December 2025

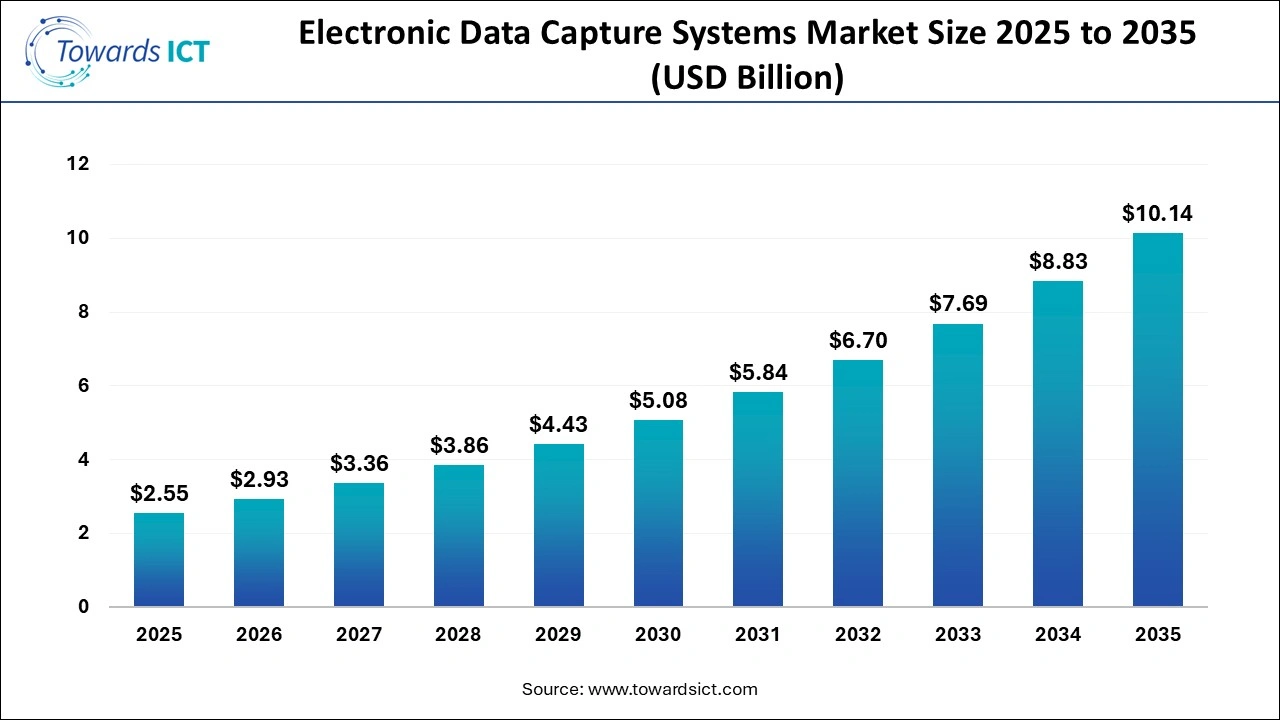

The electronic data capture systems market size is expected to be worth around USD 10.14 Billion by 2035, from USD 2.55 billion in 2025, growing at a CAGR of 14.8% during the forecast period from 2026 to 2035. The growing emphasis of the government on strengthening the biotechnology sector has driven the market expansion.

What are Electronic Data Capture Systems?

Electronic data capture systems are advanced solutions that streamline data collection for enhancing clinical trials in the healthcare sector. These solutions are deployed in several modes, including on-premises and cloud. There are several components of electronic data capture systems, including software and services. The end-users of these solutions comprise hospitals, CROs, pharmaceutical, biotechnology, medical devices, and others. This market is expected to rise significantly with the growth of the healthcare industry across the world.

| Report Coverage | Details |

| Market Size in 2026 | USD 2.93 Billion |

| Market Size by 2035 | USD 10.14 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 14.8% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Delivery Mode, By Component, By Development Phase, By End User |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Calyx, Castor, IBM, IQVIA Inc., Medidata Solutions, Inc., Oracle, OpenClinica, LLC, DATATRAK International, Inc., Clario, Veeva Systems |

The developments in AI have transformed the landscape of the electronic data capture systems industry in recent times. AI-enabled EDC systems help in automating data extraction, enhancing accuracy, predicting errors, reducing manual efforts and others. Additionally, AI-based EDC systems enhance workflow optimisation, real-time monitoring, predictive analytics and some others. Thus, AI has played a prominent role in shaping the electronic data capture systems market in a positive direction.

