January 2026

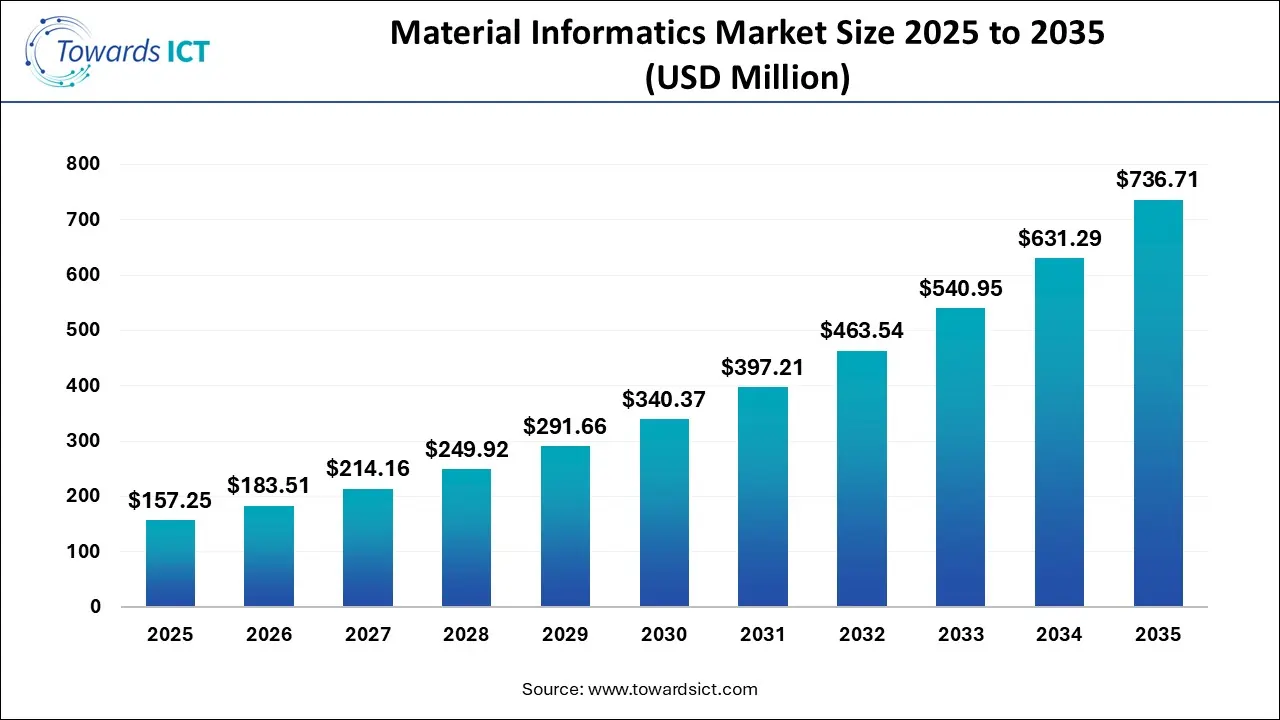

The materials informatics market size is expected to be worth around USD 736.71 million by 2035, from USD 157.25 million in 2025, growing at a CAGR of 16.7% during the forecast period from 2026 to 2035. The rising use of advanced technologies in the chemical industry is expected to drive the growth of the materials informatics market.

The materials informatics market is gaining immense popularity in recent times. This industry is involved in gathering information about different types of materials, consisting of elements, chemicals, and others. These materials are discovered using numerous technologies, such as Machine Learning, Deep Tensor, Statistical Analysis, Digital Annealer and some others. The end-users of this sector consist of material science, chemical and pharmaceutical, electronics and semiconductors, automotive, aerospace and defence, and some others.

AI has drastically changed the landscape of the materials informatics industry. The integration of AI solutions in the materials informatics industry helps in accelerating the discovery of advanced materials by detecting anomalies in substances. Moreover, rapid investment by AI developers to design advanced platforms for enhancing the material discovery procedure is an ongoing trend in the industry.

