December 2025

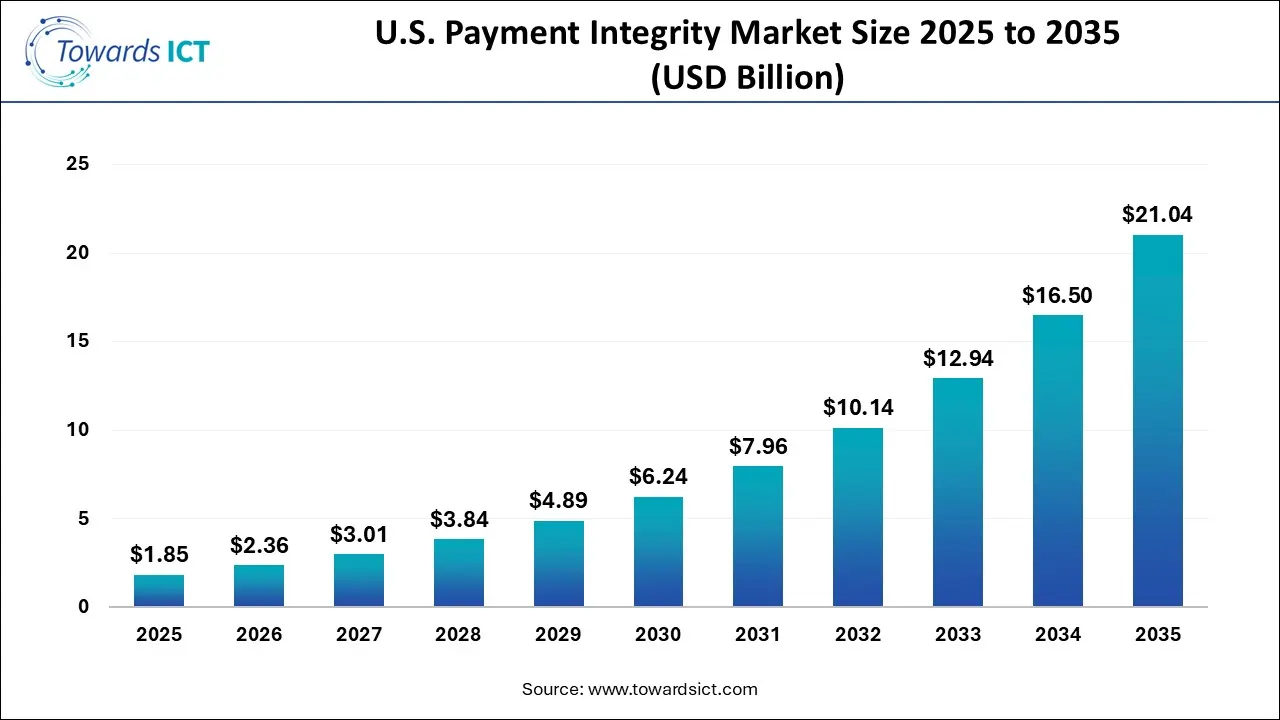

The U.S. payment integrity market size is expected to be worth around USD 21.04 billion by 2035, from USD 1.85 billion in 2025, growing at a CAGR of 27.52% during the forecast period from 2026 to 2035. The surging adoption of cloud-based payment software by healthcare companies is expected to drive the growth of the U.S. payment integrity market.

The U.S. payment integrity market is an important branch of the ICT industry. There are several components of this sector, comprising software and services. It finds application in claims editing, coding validation, data mining, reporting and analytics, special investigations, subrogation and others. The functions of the integrity solution consist of query & reporting, OLAP & visualisation, performance management and others. These solutions are deployed in several modes, consisting of on-premises, cloud-based, and hybrid. The end-users of these solutions comprise payers and healthcare providers. This industry is dominated by numerous market players, including Cognizant, Ceris, EXL, Cotiviti, Optum / Change Healthcare, Zelis, and others.

AI has played a vital role in the U.S. payment integrity industry. The integration of AI in PI platforms helps in enhancing fraud detection and real-time data analysis. Additionally, the healthcare providers are adopting AI-based PI solutions for improving medical coding accuracy and delivering automated auditing in the healthcare sector.

Numerous healthcare companies have started collaborating with payment solution providers to develop a wide range of integrity solutions.

Market players are engaged in launching various types of payment integrity solutions to cater for the needs of the healthcare sector.

The solution providers have started integrating blockchain in payment gateways to enhance transactions and reduce fraudulent activities.

The surging adoption of pre-pay models in the healthcare sector is expected to create growth opportunities for the market players in the upcoming years.

The integration of ML in payment integrity solutions is likely to reshape the industry in the future.

| Report Coverage | Details |

| Market Size in 2026 | USD 2.36 Billion |

| Market Size by 2035 | USD 21.04 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 27.52% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | Component, Function, Application, Mode of Delivery, and End Use |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | include Ceris, Cognizant, EXL, Cotiviti, Optum / Change Healthcare, Zelis, Availity, MultiPlan, Performant, Syrtis, Varis, ClarisHealth, ClaimLogiq, Rialtic, HealthEdge, and some others. |

Why did the Software Segment lead the U.S. Payment Integrity Market?

