December 2025

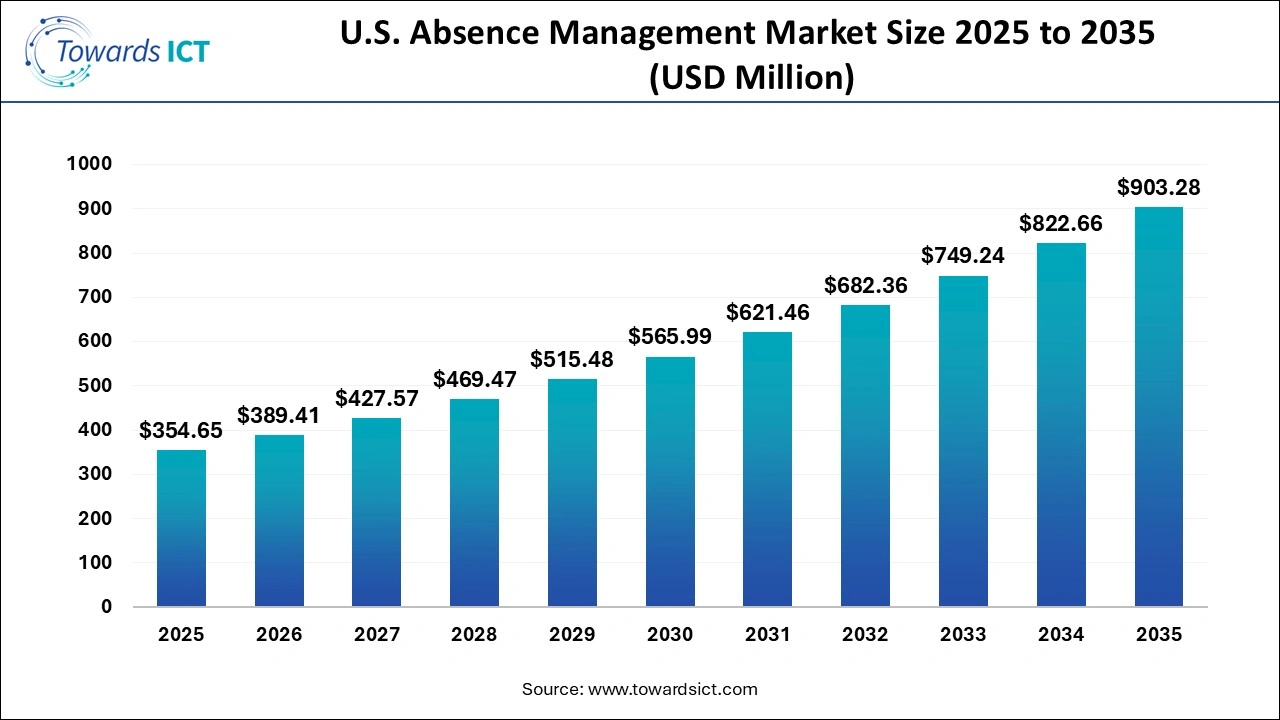

The U.S. absence management market size is expected to be worth around USD 903.28 million by 2035, from USD 354.65 million in 2025, growing at a CAGR of 9.8% during the forecast period from 2026 to 2035. The rapid deployment of blockchain-based absence management solutions for monitoring the activities of employees has driven the market expansion.

Absence management is defined as an advanced solution that helps in monitoring the attendance of employees in the U.S. These solutions are used for tracking and managing employee time-off by automation request approvals. It further enhances HR efficiency by reducing errors, along with lowering productivity loss in large organisations. The U.S. absence management market is expected to experience rapid growth due to technological advancements in the industrial sector across the nation.

| Report Coverage | Details |

| Market Size in 2026 | USD 389.41 Million |

| Market Size by 2035 | USD 903.28 Million |

| Growth Rate From 2026 to 2035 | CAGR of 9.8% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Deployment Mode, By Application, By End User |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Kronos, Namely, Workforce Software, Workday, Oracle, SAP, Zenefits, Ultimate Software, AbsenceSoft, ADP |

AI has played a prominent role in shaping the landscape of the U.S. absence management market. The integration of AI in an absence management platform helps in automating repetitive tasks, ensuring compliance, analysing data and others. Moreover, AI-based absence management solutions enhance employee experience, improving efficiency, evaluating the performance of employees and others. Thus, the corporate sector of the U.S. is rapidly deploying AI-enabled workforce management solutions in their offices to improve overall productivity.

Partnerships Among Market Players and Enterprises

The insurance companies have started adopting advanced workforce management solutions to track the attendance of employees regularly. Thus, the absence management companies are partnering with enterprises to deploy advanced solutions in offices to lessen the burden of HR, thereby driving the growth of the U.S. absence management market.

Privacy Concerns and Complexities in the Integration Process

The absence management industry is facing several problems in its day-to-day operations. Firstly, the privacy-related concern arising from the absence management solution is hampering the industry. Secondly, the integration of workforce management software in traditional organisations is very complex, which in turn acts as a restraining factor in this industry.