Government Initiatives

Governments of several countries, such as India, the U.S., Germany, the UAE and some others are launching numerous initiatives for strengthening the healthcare sector. Thus, the surging government initiatives aimed at modernising the hospital infrastructure are expected to drive the growth of the electronic data capture systems market.

Data Security Issues and Complexities in Integration

The electronic data capture systems industry is restrained by several factors. Firstly, the issues regarding data security are negatively impacting the industry. Secondly, the integration of EDC in traditional healthcare facilities is very difficult, which in turn is hampering the market.

Surging Adoption of Remote Data Monitoring Solutions

The healthcare professionals have started using remote patient data monitoring solutions to keep track of patients on the go and provide necessary suggestions based on their health records. Thus, the rising adoption of remote data monitoring solutions by doctors is expected to create ample growth opportunities for the market players in the upcoming years.

What made the Web & Cloud-Based Systems Segment Dominate the Electronic Data Capture Systems Market in 2025?

The web & cloud-based systems segment led the market in 2025. The growing adoption of cloud-based EDC systems by the pharmaceutical companies in several nations, including the U.S., China, India and others, has boosted the market expansion. Additionally, numerous advantages of web-based EDC solutions, including enhanced data quality, real-time monitoring, superior data security, streamlined workflow and others, are expected to propel the growth of the electronic data capture systems market.

The on-premises segment is expected to rise at a considerable rate during the forecast period. The rising deployment of on-premises EDC solutions by hospitals and medical device companies for improving accuracy and efficiency has boosted the market growth. Moreover, several advantages of on-premises solutions, such as enhanced security, high performance, superior control level and others, are expected to drive the growth of the electronic data capture systems market.

How did the Services Segment lead the Electronic Data Capture Systems Market in 2025?

The services segment dominated the industry. The growing emphasis of EDC companies to deliver EDC services to healthcare professionals on a subscription basis has boosted the market expansion. Moreover, collaborations among healthcare providers and market players to deploy AI-enabled EDC services in modern hospitals are expected to drive the growth of the electronic data capture systems market.

The software segment is expected to rise at a notable rate throughout the forecasted period. The rapid growth of the software industry across numerous countries, including the U.S., Canada, Germany, China and others, has driven the market growth. Also, collaborations among medical device companies and software developers to design high-quality data-capturing software for the healthcare sector are expected to accelerate the growth of the electronic data capture systems market.

Why did the Phase III Segment hold the Dominant Share of the Electronic Data Capture Systems Market in 2025?

The phase III segment dominated the market. The surging emphasis of vaccine companies to adopt EDC solutions for enhancing phase III trials has driven the market expansion. Moreover, technological advancements in the biotechnology sector are expected to foster the growth of the electronic data capture systems market.

The phase I segment is expected to grow with a significant CAGR during the forecast period. The rising deployment of on-premises EDC systems by pharma companies for conducting phase I human trials has driven the market growth. Additionally, the increasing focus of medicine manufacturing companies to perform phase I trials is expected to drive the growth of the electronic data capture systems market.

