December 2025

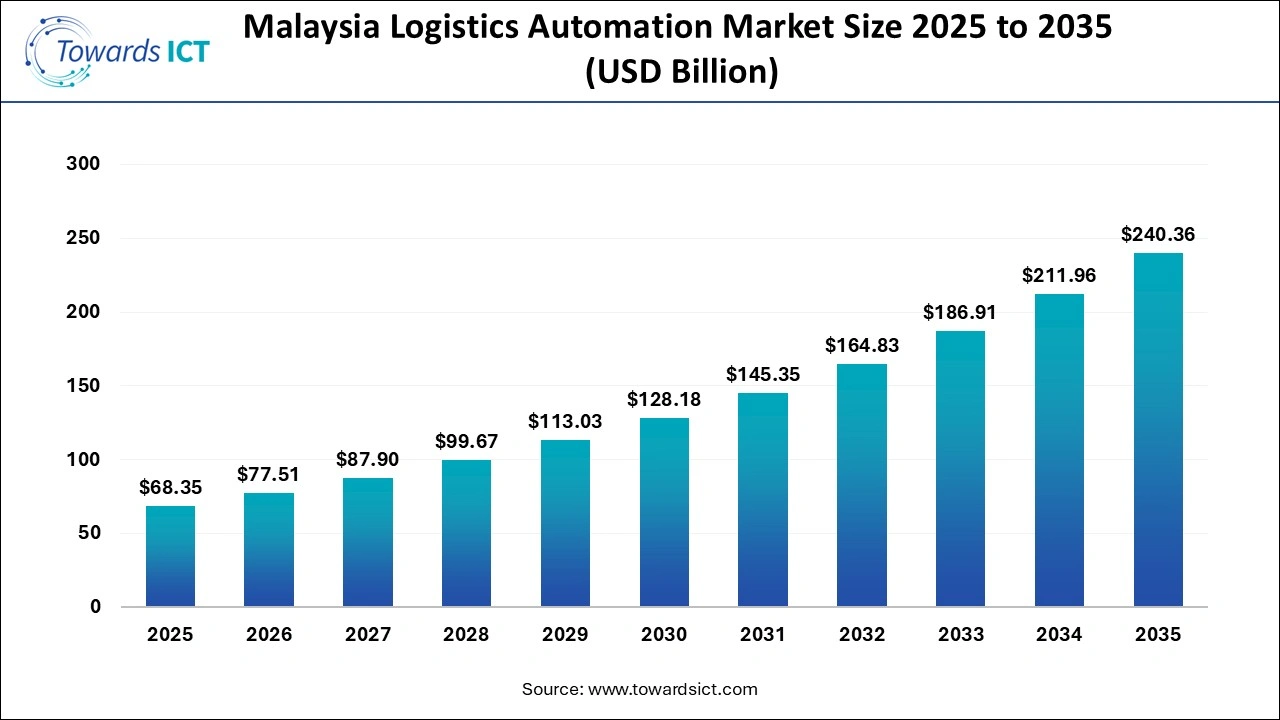

The malaysia logistics automation market size is expected to be worth around USD 240.36 Billion by 2035, from USD 68.35 billion in 2025, growing at a CAGR of 13.4% during the forecast period from 2026 to 2035. The adoption of automated solutions by smart warehouses is expected to propel the growth of the Malaysia logistics automation market.

The malaysia logistics automation market is gaining traction rapidly due to an increase in the number of smart warehouses along with the rapid expansion of the e-commerce sector. There are numerous components delivered in this sector, comprising software, hardware and services. These components find application in several sectors, including warehouse automation and transportation & distribution automation. The end-users of these automation solutions consist of retail & e-commerce, healthcare & pharmaceuticals, manufacturing, food & beverages and some others. This market is expected to grow significantly with the rise of the overall healthcare sector in Malaysia.

AI has played an integral role in the Malaysia logistics automation market. The demand for AI-based automation solutions in logistics automation solutions helps in analysing a large amount of data for deriving predictive insights, automating complex operations and improving customer experience. Moreover, AI-enabled drones are used for automating numerous tasks in the logistics sector, such as picking, sorting, and packing.

| Report Coverage | Details |

| Market Size in 2026 | USD 77.51 Billion |

| Market Size by 2035 | USD 240.36 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 13.4% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Function Insights, By Component/ Technology Insights, By Software Application Insights, By End-User Industry Insights |

| Market Analysis | Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Dematic Group, Swisslog Holding AG, Daifuku Co., Ltd., KION Group AG, Murata Machinery, Ltd., Vanderlande Industries B.V. and some others. |

Numerous logistics operators have started partnering with automation companies to deploy advanced automated solutions in logistics warehouses.

