December 2025

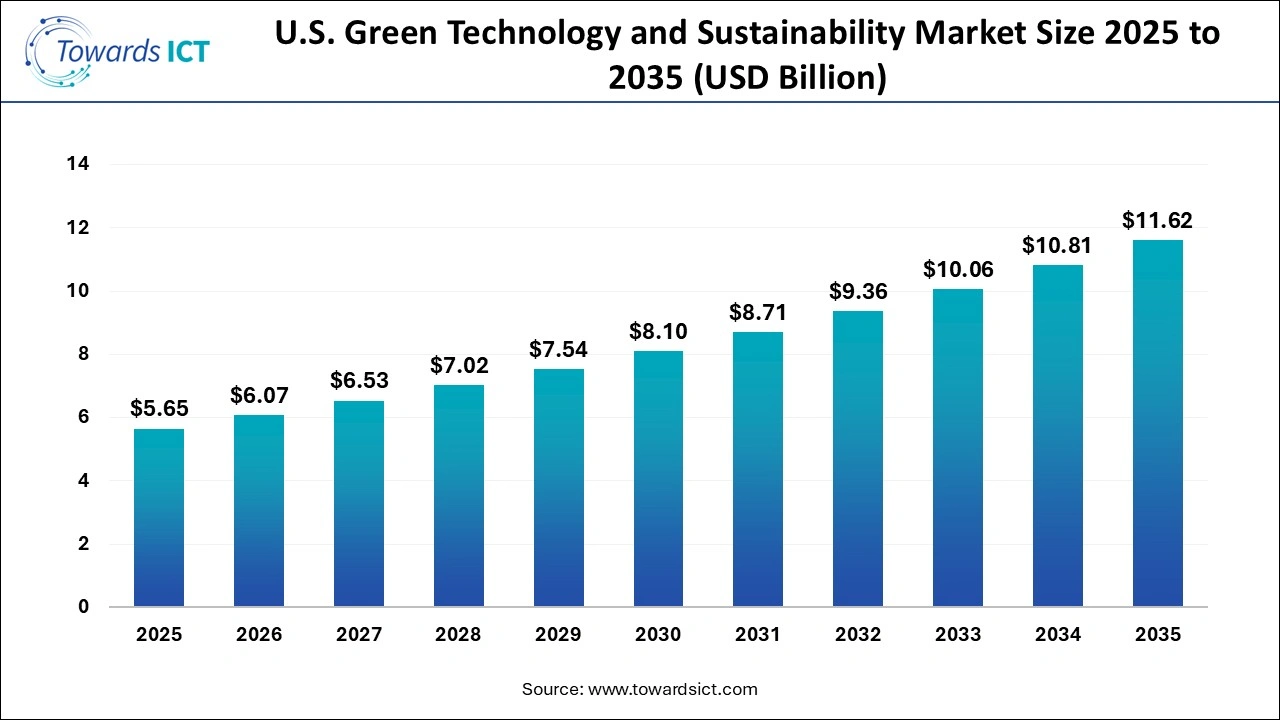

The U.S. green technology and sustainability market size is expected to be worth around USD 11.62 Billion by 2035, from USD 5.65 billion in 2025, growing at a CAGR of 7.48% during the forecast period from 2026 to 2035. The rising popularity of sustainable agricultural practices is expected to drive the growth of the U.S. green technology and sustainability market.

The U.S. green technology and sustainability market is generally driven by the rising consumer awareness to reduce emissions, along with several government initiatives aimed at constructing green buildings. This industry is dependent on numerous technologies, including the Internet of Things, cloud computing, artificial intelligence and analytics, digital twin, cybersecurity, blockchain and some others. There are various applications of green technology, such as green building, carbon footprint management, weather monitoring and forecasting, air and water pollution monitoring, forest monitoring, crop monitoring, soil condition and moisture monitoring, water purification and some others. This market is expected to rise significantly with the growth of the EV sector in this nation. Moreover, the presence of numerous market players in the U.S., such as Enphase Energy, Plug Power, Tesla, Sunrun, Vestas Wind Systems and some others, is driving the market growth.

-(1).webp)

AI has played an integral role in the U.S. green technology and sustainability market. The integration of AI in green technology solutions helps in optimising energy use, improving sustainability in industries such as construction and data centres, managing resources, enhancing renewable energy integration, aiding environmental monitoring and others. Additionally, AI-enabled technologies enhance energy optimisation and waste management.

In April 2025, Honeywell launched an AI-enabled technology suite. This platform is designed to improve the scalability and efficiency of green hydrogen production.

Numerous tech companies are partnering with the government to deploy sustainable solutions in the infrastructure sector.

Market players are launching various types of green technology solutions to cater to the needs of the residential sector.

The increasing sales of electric vehicles for lowering emissions is an ongoing trend in this industry.

.webp)

The rapid deployment of advanced weather monitoring solutions in modern houses across the U.S. region is expected to create growth opportunities for the market players in the future.

The rising demand for AI-integrated crop monitoring solutions in the agricultural sector is likely to reshape the market in the upcoming years.

| Report Coverage | Details |

| Market Size in 2026 | USD 6.07 Billion |

| Market Size by 2035 | USD 11.62 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 7.48% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Enphase Energy, Tesla, Plug Power, Sunrun, Vestas Wind Systems, First Solar, Siemens Gamesa Renewable Energy, Trane Technologies, Southern Company, and NextEra Energy |

The Internet of Things (IoT) segment dominated the industry. The growing use of IoT-based sensors in the manufacturing sector for maintaining sustainability has boosted the market expansion. Additionally, rapid investment by electronics companies for developing a wide range of IoT sensors to cater for the needs of the energy sector is playing a prominent role in shaping the industrial landscape. Moreover, collaborations among semiconductor brands and tech companies for developing IoT-enabled solutions to lower emissions are expected to accelerate the growth of the U.S. green technology and sustainability market.