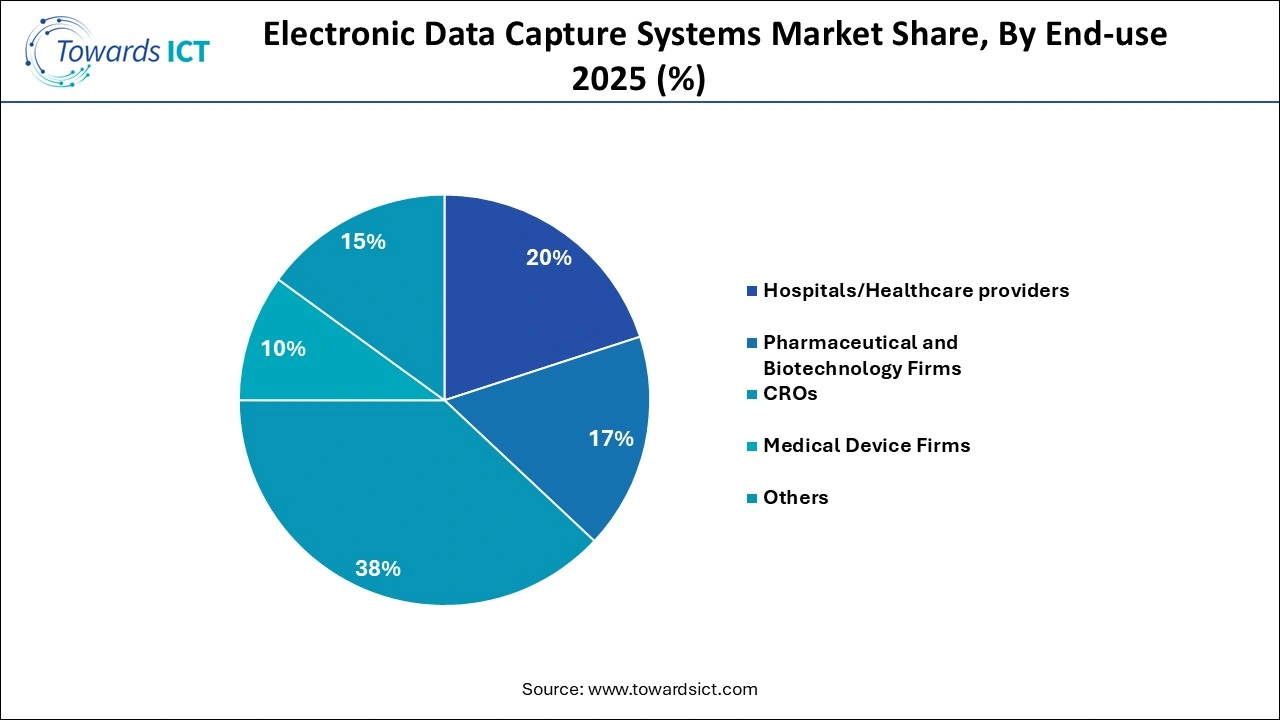

What made the CROs Segment dominate the Electronic Data Capture Systems Market in 2025?

The CROs segment held the largest share of the industry. The growing adoption of AI-enabled EDC systems by CROs for delivering superior services to healthcare providers has driven the market growth. Additionally, rapid investment by CROs for expanding their business in different parts of the world is expected to propel the growth of the electronic data capture systems market.

The hospitals/healthcare providers segment is expected to grow with the highest CAGR during the forecast period. The rise in the number of government hospitals in several nations, such as India, France, Italy, the UAE and some others has driven the market expansion. Moreover, partnerships among healthcare providers and EDC companies to deploy AI-enabled data capture systems in private hospitals are expected to drive the growth of the electronic data capture systems market.