Market players are engaged in launching numerous automation services to enhance the efficiency of the logistics sector.

Automotive companies are investing rapidly in opening smart warehouses for storing automotive parts across the Malaysian region.

The surging popularity of last-mile delivery solutions in Malaysia is expected to create growth opportunities for the market players in the upcoming years.

The rapid deployment of robots in the logistics industry to enhance the capabilities of the workers is likely to reshape the industry in the future.

.jpg)

Why did the warehouse automation segment lead the Malaysia Logistics Automation Industry?

The warehouse automation segment held the dominant share in this industry. The increasing emphasis of logistics companies on deploying advanced automation solutions in modern warehouses has driven the market expansion. Also, rapid investment by software companies for developing advanced warehouse automation solutions is playing a prominent role in shaping the industrial landscape. Moreover, the growing focus of e-commerce brands on integrating AI-enabled automation solutions in warehouses is expected to propel the growth of the Malaysia logistics automation market.

The transportation & distribution automation segment is expected to grow with a notable CAGR during the forecast period. The rising focus of logistics companies on integrating AGVs and AMRs in the distribution centres has boosted the market growth. Additionally, technological advancements in the transportation sector, as well as rapid investment by the government for strengthening the logistics industry, are shaping the industry in a positive direction. Moreover, collaborations among e-commerce brands and logistics operators to develop automated solutions are expected to boost the growth of the Malaysia logistics automation market.

How did the hardware (robots, conveyors, AGVs/AMRs, ASRS) segment dominate the Malaysia Logistics Automation Market in 2025?

The hardware segment led the market. The rapid investment by market players for opening new hardware production centres has boosted the market expansion. Additionally, the growing emphasis of robotic companies on developing a wide range of collaborative robots to cater for the needs of the logistics industry is playing a prominent role in shaping the industry in a positive direction. Moreover, the increasing sales of AGVs and AMRs in Malaysia are expected to foster the growth of the Malaysia logistics automation market.

The software segment is expected to expand with the highest CAGR during the forecast period. The rising emphasis of software companies on developing a wide range of warehouse automation software has driven the market growth. Also, the integration of AI in logistics software, coupled with technological advancements in the software development sector, is driving the industrial expansion. Moreover, an increase in the number of software startups is expected to accelerate the growth of the Malaysia logistics automation market.

What made the order management systems segment dominate the Malaysia Logistics Automation Market in 2025?

The order management systems segment dominated the industry. The growing emphasis of logistics brands to deploy order management systems in modern warehouses has driven the market growth. Additionally, partnerships among AI developers and tech brands to develop advanced automation solutions for the e-commerce sector are expected to propel the growth of the Malaysia logistics automation market.

The inventory management systems segment is expected to grow with a considerable CAGR during the forecast period. The increasing emphasis of e-commerce brands on deploying inventory management systems to enhance efficiency has driven the market expansion. Moreover, rapid investment by software companies for developing inventory management systems is expected to foster the growth of the Malaysia logistics automation market.

Why did the retail & e-commerce segment lead the Malaysia Logistics Automation Industry?

The retail & e-commerce segment held the highest share of the industry. The rapid expansion of the retail industry, coupled with rising investment by companies for opening up new retail outlets, has boosted the market expansion. Additionally, the deployment of advanced automation solutions in the retail centres to ease the task of manual labour is playing a vital role in shaping the industrial landscape. Moreover, collaborations among e-commerce brands and logistics operators to integrate AI-enabled automation solutions in modern warehouses are expected to accelerate the growth of the Malaysia logistics automation market.

.webp) The healthcare & pharmaceuticals segment is expected to rise with a significant CAGR during the forecast period. The rise in the number of pharmaceutical companies, along with numerous government initiatives aimed at strengthening the healthcare industry, has driven the market growth. Also, rapid investment by healthcare companies for opening new warehouses to store a wide range of medicines, as well as technological advancements in the pharma sector, are positively contributing to the industry. Moreover, partnerships among pharma brands and logistics companies for constructing smart inventory centres are expected to drive the growth of the Malaysia logistics automation market.