The accelerating need to shorten traditionally long materials R&D timelines is one of the most influential growth drivers of the global materials informatics market. In the chemical and materials sector, conventional discovery and optimization processes for polymers, catalysts, alloys, and functional materials often require 10–20 years, primarily due to repetitive experimentation, slow validation of properties, and uncertainties during scale-up. Materials informatics is transforming this model by enabling data-driven discovery, predictive modeling, and rapid virtual screening, allowing organizations to move from concept to commercialization in a fraction of the historical timeframe.

Chemical and materials companies are increasingly adopting machine learning based informatics platforms to significantly reduce experimental cycles, often by 50–80% in early-stage research. Instead of relying on costly trial-and-error synthesis of thousands of material variants, informatics platforms leverage historical experimental data, molecular descriptors, processing parameters, and performance metrics to identify the most promising candidates early. This targeted approach allows R&D teams to focus laboratory resources only on high-probability formulations, accelerating development while reducing cost and risk.

Numerous AI companies have started partnering with advanced materials brands to develop advanced AI platforms.

Market players are engaged in launching various types of material informatics solutions to cater for the needs of the aerospace sector.

Chemical manufacturers are heavily investing in opening R&D centres for developing a wide range of chemicals for the end-user industries.

The growing demand for sustainable EV batteries is expected to create ample growth opportunities for the market players in the upcoming years.

The integration of IoT and AI in the advanced materials industry is likely to reshape the industry in the future.

| Report Coverage | Details |

| Market Size in 2026 | USD 183.51 Million |

| Market Size by 2035 | USD 736.71 Million |

| Growth Rate From 2026 to 2035 | CAGR of 16.7% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | Material Type, Technology, End-use, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | ABB; Citrine Informatics; Dassault Systemes; Elsevier; Hitachi High-Tech Corporation; International Business Machines Corporation; Lattice Technology, Inc.; Microsoft; Phaseshift Technologies Inc.; Schrodinger, Inc. |

Why did the elements segment lead the Materials Informatics Industry?

The elements segment dominated the industry. The rising adoption of AI-enabled informatics solutions from the scientific centres for detecting the quality of elements has boosted the market expansion. Moreover, rapid investment by the market players for developing advanced analytical solutions for analysing different types of elements is expected to propel the growth of the materials informatics market.

The chemicals segment is expected to grow with the highest CAGR during the forecast period. The growing demand for high-quality chemicals from academic institutions and laboratories has driven the market growth. Additionally, rapid investment by chemical manufacturers to deploy advanced informatics solutions for investigating the efficacy of chemicals is expected to boost the growth of the materials informatics market.

What made the machine learning segment dominate the Materials Informatics Market?

The machine learning segment held the largest share of the market. The rising use of ML solutions for accelerating the discovery and design of new materials has boosted the market expansion. Also, numerous advantages of machine learning technology, including automation of complex tasks, enhanced decision-making capabilities, high accuracy rate and others, are expected to drive the growth of the materials informatics market.

The statistical analysis segment is expected to rise with the highest CAGR during the forecast period. The growing adoption of statistical analysis tools for determining the quality of metals has boosted the market growth. Additionally, several benefits of these analytics tools, such as simplifying complex data, superior decision-making capabilities, identification of hidden trends, and others, are expected to propel the growth of the materials informatics market.

How did the chemical and pharmaceutical segment dominate the Materials Informatics Market in 2025?

The chemical and pharmaceutical segment led the industry. The rapid growth of the chemical industry in several nations, including the U.S., Japan, France and some others, has boosted the market expansion. Also, numerous government initiatives aimed at developing the biopharma sector, coupled with technological advancements in the vaccine manufacturing sector, are expected to drive the growth of the materials informatics market.

The electronics and semiconductor segment is expected to expand with the highest CAGR during the forecast period. The growing demand for advanced materials from the smartphone industry, as well as the rise in the number of electronics startups in developing nations, has driven the market growth. Moreover, rapid investment by the government for strengthening the semiconductor industry is expected to propel the growth of the materials informatics market.

