January 2026

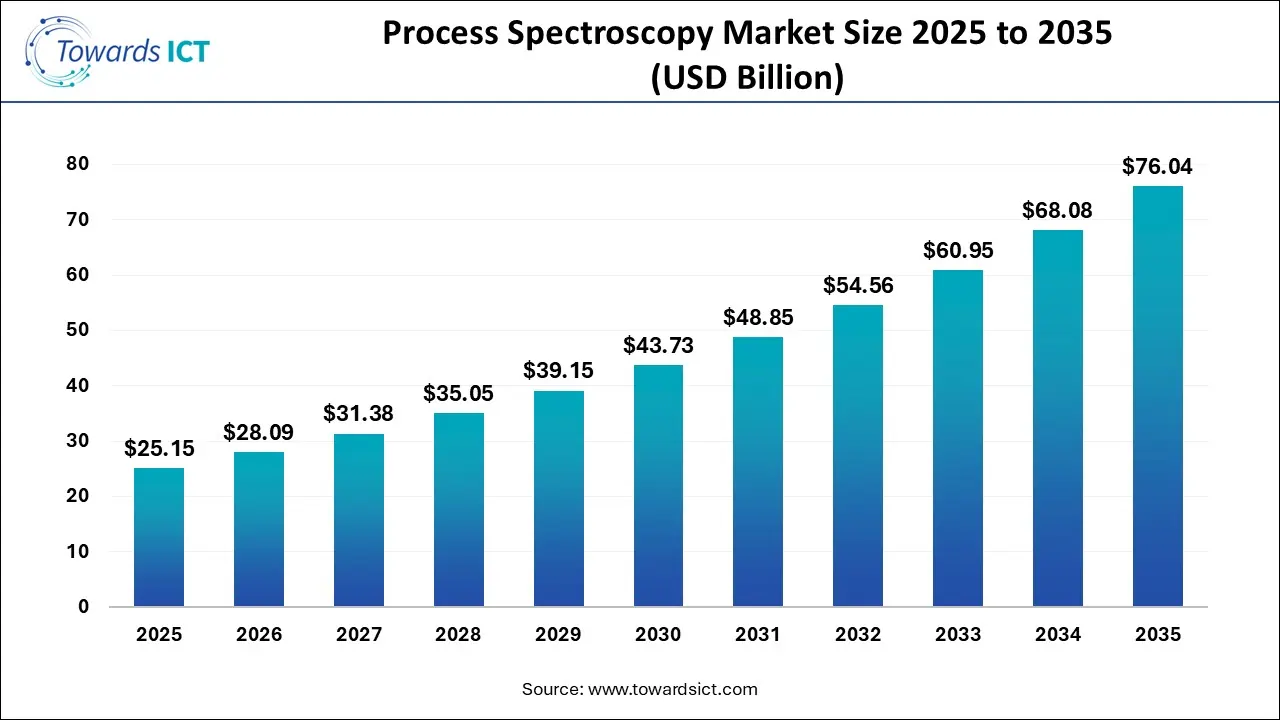

The process spectroscopy market size is expected to be worth around USD 76.04 billion by 2035, from USD 25.15 billion in 2025, growing at a CAGR of 11.7% during the forecast period from 2026 to 2035. The rising adoption of process spectroscopy solutions from the pharma sector is expected to drive the growth of the process spectroscopy market.