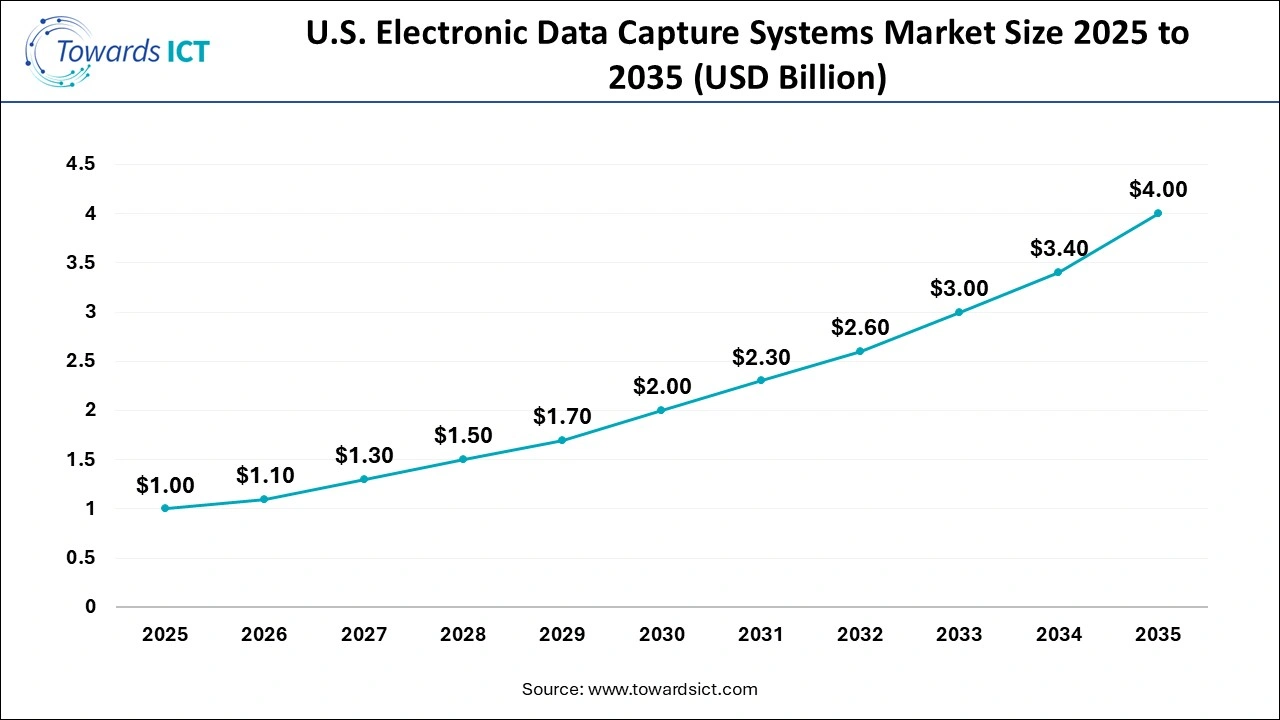

The U.S. robotic process automation market size is calculated at USD 1 billion in 2025 and is expected to reach nearly USD 4 billion in 2035, accelerating at a strong CAGR of 13.43% between 2026 and 2035.

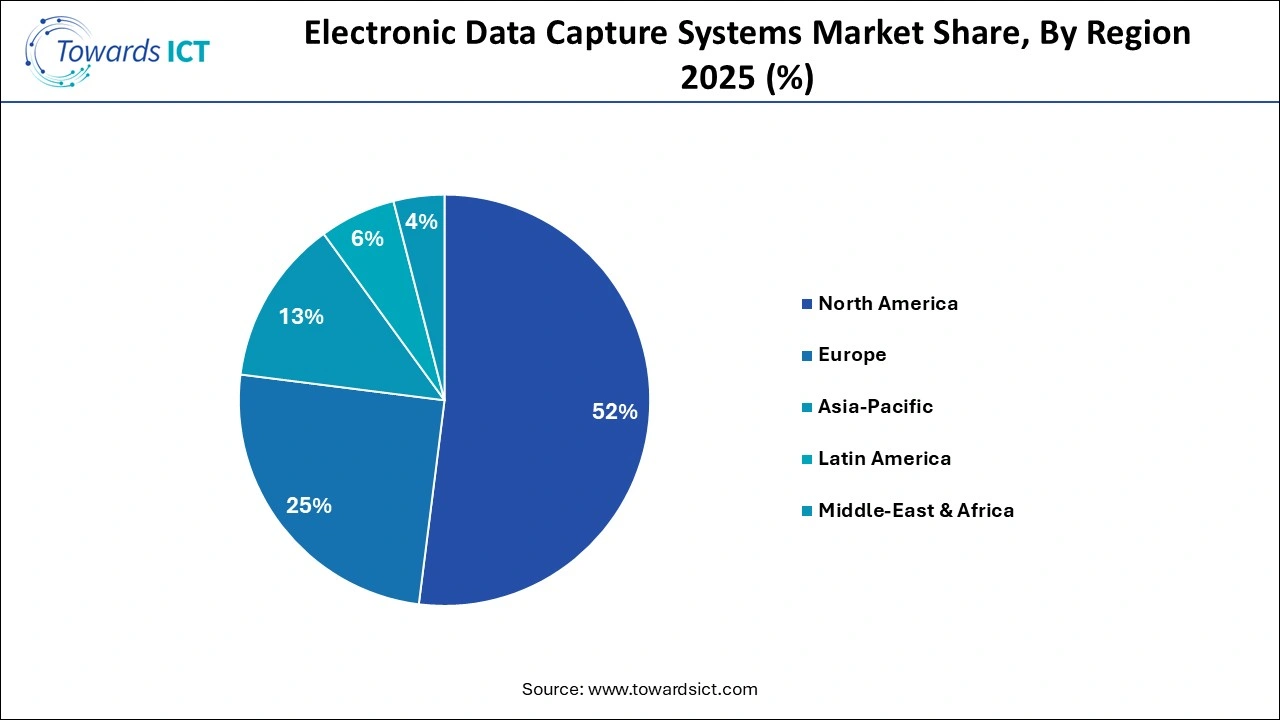

North America dominated the industry. The surging demand for high-quality medical devices in several nations, including the U.S., Canada, Mexico and others, has driven the market expansion. Additionally, numerous government initiatives aimed at developing the healthcare sector are playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Oracle, Veeva Systems, Medidata Solutions and others is expected to drive the growth of the electronic data capture systems market in this region.

