned provider of intralogistics solutions, offering innovative systems for storage, picking, and transport, combining hardware (racks, conveyors, robotics) with smart software like WAMAS for optimised warehouse management in serving industries. |

| TGW | Marchtrenk, Austria | TGW (Transportgeräte Wels) is a leading Austrian-based global systems integrator providing automated, turnkey logistics solutions, specialising in complex warehouse automation, robotics, and software for e-commerce, retail, and manufacturing. |

| Mecalux, S.A. | Barcelona, Spain | Mecalux, S.A. is a global leader in intralogistics, specialising in warehouse automation, metal racking systems, and warehouse management software (WMS), offering comprehensive solutions for efficient storage and order fulfilment for industries worldwide. |

| KNAPP AG | Hart bei Graz, Austria | KNAPP AG is a global Austrian technology leader in intralogistics, providing automated, intelligent warehouse and supply chain solutions for production and distribution, using robotics, AI, and software (WMS/WCS) for sectors like healthcare, fashion, food, and industry. |

| BEUMER Group | Beckum, Germany | The BEUMER Group is a leading global manufacturer of intralogistics systems for conveying, loading, palletising, packaging, sorting, and distribution. |

| Bastian Solutions, LLC | Indiana, USA | Bastian Solutions, LLC is a global supply chain integration partner (part of Toyota Automated Logistics) that designs, engineers, and installs automated material handling systems for manufacturing, distribution, and logistics, offering services like consulting, robotics, conveyors, AGVs, AS/RS, and proprietary software. |

Strengths

Weaknesses

Opportunities

Threats

By Type

By Function

By Vertical

By Region

December 2025