The software segment led the industry. The surging demand for advanced PI software from the insurance providers in different parts of the U.S. has boosted the market expansion. Additionally, rapid investment by software brands for developing payment integrity platforms is expected to accelerate the growth of the U.S. payment integrity market.

The services segment is expected to grow with a significant CAGR during the forecast period. The increasing focus of healthcare providers on adopting payment integrity services for delivering safe payment solutions to the payers has driven the market growth. Moreover, collaborations among AI service providers and software companies for delivering superior PI services in the U.S. are expected to foster the growth of the U.S. payment integrity market.

What made the Query & Reporting Segment dominate the U.S. Payment Integrity Market?

The query & reporting segment held the largest share of the market. The growing demand for reporting solutions from hospitals has boosted the market expansion. Moreover, rapid investment by software companies for developing query solutions to cater for the needs of the healthcare sector is expected to drive the growth of the U.S. payment integrity market.

The OLAP & visualisation segment is expected to rise with a considerable CAGR during the forecast period. The rising application of payment integrity solutions for detecting and preventing improper payments due to fraud has boosted the market expansion. Additionally, partnerships among software companies and insurance providers to deploy cloud-based OLAP solutions in the healthcare sector are expected to boost the growth of the U.S. payment integrity market.

How did the Post Payment segment dominate the U.S. Payment Integrity Market in 2025?

The post-payment segment dominated the industry. The growing emphasis of payers to pay healthcare organisations after complete treatment has increased the demand for PI solutions, thereby driving the market expansion. Additionally, numerous advantages of post-payment solutions, including enhanced convenience and flexibility, minimising risks, improved consumer satisfaction and others, are expected to accelerate the growth of the U.S. payment integrity market.

The pre-payment segment is expected to rise with the fastest CAGR during the forecast period. The rising adoption of pre-payment solutions by rich consumers to get hassle-free treatment in modern hospitals has driven the market growth. Moreover, several benefits of the pre-payment solutions, such as financial flexibility, reduced financial burden, enhanced security and others, are expected to drive the growth of the U.S. payment integrity market.

What made the On-Premises Segment dominate the U.S. Payment Integrity Market?

The on-premises segment held the largest share of the market. The deployment of on-premises payment integrity solutions in the hospitals of the U.S. has boosted the market expansion. Additionally, numerous advantages of on-premise payment solutions, such as enhanced security, superior control over data, improved customisation and others, are expected to propel the growth of the U.S. payment integrity market.

The cloud-based segment is expected to rise with the fastest CAGR during the forecast period. The surging adoption of cloud-based payment solutions by payers for enhancing security while paying hospitals has boosted the market expansion. Moreover, numerous benefits of cloud solutions, such as enhanced scalability, superior security, cost-effectiveness, delivering real-time data and others, are expected to boost the growth of the U.S. payment integrity market.

How did the Payer segment dominate the U.S. Payment Integrity Market in 2025?

The payer segment dominated the market. The growing adoption of advanced software by payers for paying healthcare providers with additional safety has boosted the market expansion. Additionally, partnerships among healthcare companies and AI developers for developing advanced payment platforms to cater for the needs of the payers are expected to drive the growth of the U.S. payment integrity market.

The healthcare providers segment is expected to grow with a significant CAGR during the forecast period. The rising deployment of cloud-based payment integrity solutions by healthcare providers in the U.S. has boosted the market expansion. Moreover, collaborations among software developers and healthcare providers for developing blockchain-based payment platforms are expected to accelerate the growth of the U.S. payment integrity market.

.webp)

| Company | Headquarters | Offerings |

| Cotiviti | South Jordan, Utah, USA | Cotiviti is a data analytics and technology company that helps healthcare payers and providers improve care quality, reduce costs, and boost efficiency, primarily through payment accuracy, risk adjustment, and quality improvement solutions, while also serving the retail sector with audit and recovery services to find savings in complex spend areas like IT and logistics. |

| Optum / Change Healthcare | Minnesota, USA | Optum is a part of UnitedHealth Group, combined with Change Healthcare (a major healthcare tech/data company) to create a more connected, efficient, and data-driven health system, simplifying clinical/payment processes, boosting data analytics, automating claims, and aiming to lower costs and improve patient/provider experiences. |

| Zelis | Massachusetts, USA | Zelis is a leading healthcare financial technology company modernising payments, claims, and data for payers, providers, and consumers, offering a connected platform for network management, payment integrity, and cost optimisation, serving major health plans, employers, and millions of users with a focus on transparency and efficiency. |

| Availity | Florida, USA | Availity is one of the largest real-time health information networks, connecting providers, payers (health plans), and technology partners on a single platform to streamline healthcare transactions, improving efficiency and collaboration. |