Surging Adoption of Biometric Solution by Corporate Companies

The IT and telecom companies in the U.S. region have started deploying advanced biometric solutions for keeping accurate records of employees. Thus, the rapid adoption of these biometrics solutions in the corporate sector is expected to create numerous growth opportunities for the market players in the upcoming years to come.

What Made the On-Premises Segment Dominate the U.S. Absence Management Market in 2025?

The on-premises segment held the largest share of the market in 2025. The increasing emphasis of the healthcare companies on deploying on-premises absence management solutions for tracking the attendance of the workforce has driven the market expansion. Additionally, numerous advantages of on-premises solutions, such as superior customisation, improved security, enhanced performance, and others, are expected to drive the growth of the U.S. absence management market.

The cloud segment is expected to grow at the fastest rate during the forecast period. The growing adoption of cloud-based workforce management solutions by the BFSI companies for tracking the attendance of employees has boosted the market growth. Moreover, several benefits of cloud-based attendance solutions, including superior flexibility, enhanced scalability, improved cost savings, and others, are expected to foster the growth of the U.S. absence management market.

How did the Large Enterprises Segment lead the U.S. Absence Management Market in 2025?

The large enterprises segment dominated the industry. The rapid deployment of blockchain-enabled workforce management solutions in large enterprises for managing the attendance of several employees has driven the market growth. Moreover, the rising focus of manufacturing companies to collaborate with software providers for adopting absence management solutions is expected to accelerate the growth of the U.S. absence management market.

The SMEs segment is expected to rise with the fastest growth rate throughout the forecasted period. The rise in the number of small and medium enterprises in several cities, including New York, Chicago, Houston, Phoenix, San Francisco and some others, has driven the market expansion. Additionally, numerous government initiatives aimed at strengthening the SMEs sector are expected to foster the growth of the U.S. absence management market.

Why did the BFSI Segment hold the Dominant Share of the U.S. Absence Management Market in 2025?

The BFSI segment held the highest share of the market. The surging adoption of advanced workforce management solutions in the BFSI sector has driven the market expansion. Additionally, the growing cases of fraudulent activities by remote employees in the insurance sector are expected to drive the growth of the U.S. absence management market.

The manufacturing segment is expected to expand with the highest CAGR during the forecast period. The growing deployment of cloud-based absence management solutions in the manufacturing industry has driven the market growth. Moreover, collaborations among AI providers and software companies for designing advanced monitoring software to cater for the needs of the manufacturing sector are expected to propel the growth of the U.S. absence management market.

| Company | Headquarters | Offerings |

| Kronos | Massachusetts, USA | Kronos is a leading provider of cloud-based Workforce Management (WFM) and Human Capital Management (HCM) solutions, helping businesses manage timekeeping, scheduling, payroll, HR, and talent acquisition for improved productivity and compliance, serving diverse industries from healthcare to retail. |

| Workday | California, USA | Workday is a cloud-based enterprise platform for Human Capital Management (HCM) and Financial Management, offering unified applications for HR, finance, planning, and analytics, known for its user-friendly interface, real-time data, and AI integration to help organisations manage people and money efficiently. |

| Oracle | Texas, USA | Oracle Corporation is a global tech giant known for its database software (Oracle Database), enterprise applications (ERP, HCM), cloud infrastructure (OCI), and hardware. It offers a complete suite for migrating, building, and running IT, from infrastructure to applications, including AI/ML services. |

| SAP | Württemberg, Germany | SAP (Systems, Applications, and Products in Data Processing) is a leading German software company providing Enterprise Resource Planning (ERP) software that integrates and manages core business processes like finance, HR, sales, and supply chain into a single, unified system, helping companies streamline operations, gain real-time insights, and make better decisions with solutions like SAP S/4HANA. |

| Zenefits |

California, USA |

Zenefits is an all-in-one, cloud-based HR platform for small to mid-sized businesses (SMBs) that centralises payroll, benefits administration, HR management, and compliance into a single, user-friendly system, aiming to simplify tasks like hiring, onboarding, time tracking, performance reviews, and employee self-service through a unified dashboard accessible on mobile and desktop. |

| Namely | New York, USA | Namely is a cloud-based, all-in-one Human Capital Management (HCM) platform for mid-sized companies, unifying HR, payroll, benefits administration, talent management (recruiting, onboarding, performance), time tracking, and HR analytics in a single, user-friendly system to help businesses manage their workforce efficiently, ensure compliance, and build a stronger culture. |

| Workforce Software | Michigan, USA | Workforce Software (WFS) is a comprehensive solution for managing employee time, attendance, scheduling, and compliance, aiming to boost productivity, cut costs, and improve employee experience through self-service and mobile access, integrating complex pay rules, labour laws, and forecasting for better business decisions and agile workforce management. |

| Ultimate Software | Florida, USA | Ultimate Software is a major cloud HCM provider known for its UltiPro platform (now UKG Pro) for HR, payroll, talent, and workforce management, offering unified solutions for businesses. V |

| AbsenceSoft | Colorado, USA | AbsenceSoft is a leading Software-as-a-Service (SaaS) platform that simplifies and automates leave and accommodations management for HR, helping companies comply with complex laws (FMLA, ADA, PWFA, etc.) while improving employee experience. |

By Deployment Mode

By Application

By End User

December 2025

December 2025

December 2025