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The rapid expansion of the healthcare industry in several nations, such as India, China, Japan, South Korea and some others, has boosted the market growth. Also, the rise in the number of software startups, as well as technological advancements in the pharmaceutical industry, is positively contributing to the market. Moreover, the presence of several market players such as Clinion, OpenClinica, Calyx and some others is expected to propel the growth of the electronic data capture systems market in this region.

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The rapid expansion of the healthcare industry in several nations, such as India, China, Japan, South Korea and some others, has boosted the market growth. Also, the rise in the number of software startups, as well as technological advancements in the pharmaceutical industry, is positively contributing to the market. Moreover, the presence of several market players such as Clinion, OpenClinica, Calyx and some others is expected to propel the growth of the electronic data capture systems market in this region.

| Company | Headquarters | Offerings |

| Calyx | Nottingham, UK | Calyx is a leading global technology provider for the biopharma industry, specialising in medical imaging and eClinical solutions (like Randomisation/Supply Management - RTSM/IRT) to speed up drug development, with deep expertise in oncology, neuroimaging, and integrating AI to improve trial efficiency and data quality for new treatments. |

| Castor | Amsterdam, Netherlands | Castor is a leading cloud-based eClinical platform for clinical trial data management, offering EDC/CDMS, ePRO, and data integration, trusted by biopharma for efficient data capture. |

| OpenClinica, LLC | Massachusetts, USA | OpenClinica, LLC provides a cloud-based, SaaS platform for running clinical trials, simplifying data capture (EDC/eCRF), management, randomisation, and patient engagement (ePRO/eCOA) for research organisations. |

| IBM | New York, USA | International Business Machines Corporation (IBM) is a global technology company that specialises in providing hybrid cloud, AI, and consulting solutions and services. It offers expertise in business transformation, technology consulting, and application operations across various industries like healthcare, finance, and retail. |

| IQVIA Inc. | North Carolina, USA | IQVIA is a global leader in health data science, tech, and clinical research, formed from the merger of IMS Health and Quintiles, providing advanced analytics, AI, and real-world evidence to help life sciences companies develop and commercialise treatments faster, aiming to improve patient outcomes through data-driven insights. |

| Clario | Wisconsin, USA | Clario is a global healthcare technology and research company, formed from the merger of ERT and Bioclinica, that provides a broad endpoint technology platform for clinical trials, combining expertise in eCOA, imaging, cardiac safety, and respiratory monitoring to generate high-quality evidence for pharmaceutical, biotech, and medical device partners. |

| Medidata Solutions, Inc. | New York, USA | Medidata Solutions, Inc. is a leading Dassault Systèmes company, providing a unified, cloud-based platform for clinical trial software and data analytics to the life sciences industry (pharma, biotech, devices). They offer end-to-end solutions for data capture (EDC), trial management (CTMS), patient engagement, randomisation, and AI-powered insights, aiming to accelerate drug development and improve patient experiences through digital transformation. |

| Oracle | Texas, USA | Oracle Corporation, headquartered in Austin, Texas, is a global tech giant known for its foundational relational database (Oracle Database) and extensive enterprise software, offering cloud infrastructure (IaaS), applications (SaaS like ERP/CRM), hardware (servers, storage), and IT services for businesses worldwide, evolving from database leader to a comprehensive cloud solutions provider with significant focus on AI and autonomous technologies. |

| DATATRAK International, Inc. | Ohio, USA | DATATRAK International, Inc. (DTRK) is a U.S.-based tech company providing unified eClinical software & services (like EDC, CTMS, Randomisation) for clinical trials to pharma/biotech, accelerating research via its DATATRAK ONE platform for data capture, management, and supply, aiming for efficiency from design to deployment. |

| BlackLine Inc. | California, USA | BlackLine, Inc. (Nasdaq: BL) provides a cloud-based software platform for modernising Finance & Accounting (F&A) operations, automating tasks like financial close, intercompany accounting, and accounts receivable through its Studio360 platform, featuring AI via Verity for enhanced efficiency and control, serving large and midsize companies globally to move from manual processes to digital transformation. |

By Delivery Mode

By Component

By Development Phase

By End User

Video Streaming Market Size, Share & Trends Analysis Report By Type Insights, By Solution Insights, By Pla...

December 2025