December 2025

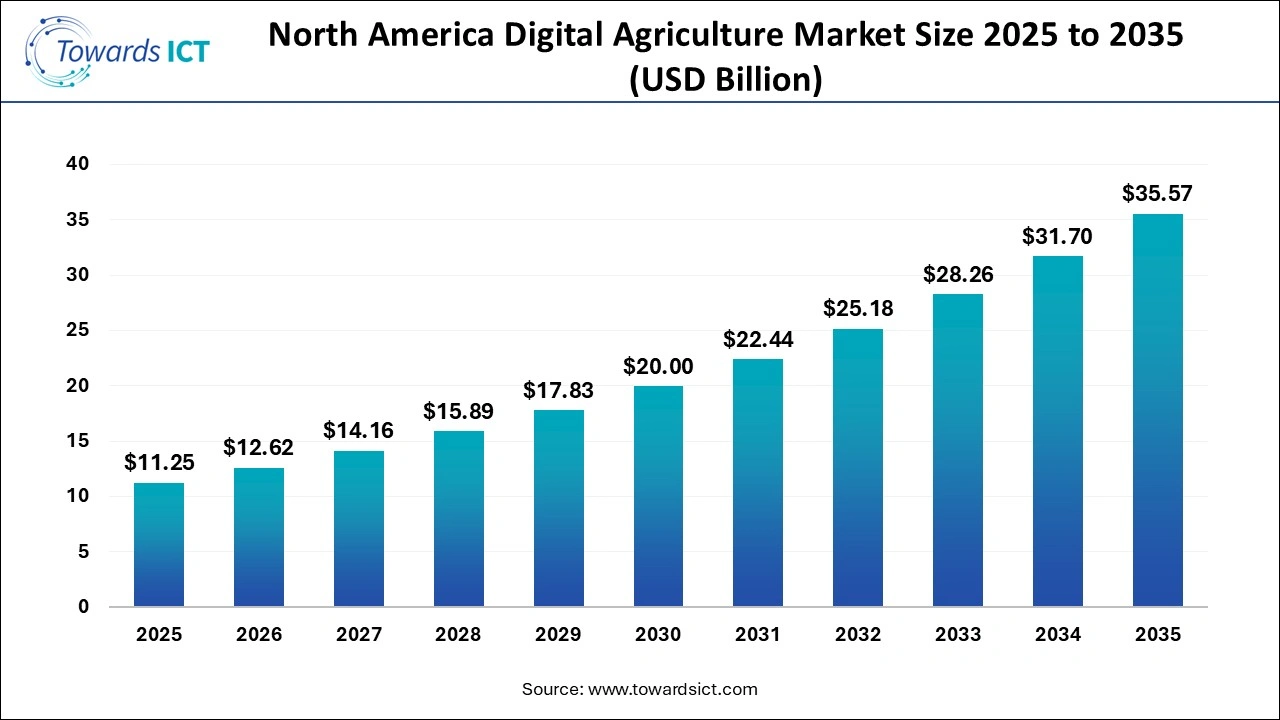

The North America digital agriculture market size is expected to be worth around USD 35.57 billion by 2035, from USD 11.25 billion in 2025, growing at a CAGR of 12.2% during the forecast period from 2026 to 2035. The rising adoption of advanced technologies in the agricultural sector across the U.S. has driven the market expansion.

The digital agriculture market in North America has been expanding rapidly in recent times. There are several components of this industry comprising hardware, software and services. This sector is operated using numerous technologies, consisting of IoT, automation, AI, drones, and others. It finds application in various sectors, including precision farming, livestock management, supply chain management, financial management and others. This market is expected to rise significantly with the growth of the overall agricultural sector in the North America region.

| Report Coverage | Details |

| Market Size in 2026 | USD 12.62 Billion |

| Market Size by 2035 | USD 35.57 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 12.2% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Components, By Deployment, By Application |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Deere & Company, Trimble, Inc., The Climate Corporation, IBM Corporation, AGCO Corporation, Bayer CropScience AG, Topcon Positioning Systems, AgEagle Aerial Systems Inc., Conservis Corporation, Aglytix Inc. |

AI has played a vital role in shaping the digital agriculture industry in North America. The integration of AI in agricultural solutions helps in automating precision farming and detecting crop diseases. Moreover, AI-based drones are highly adopted by farmers for reducing post-harvest losses and predicting the yield quality. Thus, the developments in AI technology are crucial for the growth of the North America Digital Agriculture Market.

