December 2025

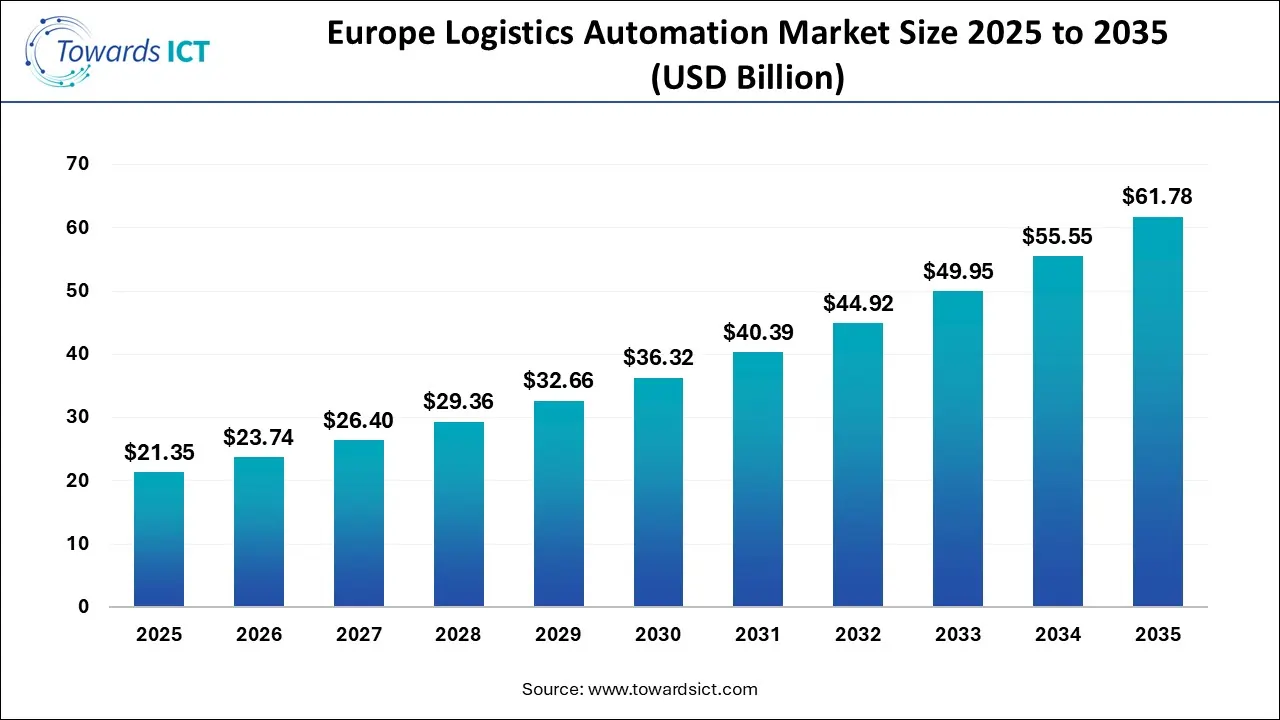

The Europe logistics automation market size is expected to be worth around USD 61.78 billion by 2035, from USD 21.35 billion in 2025, growing at a CAGR of 11.21% during the forecast period from 2026 to 2035. The growing emphasis on purchasing goods from online platforms is expected to boost the growth of the Europe logistics automation market.

The Europe logistics automation market has been growing at a rapid pace due to several government initiatives aimed at developing the road infrastructure, along with technological advancements in the warehouses. There are several components delivered in this sector, comprising hardware, software and services. These components find application in several sectors, including transport management, warehouse management,labour management and others. The end-users of these automation solutions such as manufacturing, healthcare and pharmaceuticals, fast-moving consumer goods, retail and e-commerce, automotive and some others. This market is expected to rise significantly with the growth of the overall manufacturing sector in the European region.

