January 2026

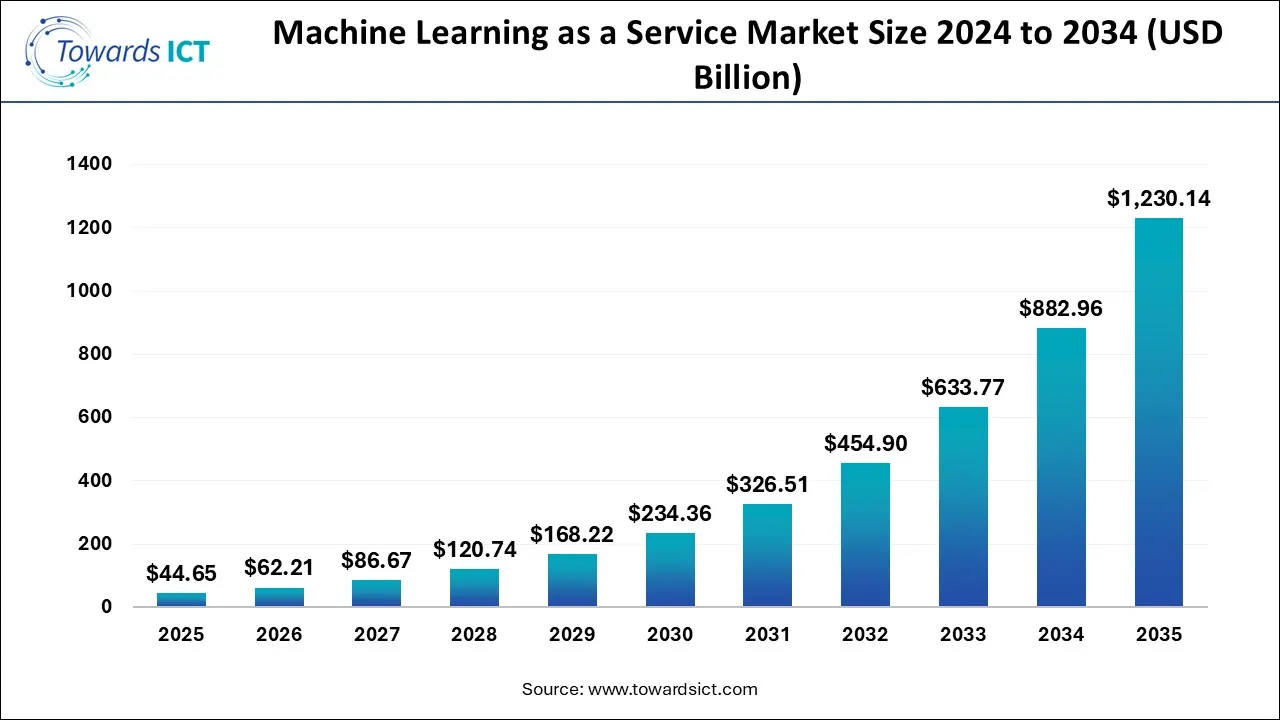

The global machine learning as a service market size was estimated at USD 44.65 billion in 2025 and is predicted to increase from USD 62.21 billion in 2026 to approximately USD 1,230.14 billion by 2035, expanding at a CAGR of 39.32% from 2026 to 2035.The growing popularity of cloud APIs in the manufacturing sector is expected to drive the growth of the machine learning as a service market.

Machine Learning as a Service (MLaaS) refers to cloud-based platforms that provide ready-to-use machine learning tools, frameworks, and infrastructure, allowing organizations to build, train, and deploy ML models without managing on-premise hardware or deep in-house expertise. MLaaS solutions typically include data preprocessing, model training, predictive analytics, and API-based model deployment, all accessible through scalable, pay-as-you-go cloud environments. This market is driven by the growing need to operationalize AI quickly, reduce development costs, and integrate machine learning capabilities into applications across industries such as finance, healthcare, retail, and manufacturing.

