January 2026

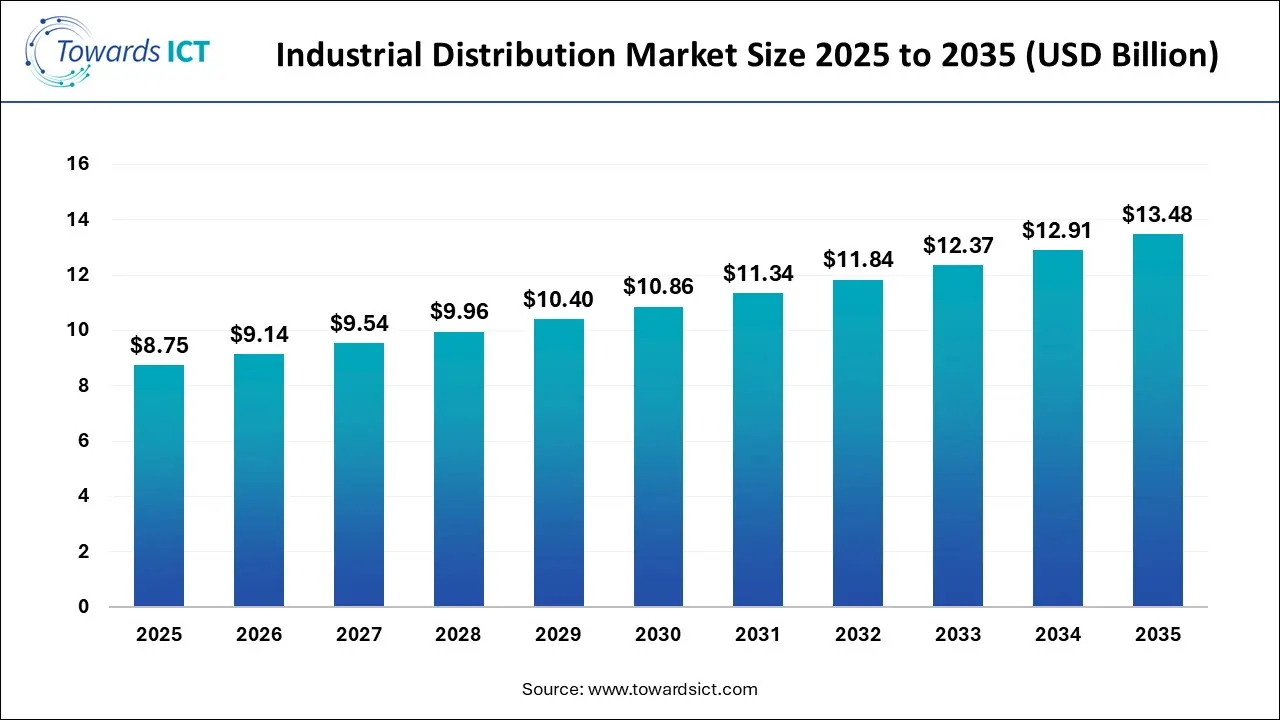

The industrial distribution market size was estimated at USD 8.75 billion in 2025 and is predicted to increase from USD 9.14 billion in 2026 to approximately USD 13.48 billion by 2035, expanding at a CAGR of 4.42% from 2026 to 2035. The rapid expansion of the manufacturing sector is expected to boost the growth of the industrial distribution market.

The industrial distribution market is an important branch of the heavy industries. There are different types of products developed in this sector, consisting of MRO supplies, electrical equipment and supplies, OEM supplies, hand tools and power tools, bearings, office equipment and supplies, and others. These products are available on several platforms, including online platforms and retail outlets. It finds application in numerous end-user industries that include manufacturing, energy and utilities, construction and infrastructure, healthcare and pharmaceuticals, mining and metals, transportation and warehousing, chemicals and process and others.

AI has played an integral role in the industrial distribution market. The deployment of AI-enabled solutions in the industrial sector helps in enhancing automation as well as improving the productivity of workers. Moreover, rapid investment by AI brands to develop a wide range of advanced equipment for the end-user industries is contributing to the industry in a positive direction.

| Report Coverage | Details |

| Market Size in 2026 | USD 9.14 Billion |

| Market Size by 2035 | USD 13.48 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 4.42% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Product, By Distribution Channel, By End-User Industry, By Regional |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

Numerous electronics companies are partnering with AI developers to manufacture a wide range of AI-integrated tools for the industrial sector

The instrument companies are engaged in launching different types of HVAC equipment to cater for the needs of the end-users.