![]()

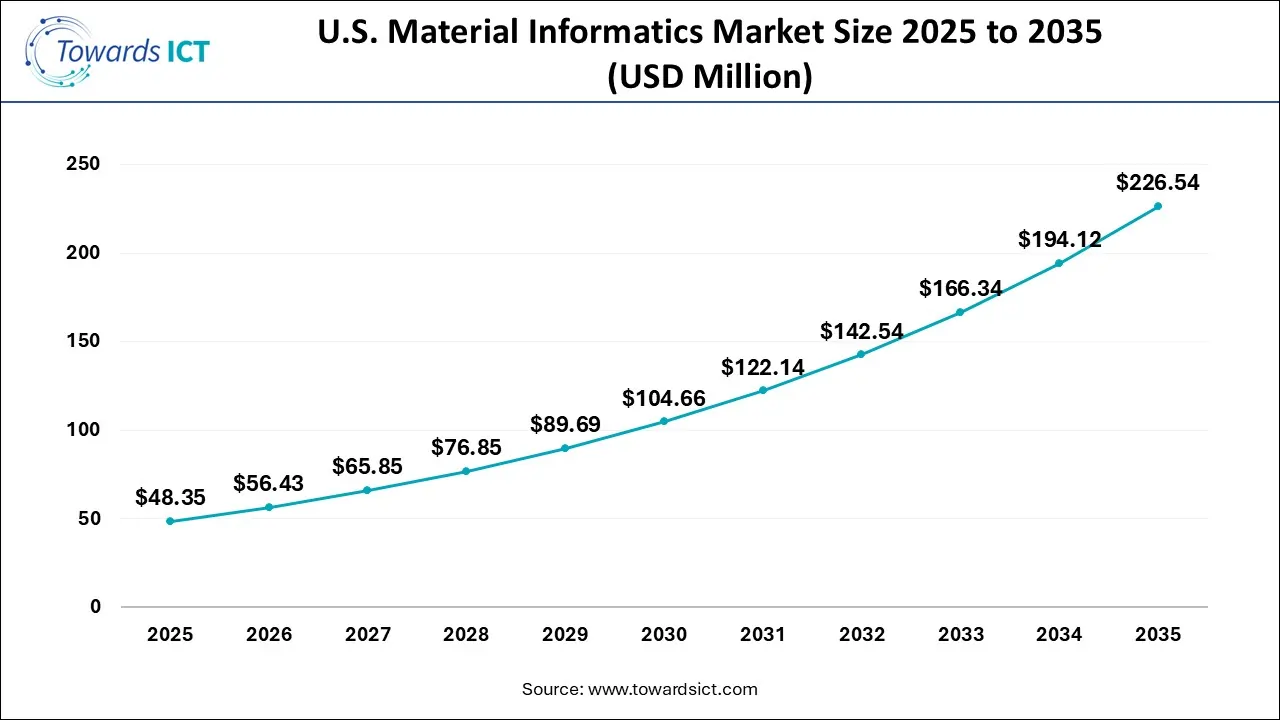

The U.S. material informatics market size is calculated at USD 48.35 million in 2025 and is expected to reach nearly USD 226.54 million in 2035, accelerating at a strong CAGR of 15.07% between 2026 and 2035.

Why has North America Led the Materials Informatics Market?

North America dominated the market. The rapid expansion of the material science industry in several countries, including the U.S., Canada, Mexico and some others, has boosted the market expansion. Additionally, numerous government initiatives aimed at increasing the adoption of sustainable materials, along with the presence of several market players such as Phaseshift Technologies Inc., Microsoft, Schrodinger, Inc. and some others, are expected to drive the growth of the materials informatics market in this region.

.webp)

The U.S. leads the market in the North America region. The growing emphasis of automakers to use eco-friendly materials for maintaining sustainability has driven the market growth. Also, technological advancements in the advanced materials industry are playing a vital role in shaping the industry in a positive direction.

Why is Asia Pacific the Fastest-Growing Region in the Materials Informatics Market?

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The rising development in the electronics industry in several nations, such as China, India, South Korea, Japan and some others, has driven the market expansion. Additionally, rapid investment by the government for developing the semiconductor industry is expected to foster the growth of the materials informatics market in this region.