AI has played an integral role in the machine learning as a service industry. The integration of AI in ML platforms helps in personalising customer experiences, automating complex tasks, enhancing decision-making with predictive analytics, optimising operations, boosting cybersecurity and some others. In September 2025, Phenom launched an AI-based fraud detection agent. This fraud detection agent is designed for the enterprises of the U.S.

| Report Coverage | Details |

| Market Size in 2026 | USD 62.21 Billion |

| Market Size by 2035 | USD 1,230.14 Billion |

| Growth Rate From 2025 to 2035 | CAGR of 39.32% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Organization Size, By Component, By Application, By End User, By Regional |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

Numerous tech providers have collaborated with the corporate sector to develop ML services for corporate companies.

The market players have started launching several machine learning services to cater to the needs of the end-users.

Several ML companies are joining hands with AI developers to enhance the research and development of ML platforms.

The increase in the number of ML providers in different parts of the world is expected to create numerous growth opportunities for the market players in the future.

The integration of IoT platforms with ML services is likely to reshape the industry in the years to come.

How did the Software Tools Segment dominate the Machine Learning as a Service Market in 2024?

The software tools segment dominated the market. The rapid expansion of the software industry in several nations such as Canada, the Netherlands, South Korea and some others has boosted the market expansion. Additionally, partnerships among software companies and AI developers to develop a wide range of ML solutions for the end-users are expected to accelerate the growth of the machine learning as a service market.

The cloud APIs segment is expected to grow with a significant CAGR during the forecast period. The growing adoption of cloud-based APIs by manufacturing companies in developed nations has driven the market growth. Moreover, numerous advantages of cloud APIs, including improved efficiency, enhanced scalability, fast innovation and others, are expected to propel the growth of the machine learning as a service market.

Why the Large Enterprise Segment Led the Industry in 2024?

The large enterprise segment led the market. The rise in the number of large enterprises in numerous countries, including France, Mexico, the Netherlands, the U.S. and some others, has boosted the market expansion. Moreover, partnerships among tech developers and large corporate organisations to deploy ML services in offices are expected to propel the growth of the machine learning as a service market.

The small & medium enterprise segment is expected to rise with the fastest CAGR during the forecast period. The increase in the number of SMEs in several nations such as India, Indonesia, Vietnam, Thailand, the UK and some others has boosted the market growth. Additionally, numerous government initiatives aimed at digitalising the SME sector are expected to boost the growth of the machine learning as a service market.

.webp)

What Made the Network Analytics Segment Dominant in the Machine Learning as a Service Market in 2024?

The network analytics segment dominated the market. The growing emphasis of telecom companies to develop AI-based analytics platforms has boosted the market expansion. Moreover, technological advancements in machine learning solutions, coupled with partnerships among ML companies and SMEs to develop a low-range analytics platform, are expected to proliferate the growth of the machine learning as a service market.

The predictive maintenance segment is expected to rise with the highest CAGR during the forecast period. The growing demand for predictive maintenance solutions from the BFSI sector has driven the market growth. Also, numerous advantages of predictive maintenance solutions, including extended asset life, enhanced safety and environment, reduced downtime and others, are expected to foster the growth of the machine learning as a service market.

Why the Healthcare Segment Led the Industry in 2024?

The healthcare segment led the market. The rapid expansion of the healthcare industry across numerous countries, including the UAE, France, India, the U.S. and some others, has driven the market expansion. Moreover, collaborations among healthcare companies and ML developers to deploy ML services for enhancing operations in the healthcare industry are expected to drive the growth of the machine learning as a service market.

The transportation segment is expected to rise with a considerable CAGR during the forecast period. The growing development of the transportation sector in various nations, including India, China, Italy, Canada and some others, has driven the market growth. Moreover, numerous government initiatives aimed at digitalising the transportation sector are expected to foster the growth of the machine learning as a service market.

North America led the machine learning as a service market. The growing expansion of the manufacturing sector across numerous countries, including the U.S., Canada, Mexico and some others, has boosted the market expansion. Additionally, the presence of numerous market players such as IBM, Microsoft, FICO and some others, coupled with technological advancements in the healthcare sector, is expected to boost the growth of the machine learning as a service market in this region.

.webp)

The U.S. is a major contributor in this region. The rise in the number of ML providers, along with the rapid expansion of the BFSI industry, has driven the market growth. Moreover, partnerships among market players and tech providers to deploy high-quality technologies in the manufacturing sector are playing a prominent role in shaping the industrial landscape.