Several market players are investing rapidly in opening up new manufacturing centres to enhance the production of industrial fasteners.

The growing development in the healthcare sector in developed nations is expected to create numerous growth opportunities for the market players in the future.

The rapid popularity of IoT-integrated material handling solutions in the European region is likely to reshape the industry in the upcoming days.

The electric supplies segment led the market. The growing demand for electrical components from the manufacturing sector has boosted the market expansion. Moreover, collaborations among market players and electronic brands to develop advanced electrical equipment from the mining sector are expected to boost the growth of the industrial distribution market.

The safety and personal protective equipment (PPE) segment is expected to rise with the highest CAGR during the forecast period. The rising focus of PPE manufacturers on developing a wide range of PPE equipment has driven the market growth. Also, numerous government initiatives aimed at enhancing security in the industrial sector are expected to propel the growth of the industrial distribution market.

The offline segment led the market. The increasing consumer preference to purchase industrial components from retail outlets has boosted the market expansion. Moreover, rapid investment by equipment manufacturers to open new service centres for providing regular servicing of industrial equipment is expected to drive the growth of the industrial distribution market.

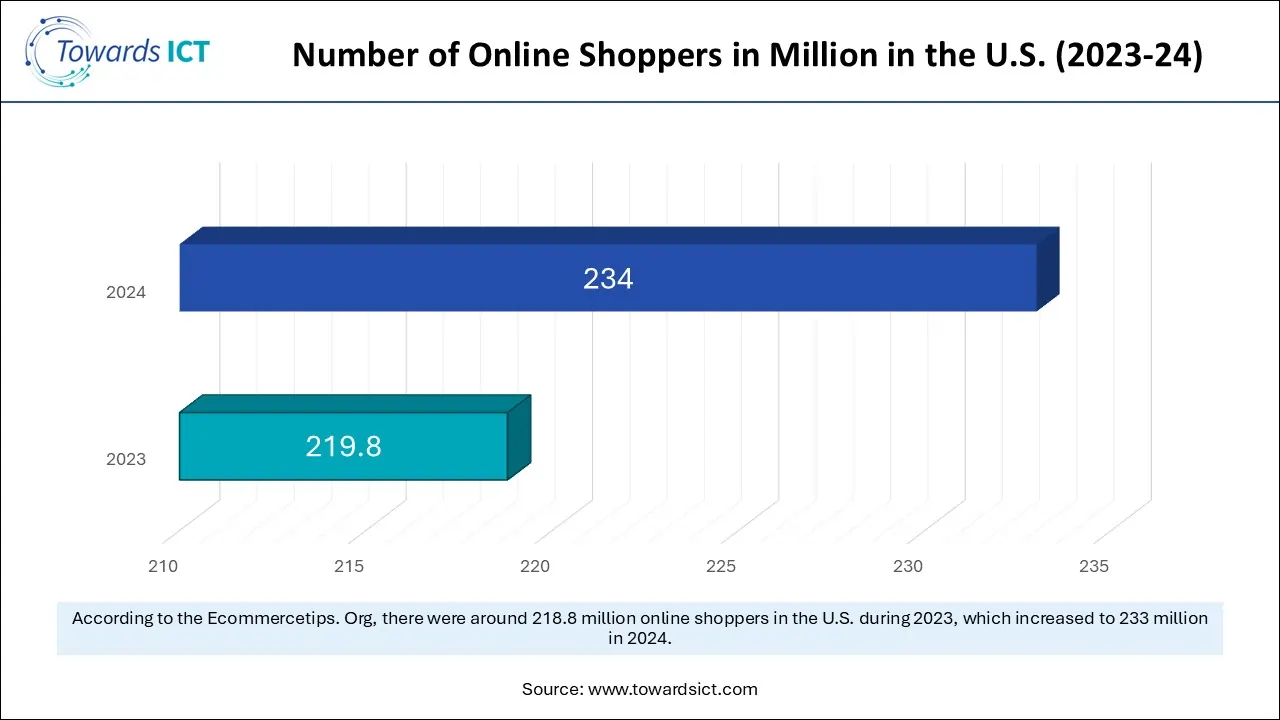

The online segment is expected to expand with the fastest CAGR during the forecast period. The rising popularity of online shopping in numerous countries, including the U.S., India, Germany and some others, has driven the market growth. Also, the availability of a wide variety of material handling solutions on e-commerce platforms is expected to boost the growth of the industrial distribution market.