The Artificial Intelligence (AI) segment is expected to grow with a significant CAGR during the forecast period. The rise in the number of AI startups in numerous states, such as Arkansas, California, Colorado, Florida and some others, has driven the market expansion. Additionally, numerous government initiatives aimed at developing the AI industry, coupled with the rapid deployment of AI in renewable energy sector, are positively contributing to the industry. Moreover, the growing investment by tech companies in developing advanced AI solutions for lowering C02 emissions is expected to propel the growth of the U.S. green technology and sustainability market.

The green building segment held the largest share of the market. The growing interest of consumers in constructing green buildings to lower emissions has boosted the market expansion. Also, numerous advantages of these buildings, including low carbon footprint, waste reduction, low operational charges, enhanced indoor air quality and others, are expected to drive the growth of the U.S. green technology and sustainability market.

The carbon footprint management segment is expected to rise with the highest CAGR during the forecast period. The growing adoption of carbon footprint management solutions by the government to report greenhouse gas (GHG) emissions has driven the market growth. Moreover, various applications of these solutions, such as reduced environmental impact, enhanced operational efficiency, improved decision making and others, are expected to accelerate the growth of the U.S. green technology and sustainability market.

The U.S. green technology and sustainability market is booming as strong federal incentives, ambitious climate policies, and private-sector innovation accelerate the transition to a low-carbon economy. Government programs and tax credits are driving large-scale investments in renewable energy, electric vehicles, energy storage, and smart infrastructure, while corporations increasingly commit to net-zero targets and sustainable operations.

Rapid advances in clean energy technologies, coupled with growing consumer and investor demand for environmentally responsible solutions, are fueling widespread adoption across industries. This momentum, supported by robust public-private partnerships and regulatory backing, positions the United States as a global leader in green technology and long-term sustainable growth.

| Company | Headquarters | Offerings |

| Enphase Energy | Fremont, California, United States | Enphase Energy is a global tech company revolutionising home solar with its microinverter-based systems, offering integrated solutions for making, using, storing, and selling solar power, featuring microinverters, batteries, and the smart Enphase App for control, enabling homeowners to manage their own clean energy for reliability and savings. |

| Tesla | Austin, Texas, United States | Tesla, Inc. is a leading American automotive and clean energy company known for its high-performance electric vehicles (EVs), battery energy storage, and solar products, aiming to accelerate the world's transition to sustainable energy. |

| Plug Power | New York, United States | Plug Power (PLUG) is a leading alternative energy company building a complete green hydrogen ecosystem, from production (using electrolysers) and storage to delivery and power generation (fuel cells), serving logistics, industrial, and mobility sectors with solutions like GenDrive for material handling and GenSure for backup power. |

| Sunrun | California, United States | Sunrun is a leading U.S. residential solar, storage, and energy services company that provides clean energy to homeowners through leases, Power Purchase Agreements (PPAs), and system sales, focusing on making solar accessible with little to no upfront cost, combining panels with battery storage for energy independence, and servicing multi-family homes and new developments. |

| Vestas Wind Systems | Aarhus, Denmark | Vestas Wind Systems A/S is a Danish global leader in wind energy, designing, manufacturing, installing, and servicing onshore & offshore wind turbines, offering full lifecycle solutions from data-driven consultancy to power plant optimisation, serving as a key player in the transition to sustainable energy with extensive global reach and a significant market share in the wind industry. |

| First Solar | Arizona, USA | First Solar, Inc. (FSLR) is a leading U.S.-based manufacturer of advanced, thin-film (cadmium telluride - CdTe) solar panels, known for producing modules with a lower carbon footprint than traditional silicon panels, focusing on utility-scale projects and operating globally with manufacturing in the U.S., Malaysia, and Vietnam. They are unique as the only U.S.-headquartered company among the world's largest solar manufacturers, emphasising responsibly produced, high-performance PV technology for utilities and independent power producers. |

| Siemens Gamesa Renewable Energy | Vizcaya, Spain | Siemens Gamesa Renewable Energy (SGRE) is a global leader in wind power, designing, manufacturing, installing, and servicing onshore & offshore wind turbines, driven by its parent company Siemens Energy, aiming to combat climate change with clean energy solutions. |

| Trane Technologies | Dublin, Ireland | Trane Technologies is a global climate innovator. It designs, manufactures, and services climate control systems, aiming to combat climate change with energy-efficient products, digital tools (like AI), and circular economy practices, aiming for a sustainable future. |

| Southern Company | Georgia, USA | Southern Company (NYSE: SO) is a major U.S. energy holding company providing electric and natural gas services to millions in the Southeast, focusing on reliable, affordable, and clean energy, with a goal of net-zero emissions by 2050 through diverse sources including solar, nuclear, and advanced tech. |

| NextEra Energy | Georgia, USA | NextEra Energy, Inc. is a North American energy company, a Fortune 200 firm, and the world's largest electric utility holding company by market cap, owning Florida Power & Light (FPL), America's biggest utility, and NextEra Energy Resources (NEER), the world's leading generator of wind, solar, and battery storage power, providing clean, diverse energy across the U.S. and Canada. |

Strengths

Weaknesses

Opportunities

Threats

By Technology

By Application

December 2025

December 2025

December 2025

December 2025