China is the major contributor to the market in the APAC region. The growing focus of chemical companies on opening new production centres has boosted the market growth. Moreover, technological advancements in the pharmaceutical industry and the rapid expansion of the aerospace sector are playing a vital role in shaping the industrial landscape.

What made Europe rise with a Significant CAGR in the industry?

Europe is expected to rise with a significant CAGR during the forecast period. The growing demand for advanced materials from the heavy equipment industries in numerous countries, including Germany, France, the UK, Spain and some others, has driven the market expansion. Moreover, the increasing adoption of sustainable materials in the automotive sector, coupled with a rise in the number of pharma startups, is expected to boost the growth of the materials informatics market in this region.

Germany dominated the industry in the European region. The rapid investment by automotive brands in opening new production centres has boosted the market expansion. Moreover, the integration of AI and IoT in the defence sector is playing a crucial role in shaping the industrial landscape.

North America – Chemicals & Materials Regulations

Europe – Chemical and Digital Regulation Frameworks

Asia-Pacific – Emerging and Evolving Regulatory Ecosystem

| Company | Headquarters | Offerings |

| ABB Ltd. | Zurich, Switzerland | ABB Ltd. is a Swedish technology company focused on electrification and automation, providing digital solutions, engineering, and products like motors, drives, and robotic systems to improve industrial performance and sustainability for industries, transport, and infrastructure worldwide, operating in over 100 countries with its HQ in Zurich. |

| Citrine Informatics | California, USA | Citrine Informatics is one of the leading enterprise Software as a Service (SaaS) companies that uses generative artificial intelligence (AI) and a materials-specific data infrastructure to accelerate the development and deployment of new materials and chemicals. |

| Dassault Systèmes | Paris, France | Dassault Systèmes is a French software company that provides virtual environments (virtual twins) for designing, simulating, and managing products and processes across industries such as aerospace, automotive, life sciences, and construction. |

| Elsevier | Amsterdam, Netherlands | Elsevier is a major global publisher for scientific, technical, and medical (STM) information. This brand offers numerous tools, such as ScienceDirect (abstracts, citations, metrics) and Scopus (bibliographic database) for research evaluation and discovery. |

| Hitachi High-Tech Corporation | Tokyo, Japan | Hitachi High-Tech Corporation (HTHT) is a global technology company focused on observation, measurement, and analysis, providing advanced equipment and solutions for semiconductors (like CD-SEMs, FIB-SEMs), healthcare (clinical analyzers, biotech), and various industries (mobility, energy) using its core tech to solve societal challenges and drive innovation, leveraging data with AI for sustainable growth. |

| International Business Machines Corporation | New York, United States | IBM (International Business Machines Corp) is a global tech giant focusing on hybrid cloud, AI, consulting, and IT services, evolving from punch cards to mainframes, PCs, and now advanced solutions in data, security, and automation for diverse industries, including finance, healthcare, and retail. |

| Lattice Technology, Inc. | San Francisco, USA | Lattice Technology, Inc. provides 3D data solutions for manufacturing, using its XVL technology to convert, manage, and publish 3D CAD data for technical illustrations, work instructions, assembly simulations, and digital manuals. |

| Microsoft | Washington, United States | Microsoft is a global tech giant known for Windows & Office, heavily focused on cloud (Azure), AI, gaming (Xbox), hardware (Surface), and productivity tools (Microsoft 365, LinkedIn), empowering digital transformation with its mission to help everyone achieve more through intelligent cloud and edge solutions. |

| Phaseshift Technologies Inc. | Ontario, Canada | Phaseshift Technologies Inc. is a Toronto-based advanced materials company using an AI-powered platform. This platform is designed to accelerate the creation of custom metallic alloys and composites for industries such as aerospace, energy, and manufacturing. |

| Schrodinger, Inc. | New York, USA | Schrödinger, Inc. is a public scientific software company that uses a physics-based computational platform for accelerating drug discovery and materials science, aiming to improve health by designing better molecules for medicines and materials. |

Strengths

Weaknesses

Opportunities

Threats

By Material Type

By Technology

By End-Use

By Region

January 2026

December 2025

December 2025

December 2025