The manufacturing segment held the largest share of the industrial distribution market. The rapid expansion of the manufacturing industry across numerous countries, including Germany, the UK, the U.S., Canada and some others, has boosted the market expansion. Moreover, technological advancements in the manufacturing sector are expected to propel the growth of the industrial distribution market.

The energy and utilities segment is expected to rise with a significant CAGR during the forecast period. The growing development in the renewable energy industry across several nations, such as France, India, Italy and some others, has driven the market growth. Additionally, rapid investment by market players for opening up new utility centres is expected to drive the growth of the industrial distribution market.

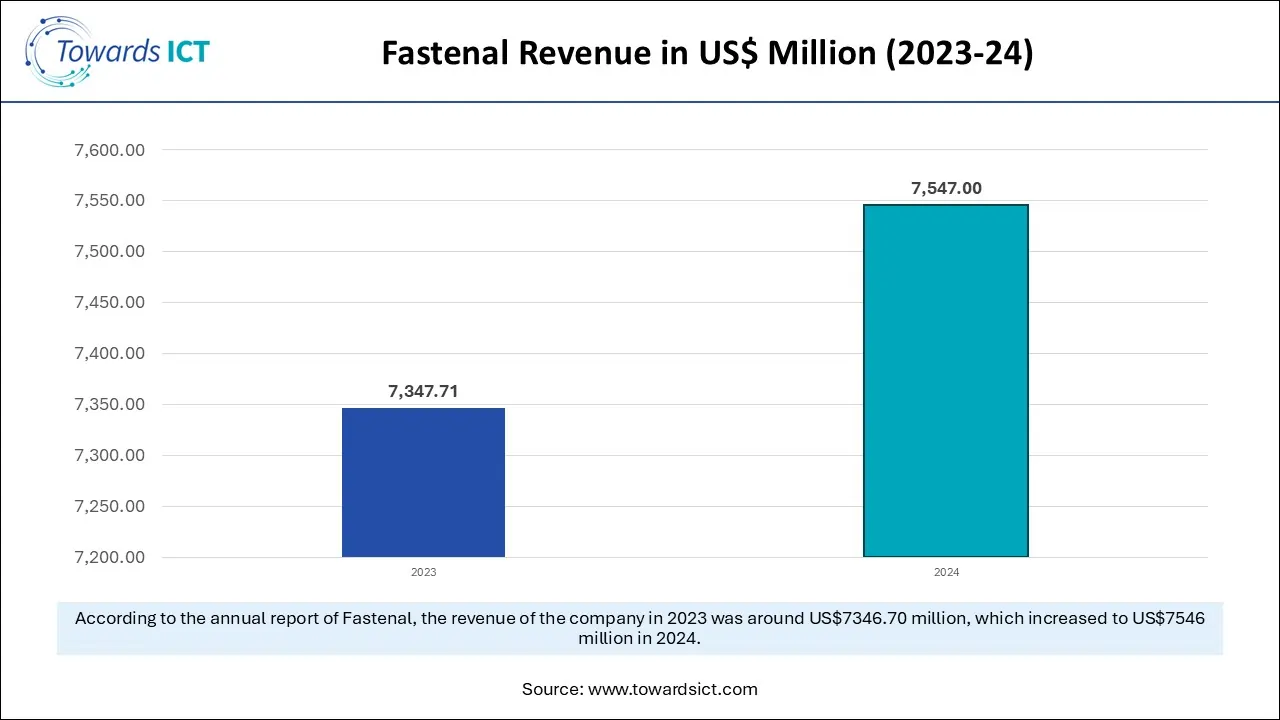

North America led the industrial distribution market. The rapid expansion of the manufacturing sector in several nations such as the U.S., Canada, Mexico and some others has boosted the market expansion. Also, numerous government initiatives aimed at developing the mining sector, coupled with the presence of several market players such as Fastenal Company, Motion Industries Inc., WESCO International Inc. and some others, are expected to drive the growth of the industrial distribution market in this region.

The U.S. is a major contributor in this region. The growing demand for high-quality fasteners from the energy and utility companies, coupled with technological advancements in the construction sector, has driven the market growth. Moreover, the popularity of e-commerce platforms, along with increasing sales of lubricants, is playing a prominent role in shaping the industrial landscape.