AI has played a crucial role in the Europe logistics automation market. The integration of AI in the logistics automation solutions helps in automating complex operations, analysing a large amount of data for deriving predictive insights, and enhancing customer experience. Moreover, AI robots are used for operating several tasks in the logistics sector, such as sorting, picking, and packing.

| Report Coverage | Details |

| Market Size in 2026 | USD 23.74 Billion |

| Market Size by 2035 | USD 61.78 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 11.21% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Type, By Component, By Organisation Size, By Mode of Freight Transport, By Application, By End-User, By Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Swisslog Holding AG, SAP SE, KNAPP AG, TGW Logistics Group GmbH, BEUMER Group GmbH & Co KG, Daifuku Co. Ltd., SSI Schäfer AG, Jungheinrich AG, KION Group AG, ABB Ltd. |

Numerous logistics companies are partnering with robot manufacturers to deploy collaborative robots in logistics warehouses.

Market players are launching various types of automation solutions to cater to the needs of the logistics sector.

The logistics operators are investing rapidly in opening warehouses across the European region.

The rising popularity of automation as a service in the EU region is expected to create growth opportunities for the market players in the future.

The rapid growth in the drone manufacturing sector is likely to reshape the industry in the coming days.

The production logistics segment held the largest share of the market. The growing use of advanced logistics solutions in the production centres to manage the flow of materials and boost efficiency has boosted the market expansion. Additionally, rapid investment by market players for developing high-quality conveyors to cater for the needs of the manufacturing centres is expected to drive the growth of the Europe logistics automation market.

The sales logistics segment is expected to rise with a significant share of the industry. The rising emphasis of logistics companies to deploy advanced automated solutions for delivering end products to consumers has driven the market growth. Moreover, the surging adoption of road-based logistics solutions by entrepreneurs to sell their products in different parts of the European region is expected to boost the growth of the Europe logistics automation market.

The hardware segment led the Europe logistics automation market. The growing demand for AGVs and conveyors from the logistics sector has boosted the market expansion. Moreover, rapid investment by market players for manufacturing a wide range of hardware components is expected to accelerate the growth of the Europe logistics automation market.

The software segment is expected to rise with the highest CAGR during the forecast period. The rapid expansion of the software industry across numerous countries, including France, Germany, the UK and some others, has driven the market growth. Moreover, collaborations among AI developers and software companies to develop advanced automation software are expected to drive the growth of the Europe logistics automation market.

The large enterprises segment dominated the industry. The rise in the number of large enterprises in numerous countries, such as France, Germany, Italy, the UK, and others, has boosted the market expansion. Moreover, rapid investment by aerospace and defence companies in opening new warehouses is expected to drive the growth of the Europe logistics automation market.

The SMEs segment is expected to grow with a considerable CAGR during the forecast period. The growing investment by SMEs in opening up new storage centres has driven the market growth. Moreover, collaborations among SMEs and logistics companies for deploying advanced automation solutions is expected to foster the growth of the Europe logistics automation market.

The road segment held the largest share of the market. The growing focus of logistics companies on launching road-based logistics services in the European region has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the road infrastructure are expected to drive the growth of the Europe logistics automation market.

The sea segment is expected to expand with the highest CAGR during the forecast period. The increasing adoption of sea-based logistics services by the manufacturing companies has driven the industrial growth. Moreover, the integration of AI-based automation solutions in the sea logistics sector is expected to propel the growth of the Europe logistics automation market.

The transportation management segment led the market. The growing use of advanced analytics solutions for managing transport movement in the logistics sector has boosted the market expansion. Moreover, partnerships among automation companies and logistics operators to develop advanced transportation management solutions are expected to accelerate the growth of the Europe logistics automation market.

The warehouse and storage segment is expected to grow with a considerable CAGR during the forecast period. The rise in the number of logistics warehouses in several nations, including Germany, France, the UK, Italy and some others, has boosted the market expansion. Additionally, rapid investment by pharma companies to open new storage centres is expected to propel the growth of the Europe logistics automation market.

The automotive segment dominated the market. The rising adoption of robots in the automotive warehouses for enhancing the efficiency of workers has boosted the market expansion. Moreover, rapid investment by automotive brands for opening up new warehouses to store automotive spare parts is expected to foster the growth of the European logistics automation market.

The retail and e-commerce segment is expected to grow with a significant CAGR during the forecast period. The rapid expansion of the e-commerce sector in several countries, including Germany, Italy, France, the UK and some others, has boosted the market growth. Moreover, partnerships among logistics brands and the retail sector for the deployment of AI-based logistics solutions in warehouses are expected to proliferate the growth of the European logistics automation market.