| MultiPlan | Virginia, USA | MultiPlan provides technology-driven, data-focused cost management and payment integrity solutions for the U.S. healthcare industry, helping payers and providers reduce costs and improve transparency through analytics for out-of-network claims, payment integrity, and network optimisation, serving millions of consumers and providers. |

| Ceris | Texas, USA | CERIS is a private company, specialising in healthcare payment integrity solutions, using technology and clinical expertise for pre-payment and post-payment review to ensure accurate and cost-effective medical claims processing for payers. |

| Cognizant | New Jersey, USA | Cognizant is a major global professional services (IT & Consulting) firm helping businesses modernise for the digital age through AI, cloud, digital engineering, automation, and business process outsourcing, serving diverse industries like finance, healthcare, and manufacturing worldwide. |

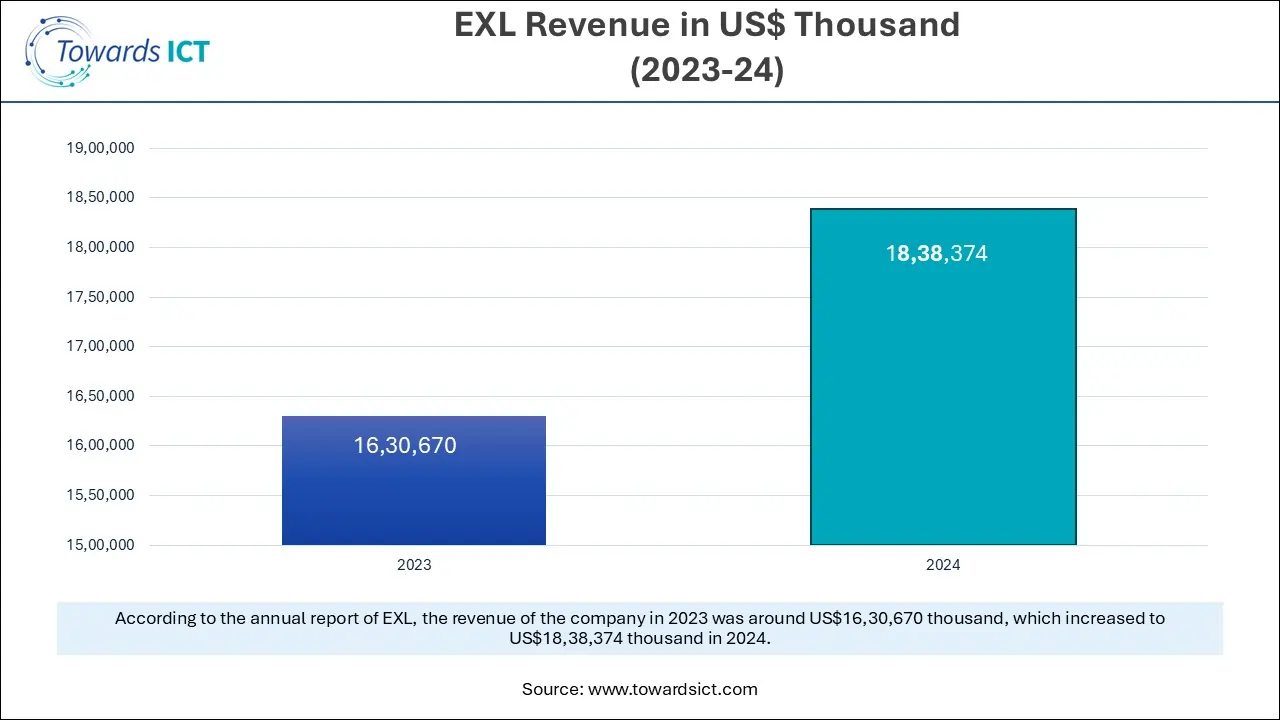

| EXL | New York, USA | EXL (EXLS) is a global data, analytics, and AI company founded in 1999, headquartered in New York, that helps businesses transform operations through data-driven insights and digital solutions, serving industries like Insurance, Healthcare, Banking, and Retail, with a strong global presence and a focus on innovation, leveraging AI, machine learning, and deep domain expertise to drive better outcomes for clients worldwide. |

| Performant | Florida, USA | Performant Healthcare, Inc. is a specialised firm helping health payers (like insurance companies, government programs) find and recover improper payments, waste, and fraud, using tech, data analytics, and expert teams for payment integrity, coordination of benefits (COB), and cost containment, recently acquired by Machinify to focus on AI-driven solutions. |

| Syrtis | Texas, USA | Syrtis Solutions provides technology-based solutions for healthcare payers, specifically focusing on cost avoidance and medical cost recovery in the Medicaid sector. |

Strengths

Weaknesses

Opportunities

Threats

By Component

By Function

By Application

By Mode of Delivery

By End Use

The robotic process automation market is expanding rapidly due to the rapid expansion of the manufacturing sec...

December 2025

December 2025

December 2025