Asia Pacific is the fastest growing area for the machine learning as a service market. The growing adoption of machine learning services by the telecom sector across numerous countries, including Japan, China, India, South Korea and some others, has boosted the market growth. Also, numerous government initiatives aimed at strengthening the healthcare sector, coupled with the rapid expansion of the BFSI sector, are expected to boost the growth of the machine learning as a service market in this region.

China led the market in this region. The growing focus of market players to develop ML-based platforms for the aerospace and defence sector has driven the market growth. Moreover, collaborations among IT companies and tech developers to develop a wide range of predictive analytics software are playing a vital role in shaping the industrial landscape.

Europe emerged as a considerable region during the forecast period. The increasing demand for cloud APIs from the governments of several nations, such as Germany, France, Italy, the UK and some others has boosted the market growth. Also, rapid adoption of ML services in the transportation sector, coupled with a rise in the number of technology startups, is expected to drive the growth of the machine learning as a service market in this region.

The U.K. is a significant contributor in this region. The surging adoption of web-based APIs by the corporate sector, along with the rise in the number of SMEs, has driven the market expansion. Moreover, collaborations among automotive companies and tech providers to deploy ML services in automotive service centres are positively contributing to the industry.

| Company | Headquarters | Offerings |

| Google Inc | California, USA | Google LLC, a subsidiary of Alphabet Inc., is a US multinational tech giant known for its dominant search engine, online advertising (AdWords/Ads), cloud computing, software, and hardware. |

| Amazon Web Services, Inc. | Washington, USA | Amazon Web Services (AWS) is Amazons massive, comprehensive cloud computing platform, offering on-demand, pay-as-you-go access to over 200 services like compute power, storage, databases, AI/ML, analytics, and more, used by millions of businesses, governments, and startups globally to cut costs, boost agility, and innovate faster. |

| SAS Institute Inc | North Carolina, USA | SAS Institute Inc. is a global leader in data analytics, AI, and business intelligence, providing software and services that help organisations make sense of complex data for better decisions, known for its trusted, privately-held status and deep roots in statistical analysis, serving major industries such as finance, healthcare, and government from its Cary, NC HQ. |

| IBM | New York, USA | IBM (International Business Machines Corporation), nicknamed "Big Blue," is an American multinational technology company that specialises in hybrid cloud and AI solutions, consulting services, and enterprise infrastructure. It is a global leader in business innovation and research, operating in over 170 countries. |

| FICO | Bozeman, USA | FICO is a leading data analytics software company, famous for its predictive analytics and the widely used FICO Score for consumer credit risk, empowering better lending decisions. Founded in 1956, FICO provides solutions across industries (finance, insurance, retail) for fraud protection, customer management, and operational decisions through its FICO Platform. |

| Hewlett-Packard Enterprise | Texas, USA | Hewlett Packard Enterprise (HPE) is a global IT leader providing enterprise tech for the AI era, focusing on servers, storage, networking, and hybrid cloud solutions to help businesses modernise, secure, and optimise their IT environments from edge to cloud. |

| Yottamine Analytics | Washington, United States | Yottamine Analytics is a software company that provides AI-powered predictive modelling for finance and big data solutions. The company specialises in highly scalable, cloud-based machine learning (ML) platforms that enable businesses to build accurate data-mining models, especially for high-value or rare events such as fraud detection, risk modelling, and financial time series prediction. |

| BIGML, INC | Oregon, USA | BIGML INC. is a technology company that provides a comprehensive, cloud-based Machine Learning as a Service (MLaaS) platform designed to make machine learning "beautifully simple for everyone". The platform allows users to build, automate, and deploy predictive models without requiring deep technical expertise. |

| Microsoft Corporation | Washington, United States | Microsoft Corporation is a global tech giant known for Windows, Office, and Azure, empowering digital transformation with software, services, devices (Xbox, Surface), and AI, focused on cloud, productivity, gaming, and empowering individuals/organisations to achieve more, driven by innovation in AI and sustainability. |

| Predictron Labs Ltd | Cardiff, United Kingdom | Predictron Labs Ltd. is a London-based, unfunded startup from 2014, focused on cloud-based predictive analytics. The company develops and provides predictive analytics solutions designed for various business applications. |

By Organization Size

By Component

By Application

By End User

By Region

January 2026

December 2025

December 2025

December 2025