.webp)

Germany led the Europe logistics automation market. The rapid expansion of the e-commerce sector in several cities, such as Berlin, Munich, Hamburg, Cologne and others, has boosted the market expansion. Also, various government initiatives aimed at developing the logistics sector, coupled with the presence of several market players such as Kion Group, Jungheinrich, SSI Schaefer and some others, are expected to drive the growth of the Europe logistics automation market in this country.

.webp)

France is expected to rise with the highest CAGR during the forecast period. The rising demand for advanced logistics solutions from the automotive sector has boosted the market growth. Additionally, rapid investment by market players for opening new production centres, coupled with technological advancements in the logistics sector, is playing a vital role in shaping the industrial landscape. Moreover, the presence of numerous local automation providers, including Alstef Group, Exotec, Stanley Robotics, and some others, is expected to foster the growth of the Europe logistics automation market in this country.

The UK held a significant share of the industry. The increasing adoption of green logistics solutions in the healthcare sector, coupled with the rapid adoption of AI in the logistics industry, has driven the market expansion. Also, rapid investment by the government for developing the road infrastructure, as well as a rise in the number of smart warehouses, is expected to accelerate the growth of the Europe logistics automation market in this country.

| Company | Headquarters | Offerings |

| Swisslog Holding AG | Aarau, Switzerland | Swisslog Holding AG is a global leader in logistics automation, designing and delivering robotic & data-driven solutions for warehouses, distribution centres, and hospitals. |

| SAP SE | Walldorf, Baden, Germany | SAP SE is a German multinational software giant, the worlds leading provider of Enterprise Resource Planning (ERP) software, offering solutions for managing core business operations, including finance, HR, supply chain, and customer experience. |

| KNAPP AG | Hart bei Graz, Austria | KNAPP AG is a global leader in intralogistics, providing automated warehousing and supply chain solutions with cutting-edge technology, such as robotics, AI, and software (WMS, WCS) for industries from healthcare to automotive, focusing on efficiency and Industry 4.0. |

| TGW Logistics Group GmbH | Marchtrenk, Upper Austria, Austria | TGW Logistics Group GmbH is a leading Austrian-based, foundation-owned global systems integrator specialising in highly dynamic, automated warehouse and intralogistics solutions, designing, implementing, and maintaining complex fulfilment centres using robotics and advanced software for clients like Adidas and Zalando. |

| BEUMER Group GmbH & Co KG | Beckum, Germany | BEUMER Group GmbH & Co. KG is a global, family-owned German manufacturer specialising in intralogistics, bulk material handling, and packaging systems, offering automated solutions for conveying, palletising, sorting, and loading across numerous industries such as cement, logistics, e-commerce, and mining, known for its long-term vision and innovation. |

| Daifuku Co. Ltd. | Osaka, Japan | Daifuku Co., Ltd. is a global leader in automated material handling and logistics systems, providing integrated solutions from consulting, design, engineering, manufacturing, installation, to after-sales service for diverse industries like automotive, semiconductor, airport, and e-commerce. |

| SSI Schäfer AG | North Rhine-Westphalia, Germany | SSI Schäfer AG (part of the global SSI Schaefer Group) is a world-leading, family-owned provider of modular warehousing and logistics solutions, specialising in intralogistics, waste management, and recycling. The company offers comprehensive services from initial design to the implementation of complex, fully automated systems. |

| Jungheinrich AG | Hamburg, Germany | Jungheinrich AG is a leading German global provider of intralogistics solutions, specialising in material handling equipment (forklifts, pallet trucks), automated systems, and comprehensive services like maintenance, parts, and financing. |

| KION Group AG | Frankfurt, Germany | KION Group AG is a German multinational leader in intralogistics, providing forklift trucks, warehouse equipment, and integrated supply chain automation & software solutions globally. |

| ABB Ltd. | Zurich, Switzerland | ABB Ltd. is a global technology leader in electrification and automation, headquartered in Zurich, Switzerland, focused on enabling a smarter, safer, and more sustainable future for industries, transport, and infrastructure. |

By Type

By Component

By Organisation Size

By Mode of Freight Transport

By Application

By End-User

By Country

December 2025

December 2025