December 2025

The U.S. artificial intelligence market size is expected to be worth around USD 558.38 Billion by 2035, from USD 56.25 billion in 2025, growing at a CAGR of 25.8% during the forecast period from 2026 to 2035. The rapid adoption of AI-enabled software solutions in the manufacturing sector has driven the market expansion.

What is the Demography of the U.S. Artificial Intelligence Market?

The U.S. artificial intelligence market is growing significantly due to technological advancements in the IT sector, coupled with rapid investment by the government for strengthening the 5G infrastructure. There are several components of this industry comprising hardware, software, services and others. These components find application in various end-user industries consisting of healthcare, BFSI, law, retail, automotive, advertising, agriculture, manufacturing, education and others. This market is expected to experience significant growth with the rise of the telecom industry in the U.S. region.

| Report Coverage | Details |

| Market Size in 2026 | USD 70.76 Billion |

| Market Size by 2035 | USD 558.38 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 25.8% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Solution, By Technology, By End User |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) Regional |

| Key Companies Profiled | AiCure, Atomwise, Inc., Ayasdi AI LLC, Clarifai, Inc., Cyrcadia Health, Enlitic, Inc., Google LLC, and H2O.ai.; HyperVerge, Inc.; IBM Watson Health; Intel Corporation; Microsoft; NVIDIA Corporation; Sensely, |

AI has played a prominent role in shaping the landscape of the U.S. absence management market. The integration of AI in an absence management platform helps in automating repetitive tasks, ensuring compliance, analysing data and others. Moreover, AI-based absence management solutions enhance employee experience, improving efficiency, evaluating the performance of employees and others. Thus, the corporate sector of the U.S. is rapidly deploying AI-enabled workforce management solutions in their offices to improve overall productivity.

Government Initiatives

The government of the U.S. is constantly engaged in launching numerous AI-related initiatives. These initiatives are mainly aimed at deploying AI in various sectors to lower the dependency on the manual workforce and lessen errors in government offices. Moreover, rapid investment by the government for strengthening the AI infrastructure is driving the growth of the U.S. artificial intelligence market.

Cybersecurity Issues and Threat to Human Jobs

The AI industry in the U.S is facing numerous problems in recent times. The cybersecurity issue in the AI platform is negatively impacting the industry. Moreover, the surging deployment of AI in the IT sector is replacing human jobs at a rapid pace, thereby restraining the market growth.

Rapid Investment in Generative AI Technology

The tech companies are constantly engaged in developing generative AI technology for the end-user industries. The AI developers have started investing heavily in designing generative AI solutions for enhancing the capabilities of content creation and improving customer service experience. Thus, the surging investment in generative AI is expected to create numerous growth opportunities for the market players in the upcoming days.

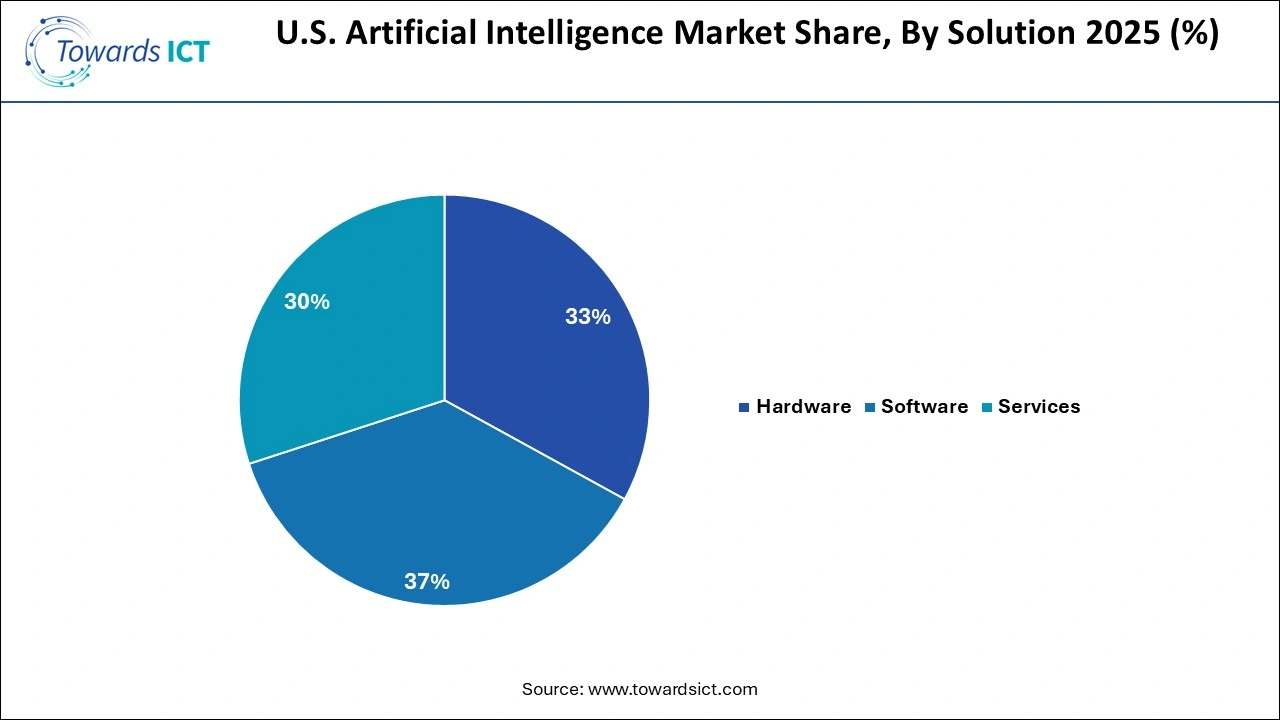

What made the Software Segment Dominate the U.S. Artificial Intelligence Market in 2025?