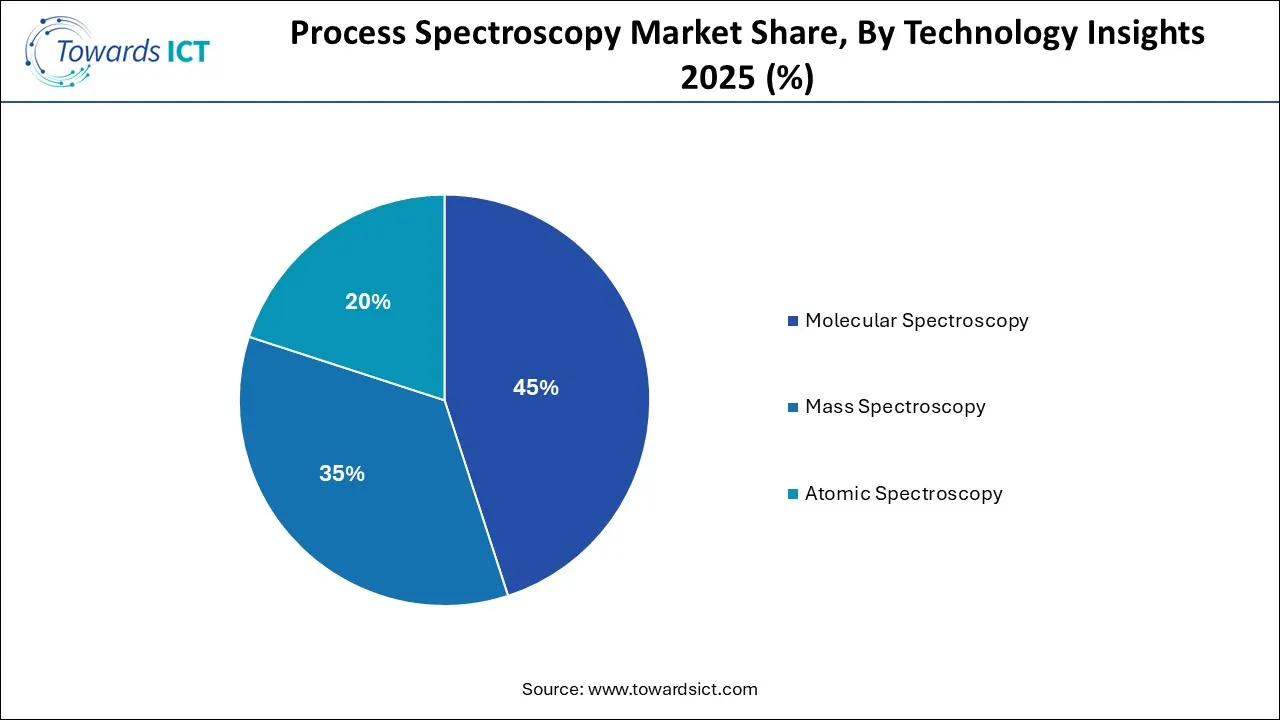

The process spectroscopy market has gained traction in recent times. There are different components of this sector, comprising hardware and software. This industry is based on several technologies, including molecular spectroscopy, mass spectroscopy, atomic spectroscopy and others. It finds application in various industries such as polymer, oil and gas, pharmaceutical, food and agriculture, chemical, water and wastewater, pulp and paper, metal and mining and some others.

AI has played a vital role in the process spectroscopy market. The integration of AI in process spectroscopy helps in automating data analysis, fast quality control capabilities, handling complex sets of data and others. Moreover, the growing adoption of AI-enabled spectrometers in the food and beverage sector for the accurate identification of food products is an ongoing trend in the industry.

Numerous AI developers have started collaborating with chemical brands to develop advanced AI solutions.

Market players are engaged in launching various types of spectroscopy solutions to cater for the needs of the end-users.

Biopharma companies are heavily investing in opening R&D centres for developing a wide range of medicines for consumers.

The growing demand for prosthetic sensors from healthcare professionals is expected to create ample growth opportunities for the market players in the upcoming years.

The integration of AI and blockchain in the forensics sector for detecting culprits is likely to reshape the industry in the future.

| Report Coverage | Details |

| Market Size in 2026 | USD 28.09 Billion |

| Market Size by 2035 | USD 76.04 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 11.7% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | Component, Technology, Application, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | ABB Ltd.; Agilent Technologies; Inc.; Bruker Corporation; BÜCHI Labortechnik AG; Danaher Corporation; Endress+Hauser Group Services AG; FOSS; HORIBA Group; Sartorius AG; Shimadzu Corporation; Thermo Fisher Scientific Inc.; Yokogawa Electric Corporation. |

Why did the hardware segment lead the Process Spectroscopy Industry?

The hardware segment held the leading share in the industry. The increasing demand for high-quality spectrometers from the chemicals industry has fueled market growth. Furthermore, rapid investments by market players to establish new production centres to enhance hardware component manufacturing are expected to drive the growth of the process spectroscopy market.

The software segment is expected to grow with the highest CAGR during the forecast period. The surging adoption of AI-enabled spectroscopy software in the polymer industry has driven the market expansion. Also, collaborations among market players and software developers to design new platforms for enhancing the spectroscopy experience are expected to boost the growth of the process spectroscopy market.

How did the pharmaceutical segment dominate the Process Spectroscopy Market in 2025?