Government Initiatives

The governments of the U.S. and Canada are launching numerous initiatives to strengthen the agricultural sector. Additionally, the governments of these countries have begun providing subsidies to farmers to enhance crop productivity. Moreover, rapid government investment in deploying advanced technologies in the farming sector is expected to accelerate the growth of the North American digital agriculture market.

Low Literacy and Data Issues

The digital agriculture industry in North America encounters numerous problems in its day-to-day operations. Firstly, the traditional farmers do not have proper information for the adoption of advanced technologies in the farms, thereby restraining the market growth. Secondly, the privacy concerns related to robot adoption in the agricultural sector are negatively impacting the market.

Rapid Adoption of AI-Robots in the Agricultural Sector

The farmers have started adopting robots for spraying pesticides in isolated areas. Additionally, the robotic brands are investing heavily in developing a wide range of robots for the agricultural sector. Moreover, the integration of AI technology in robots helps in detecting crop diseases and provides the necessary precautions. Thus, the surging adoption of AI-robots in the agro-farming sector is expected to create ample growth opportunities for the market players in the future.

What made the Hardware Segment Dominate the North America Digital Agriculture Market in 2025?

The hardware segment led the market in 2025. The surging demand for AI-based drones from the agricultural sector to track crop productivity has boosted the market expansion. Additionally, rapid investment by the market players for opening up new production centres to increase the manufacturing of agro-based hardware components is expected to drive the growth of the North America digital agriculture market.

The software segment is expected to rise at a considerable rate during the forecast period. The rapid expansion of the software industry across the U.S., Canada, Mexico and other countries has driven the market growth. Also, collaborations among software companies and AI developers for designing advanced AI platforms to cater for the needs of the agricultural sector are expected to foster the growth of the North America digital agriculture market.

How did the Cloud Segment lead the North America Digital Agriculture Market in 2025?

The cloud segment held the largest share of the industry. The rising adoption of cloud-based crop monitoring solutions from the farming institutes has boosted the market expansion. Additionally, numerous advantages of cloud platforms, including cost savings, enhanced scalability, improved flexibility, and superior accessibility, are expected to propel the growth of the North America digital agriculture market.

The on-premise segment is expected to expand with a considerable CAGR throughout the forecasted period. The rapid deployment of on-premises soil monitoring solutions by the agricultural brands for gathering information about the soil quality has boosted the market growth. Moreover, several benefits of on-premises solutions, such as enhanced security, backup capability, improved customisation and others, are expected to drive the growth of the North America digital agriculture market.

Why did the Yield Monitoring Segment hold the Dominant Share of the North America Digital Agriculture Market in 2025?

The yield monitoring segment led the industry. The surging demand for yield monitoring solutions by farmers to track yield conditions has boosted the market expansion. Additionally, collaborations among tech companies and agro-based brands to deploy yield monitoring solutions in their farmlands are expected to drive the growth of the North America digital agriculture market.

The field mapping segment is expected to rise with the highest CAGR during the forecast period. The growing popularity of field mapping solutions for creating detailed digital maps of farms has boosted the market growth. Also, the integration of AI and IoT in field mapping solutions is expected to foster the growth of the North America digital agriculture market.

Why did the U.S. Region dominate the North America Digital Agriculture Market?

The U.S. dominated the industry. The growing demand for high-quality livestock monitoring tools from the agricultural sector has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the farming sector, as well as the rise in the number of IoT startups, are playing a prominent role in shaping the industrial landscape. Moreover, the presence of various market players such as Deere and Company, Trimble, AGCO Corporation and others is expected to drive the growth of the North America digital agriculture market.