The software segment led the market in 2025. The rapid investment by tech companies in developing a wide range of AI-enabled software has driven the market expansion. Moreover, collaborations among software companies and automotive brands for deploying advanced software in SDVs are expected to accelerate the growth of the U.S. artificial intelligence market.

The hardware segment is expected to grow at the fastest rate during the forecast period. The surging demand for AI-based CPUs from the IT sector has boosted the market expansion. Additionally, rapid investment by AI companies for opening up new production centres to increase the manufacturing of AI chips is expected to propel the growth of the U.S. artificial intelligence market.

How did the Deep Learning Segment lead the U.S. Artificial Intelligence Market in 2025?

The deep learning segment held the largest share of the industry. The growing use of deep learning technology in autonomous driving vehicles and medical equipment has boosted the market expansion. Additionally, numerous advantages of deep learning technology, including automating extraction, lowering manual tasks, handling complex data and others, are expected to drive the growth of the U.S. artificial intelligence market.

The Natural Language Processing (NLP) segment is expected to expand with the highest growth rate throughout the forecasted period. The surging emphasis of tech companies to develop a wide range of virtual assistants for the BFSI sector has boosted the market growth. Moreover, several benefits of NLP technology, such as enhanced productivity, deriving data-driven insights, superior accessibility and others, are expected to propel the growth of the U.S. artificial intelligence market.

Why did the Advertising & Media Segment hold the Dominant Share of the U.S. Artificial Intelligence Market in 2025?

The advertising & media segment dominated the market. The surging adoption of AI solutions by advertising brands for gaining maximum consumer attention has driven the market expansion. Additionally, rapid investment by AI brands for designing advanced AI platforms to enhance the capabilities of the media sector is expected to drive the growth of the U.S. artificial intelligence market.

The healthcare segment is expected to grow with the fastest CAGR during the forecast period. The rapid deployment of advanced AI solutions in the healthcare sector for enhancing diagnosis and improving treatment methodology has driven the market expansion. Also, partnerships among AI companies and hospitals to deploy AI-enabled payment integration solutions in the accounts department are expected to propel the growth of the U.S. artificial intelligence market.

| Company | Headquarters | Offerings |

| AiCure | New York, United States | AiCure is an artificial intelligence (AI) and advanced data analytics company that provides a patient engagement platform, called H.Code, to improve the predictability, efficiency, and data quality of clinical trials. The platform uses AI-powered computer vision and predictive analytics to remotely monitor patient behaviour and medication adherence via their smartphones. |

| Ayasdi AI LLC | California, United States | Ayasdi AI LLC is a technology company that provides artificial intelligence and machine learning solutions primarily for financial crime prevention and compliance. This company focuses on financial services (specifically anti-money laundering (AML) and fraud detection), government, healthcare, and scientific research. |

| Clarifai, Inc | Wilmington, United States | Clarifai, Inc. is an independent AI brand that offers a comprehensive platform to help developers and enterprises build, deploy, and manage AI at scale, focusing on unstructured data like images, video, text, and audio. |

| Cyrcadia Health | Nevada, United States | Cyrcadia Health develops non-invasive wearable technology, like the iTBra, for early breast cancer screening by detecting subtle circadian temperature changes in breast tissue using sensors, an app, and AI to identify abnormal patterns. |

| Enlitic, Inc. | Colorado, USA | Enlitic, Inc. is an AI-driven healthcare technology company focused on revolutionising medical imaging data management by standardising, processing, and analysing vast amounts of data to improve clinical workflows, boost efficiency, and create real-world evidence databases for better patient care and operational insights. |

| Sensely, Inc. | Colorado, USA | Sensely is a healthcare technology company that provides empathy-driven conversational artificial intelligence (AI) solutions for enterprises, such as hospital systems, insurance companies, and pharmaceutical clients worldwide. |

| Google LLC | California, USA | Google LLC is an American multinational technology company that specialises in Internet-related services and products, most notably its dominant search engine, online advertising technologies, cloud computing, software, and hardware. |

| H2O.ai. | California, USA | H2O.ai is an AI/ML company offering an open-source platform (H2O-3) and enterprise solutions (H2O AI Cloud, Driverless AI) for building, deploying, and managing AI models, featuring AutoML, deep learning, and robust explainability for data scientists, analysts, and developers to automate tasks and create scalable, responsible AI applications across cloud, on-premise, and air-gapped environments. |

| HyperVerge, Inc. | California, USA | HyperVerge, Inc. is a leading AI company providing AI-powered digital onboarding and identity verification (KYC/KYB) solutions for global enterprises in finance, telecom, gaming, e-commerce, and logistics, using advanced computer vision, deep learning, and risk analytics for deriving high accuracy. |

| Atomwise, Inc. | California, USA | Atomwise, Inc. is a privately held biotechnology company that pioneers the use of artificial intelligence (AI) and deep learning for small molecule drug discovery. |

By Solution

By Technology

By End User

The IT devices market is growing significantly due to the surging demand for smartphones, as well as technolog...

December 2025

December 2025

December 2025

December 2025