The pharmaceutical segment led the market. The rapid expansion of the pharma industry in numerous countries, including the U.S., India, Canada and some others, has boosted the market growth. Additionally, the growing adoption of AI-enabled spectrometers from the biopharma sector is expected to accelerate the growth of the process spectroscopy market.

The food and agriculture segment is expected to rise with the fastest CAGR during the forecast period. The use of process spectroscopy solutions has increased in the food and agricultural sector to provide real-time analysis for enhancing the quality control of food products has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the agricultural sector are expected to foster the growth of the process spectroscopy market.

What made the operations systems segment dominate the Process Spectroscopy Market in 2025?

The molecular spectroscopy segment dominated the industry. The growing use of molecular spectroscopy for determining molecular structures and detecting several processes in the pharma sector has boosted the market expansion. Moreover, numerous advantages of molecular spectroscopy, including quantitative analysis, structural identification, non-destructive testing, process monitoring and others are expected to propel the growth of the process spectroscopy market.

The mass spectroscopy segment is expected to expand with the highest CAGR during the forecast period. The rising application of mass spectroscopy in the healthcare sector for disease screening and newborn testing has boosted the market growth. Additionally, several benefits of mass spectroscopy, such as high sensitivity & specificity, broad applicability, structural elucidation, superior speed & efficiency and others, are expected to drive the growth of the process spectroscopy market.

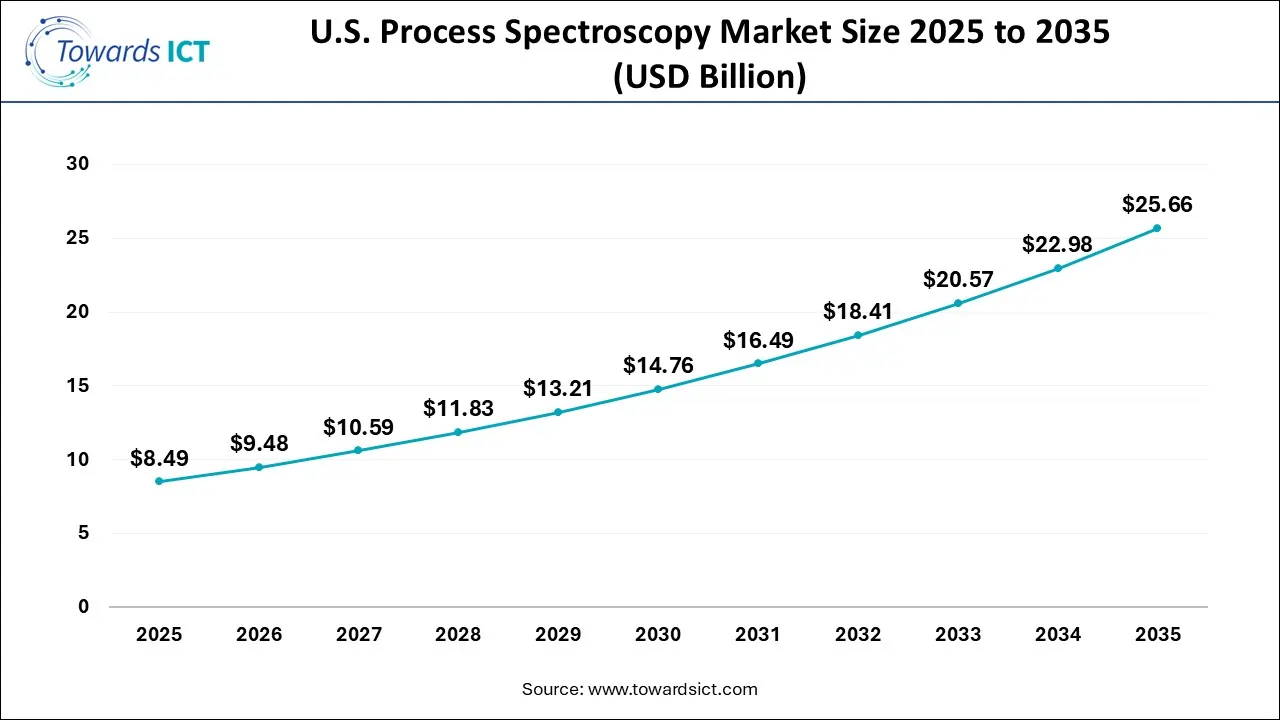

The U.S. process spectroscopy market size is calculated at USD 8.49 billion in 2025 and is expected to reach nearly USD 25.66 billion in 2035, accelerating at a strong CAGR of 10.58% between 2026 and 2035.