Asia Pacific is expected to rise with the highest CAGR during the forecast period. The rising demand for material handling solutions from the logistics sector in numerous countries, including India, China, Japan, South Korea, Singapore and some others, has boosted the market growth. Moreover, rapid investment by the government for digitalising the industrial sector, coupled with a rise in the number of chemical startups, is expected to drive the growth of the industrial distribution market in this region.

China dominated the market in this region. The surging adoption of automation solutions by the automotive and aerospace sectors has driven the market expansion. Moreover, rapid investment by market players for opening new manufacturing plants is contributing to the industry in a positive manner.

Europe held a significant share of the market. The growing demand for tools and instruments from the metals and energy industry across numerous countries, including Germany, France, Italy, the UK, the Netherlands and some others, has boosted the market growth. Also, numerous government initiatives aimed at strengthening the healthcare sector, coupled with surging sales of HVAC equipment, are expected to boost the growth of the industrial distribution market in this region.

Germany led the market in this region. The rising demand for industrial fluids and lubricants from the heavy industries has driven the market growth. Moreover, collaborations among metal companies and equipment manufacturers to develop a wide range of material handling solutions are playing a vital role in shaping the industrial landscape.

| Company | Headquarters | Offerings |

| Fastenal Company | Minnesota, USA | Fastenal Company ($FAST) is a major American distributor of industrial, safety, and construction supplies, known for fasteners, tools, PPE, and supply chain solutions. It offers a broad product range from nuts, bolts, and screws to janitorial supplies and Vending solutions, leveraging local expertise and global sourcing to support manufacturing, construction, government, and healthcare sectors. |

| Motion Industries Inc. | Birmingham, AL. 35210, USA | Motion Industries, Inc. is a leading North American distributor of industrial MRO (maintenance, repair, and operation) replacement parts and services. This brand offers bearings, power transmission, automation, fluid power, and safety products. |

| MSC Industrial Direct Co. Inc. | New York, USA | MSC Industrial Direct Co., Inc. is a renowned distributor of metalworking and Maintenance, Repair, and Operations (MRO) supplies, serving manufacturers, construction, and government with a vast range of products such as cutting tools, safety gear, and machinery. |

| Rexel Group | Paris, France | Rexel Group is a French multinational company and a global leader in the professional distribution of electrical products, services, and solutions, serving residential, commercial, and industrial markets for construction, renovation, and maintenance. They provide a vast range of low/ultra-low voltage electricals, automation, lighting, and energy-efficient solutions. |

| W.W. Grainger Inc. | Illinois, USA | W.W. Grainger, Inc. (NYSE: GWW) is a leading global distributor of MRO (Maintenance, Repair, and Operating) supplies, tools, and equipment, serving commercial, industrial, contractor, and institutional customers in North America and globally through brands including Grainger, Zoro, and MonotaRO. |

| WESCO International Inc. | Pennsylvania, USA | WESCO International, Inc. is a global Fortune 500 provider of business-to-business distribution, logistics, and supply chain solutions, offering electrical, industrial, communications, security, and MRO (Maintenance, Repair, & Operations) products, alongside tech-enabled services like automation, data centre solutions, and digital supply chain management for commercial, industrial, utility, and government sectors. |

| MRC Global Inc. | Texas, United States | MRC Global Inc. was a leading global distributor of pipes, valves, fittings (PVF), and related products/services for energy & industrial sectors, known for serving demanding environments with products such as carbon steel, stainless steel, & automation solutions. |

| Graybar Electric Co. | St. Louis, Missouri, USA | Graybar Electric Company, Inc. is a leading Fortune 500, employee-owned North American distributor of electrical, communications, and data networking products, offering supply chain and logistics services for construction, industrial, and government sectors, connecting thousands of manufacturers to hundreds of thousands of customers from its Clayton, Missouri headquarters. |

| Airgas Inc. | Pennsylvania, United States | Airgas, Inc. is the largest U.S. distributor of industrial, medical, and speciality gases, plus related hard goods (welding, safety, tools) and chemicals, serving over a million customers across vital sectors such as healthcare, food, manufacturing, and energy. |

| Sonepar USA | South Carolina, USA | Sonepar USA is the American arm of the global leader in B2B electrical distribution, Sonepar, serving markets like building, industry, and energy with electrical products, solutions, and services through a large network of local brands and over 570 locations nationwide. |

By Product

By Distribution Channel

By End-User Industry

By Region

January 2026

December 2025

December 2025

December 2025