The healthcare & pharmaceuticals segment is expected to rise with a significant CAGR during the forecast period. The rise in the number of pharmaceutical companies, along with numerous government initiatives aimed at strengthening the healthcare industry, has driven the market growth. Also, rapid investment by healthcare companies for opening new warehouses to store a wide range of medicines, as well as technological advancements in the pharma sector, are positively contributing to the industry. Moreover, partnerships among pharma brands and logistics companies for constructing smart inventory centres are expected to drive the growth of the Malaysia logistics automation market.

State governments across Malaysia are actively supporting the logistics automation market by aligning with national initiatives such as Industry 4.0 and digital economy roadmaps while developing region-specific industrial and logistics hubs. Key states like Selangor, Johor, and Penang are investing in smart industrial parks, automated warehouses, and advanced port infrastructure to attract logistics, manufacturing, and e-commerce players. Incentives such as tax benefits, land development support, and fast-track approvals encourage companies to adopt automation technologies, robotics, and intelligent supply-chain systems.

Additionally, states are collaborating with federal agencies, technology providers, and educational institutions to strengthen digital skills and innovation ecosystems. Programs focused on workforce upskilling, smart port development, and the adoption of IoT- and AI-enabled logistics solutions help reduce operational bottlenecks and improve efficiency. By upgrading transport corridors, free trade zones, and last-mile delivery infrastructure, Malaysian states are creating a favorable environment for logistics automation, supporting both domestic growth and regional trade competitiveness.

| Company | Headquarters | Offerings |

| SAP SE | Walldorf, Baden, Germany | SAP SE (Systems, Applications, and Products in Data Processing) is a German multinational software corporation and the worlds leading enterprise resource planning (ERP) software provider, enabling businesses to manage operations and customer relations by integrating functions including finance, HR, supply chain, and analytics in real-time, increasingly through cloud-based solutions. |

| KNAPP AG | Hart bei Graz, Austria | KNAPP AG is a global leader in intralogistics, providing automated warehousing and supply chain solutions along with cutting-edge technology, such as robotics, AI, and software (WMS, WCS) for industries such as healthcare and automotive, focusing on efficiency and Industry 4.0. |

| TGW Logistics Group GmbH | Marchtrenk, Upper Austria, Austria | TGW Logistics Group GmbH is one of the Austrian-based, foundation-owned global systems integrator brands that specialises in highly dynamic, automated warehouse and intralogistics solutions, designing, implementing, and maintaining complex fulfilment centres using robotics and advanced software for clients like Adidas and Zalando. |

| BEUMER Group GmbH & Co KG | Beckum, Germany | BEUMER Group GmbH & Co. KG is a global, family-owned German manufacturer specialising in intralogistics, bulk material handling, and packaging systems, offering automated solutions for conveying, palletising, sorting, and loading across numerous industries such as cement, logistics, e-commerce, and mining, known for its long-term vision and innovation. |

| Daifuku Co. Ltd. | Osaka, Japan | Daifuku Co., Ltd. is a global leader in automated material handling and logistics systems, providing integrated solutions from consulting, design, engineering, manufacturing, installation, to after-sales service for diverse industries like automotive, semiconductor, airport, and e-commerce. SSI Schäfer AG (part of the global |

| SSI Schäfer AG | North Rhine-Westphalia, Germany | SSI Schaefer Group) is a world-leading, family-owned provider of modular warehousing and logistics solutions, specialising in intralogistics, waste management, and recycling. The company offers comprehensive services from initial design to the implementation of complex, fully automated systems. |

| Jungheinrich AG | Hamburg, Germany | Jungheinrich AG is a leading German global provider of intralogistics solutions, specialising in material handling equipment (forklifts, pallet trucks), automated systems, and comprehensive services including maintenance, parts, and financing. |

| KION Group AG | Frankfurt, Germany | KION Group AG is a German multinational leader in intralogistics, providing forklift trucks, warehouse equipment, and integrated supply chain automation & software solutions globally. |

| ABB Ltd. | Zurich, Switzerland | ABB Ltd. is a global technology leader in electrification and automation, headquartered in Zurich, Switzerland, focused on enabling a smarter, safer, and more sustainable future for industries, transport, and infrastructure. |

By Function

By Component/ Technology

By Software Application

By End-Use Industry

Automated Storage And Retrieval Systems Market Size, Share & Trends Analysis Report By Function (Assembly,...

December 2025

December 2025