Canada is expected to expand with a significant CAGR during the forecast period. The surging adoption of advanced crop monitoring solutions by farmers to enhance their farming experience has driven the market growth. Also, rapid investment by the government for strengthening the agro-based industries is positively contributing to the industry. Moreover, technological advancements in the drone manufacturing sector are expected to foster the growth of the North America digital agriculture market.

| Company | Headquarters | Offerings |

| Deere & Company | Illinois 61265, USA | Deere & Company (John Deere) is a global leader in manufacturing agricultural, construction, forestry, and lawn care equipment, known for its iconic green and yellow machinery, but also offers advanced tech like precision agriculture, financial services, and engines, serving customers worldwide with a focus on smart, connected solutions for enhanced productivity and sustainability. |

| Trimble, Inc. | Colorado, USA | Trimble Inc. is a global tech company providing hardware, software, and services that connect the digital and physical worlds, enabling industries such as construction, geospatial, agriculture, and transportation to work more efficiently through core tech in positioning (GPS/GNSS), modelling, connectivity, and data analytics. |

| The Climate Corporation | California, USA | The Climate Corporation provides digital farming solutions, primarily through its Climate FieldView platform, using AI, data analytics, and hyper-local weather to help farmers maximise yields, improve efficiency, and reduce risk through data-driven insights for planting, managing, and harvesting crops. |

| IBM Corporation | New York 10504, United States | IBM (International Business Machines Corp.) is a global tech giant specialising in hybrid cloud, AI, consulting, and enterprise software/hardware, helping businesses transform with data insights, automation, and security. |

| AGCO Corporation | Georgia, USA | AGCO Corporation (AGCO) is a global leader in designing, manufacturing, and distributing farm machinery and precision agriculture technology. This brand focuses on farmer-centric, sustainable solutions, investing heavily in R&D for smart machines, clean energy, and digital connectivity to boost efficiency and yield. |

| Bayer CropScience AG | Leverkusen, Germany | Bayer CropScience is the agricultural arm of Bayer AG, a global leader in research-driven solutions for modern farming, offering seeds, traits, chemical/biological crop protection (herbicides, fungicides, insecticides), and digital tools like Climate FieldView, focusing on sustainable practices, increasing yields, and addressing food security challenges for both large and small farmers worldwide. |

| Topcon Positioning Systems | California, USA | Topcon Positioning Systems (TPS) is a global leader in tech for construction, surveying, agriculture, and geospatial markets, providing precision measurement, machine control, and workflow software/hardware (like GNSS, lasers, scanners) to boost efficiency in building infrastructure and farming. |

| AgEagle Aerial Systems Inc. | Wichita, KS 67226, United States | AgEagle Aerial Systems (now often operating as EagleNXT (UAVS)) provides full-stack drone solutionsdrones, sensors, and software for agriculture, defence, energy, and surveying, delivering data for actionable insights. |

| Conservis Corporation | Minnesota, USA | Conservis Corporation provides farm management software (FMS) for large, complex agricultural operations, offering tools for planning, budgeting, field management, and financial analysis to boost efficiency and profitability for both family and institutional farms, integrating operations from planting to harvest and connecting disparate farm technologies into a single platform for better decision-making. |

| Aglytix Inc | Minnesota, USA | Aglytix Inc. is a US-based ag-tech company from Mankato, MN, focused on providing advanced farm analytics using patented "Solver" algorithms to analyse data from sensors, satellites, drones, weather, etc., helping farmers identify issues, boost yields, and cut costs by pinpointing problems like crop stress, poor emergence, and resource inefficiency. |

In October 2025, DMR Technologies announced an investment of around US$1.4 million. This investment is aimed at opening a drone production centre in Lafayette, the U.S.

In October 2025, Ecorobotix launched an ultra-high precision (UHP) sprayer. These sprayers are designed for the farmers of North America.

In April 2025, Walmart partnered with Cropin. This partnership is aimed at launching an AI-based crop monitoring solution in the U.S.

By Components

By Deployment

By Application

December 2025