Why has North America led the Process Spectroscopy Market?

North America dominated the market. The rapid expansion of the polymer industry and chemical industry in the U.S. and Canada has bolstered the market growth. Also, numerous government initiatives aimed at developing the mining sector, coupled with the presence of several market players such as Agilent Technologies, Inc., Bruker Corporation, Thermo Fisher Scientific and some others, are expected to accelerate the growth of the process spectroscopy market in this region.

.webp)

The U.S. leads the market in the North America region. The growing emphasis of market players on opening new research and development centres for advancing chemical development has boosted the market expansion. Additionally, technological advancements in the vaccine manufacturing sector are playing a vital role in shaping the industrial landscape.

Why is Asia Pacific the fastest-growing region in the Process Spectroscopy Market?

Asia Pacific is expected to expand with the highest CAGR during the forecast period. The growing development in the oil and gas industry in numerous countries, including China, India, Australia, South Korea, Japan and others, has boosted the market growth. Moreover, rapid investment by pharma companies for opening new production units is expected to propel the growth of the process spectroscopy market in this region.

.webp)

China is the major contributor to the market in the APAC region. The rapid expansion of the polymer industry, as well as advancements in molecular spectroscopy technology, has boosted the market growth. Additionally, numerous government initiatives aimed at developing the petrochemicals industry are positively contributing to the industry.

What made Europe rise with a significant CAGR in the industry?

Europe is expected to rise with a significant CAGR during the forecast period. The rising adoption of mass spectroscopy technology in the metals industry across various nations, such as Germany, France, Italy, the UK, the Netherlands and some others has driven the market expansion. Moreover, the surging adoption of Industry 4.0 in the manufacturing sector, along with rapid advancements in the forensics sector, is expected to foster the growth of the process spectroscopy market in this region.

Germany dominated the industry in the European region. The growing demand for real-time analytics tools from the pharma industry has boosted the market expansion. Moreover, the rise in the number of chemical startups is playing a vital role in shaping the industrial landscape.

| Company | Headquarters | Offerings |

| ABB Ltd. | Zurich, Switzerland | ABB Ltd. is a global Swedish-Swiss technology giant focused on electrification and automation, providing digital solutions, engineering, and products like motors, drives, and robotic systems to improve industrial performance and sustainability for industries, transport, and infrastructure worldwide, operating in over 100 countries with its HQ in Zurich. |

| Agilent Technologies, Inc. | California, USA | Agilent Technologies, Inc. (NYSE: A) is a global leader in life sciences, diagnostics, and applied chemical markets, providing instruments, software, services, and consumables. Its offerings include Advanced analytical instruments (chromatography, mass spec), software, consumables, reagents, and comprehensive lab services (maintenance, training). |

| Bruker Corporation | Massachusetts, USA | Bruker Corporation is a global leader in high-performance scientific instruments, providing advanced analytical and diagnostic solutions for exploring life and materials at molecular, cellular, and microscopic levels, enabling breakthroughs in life science research, pharma, microscopy, semiconductors, and more, with key offerings in mass spectrometry, microscopy, automation, and biology tools for innovation and discovery. |

| BÜCHI Labortechnik AG | Flawil, Switzerland | BÜCHI Labortechnik AG is a globally operating, family-owned Swiss company that is a leading provider of laboratory technology solutions for research and development, quality control, and production across a wide range of industries. |

| Danaher Corporation | Washington, DC, United States | Danaher Corporation is a global science and technology innovator focused on life sciences, diagnostics, and biotechnology, providing tools, diagnostics, and services to healthcare, research, and pharma customers worldwide. |

| Endress+Hauser Group Services AG FOSS |

Basel-Landschaft, Switzerland | Endress+Hauser Group Services AG is the central support entity for the global Endress+Hauser Group, a leading family-owned Swiss company providing measurement instrumentation, automation solutions, and services for industrial processes, optimising efficiency, safety, and sustainability for industries like chemical, food & beverage, oil & gas, and water & wastewater. |

| HORIBA Group | Kyoto, Japan | The HORIBA Group, a global leader based in Japan, specialises in precision measurement and analysis instruments for diverse industries such as Automotive (emission testing), Semiconductors, Medical (Bio & Healthcare) (diagnostics), Environment, and Scientific Research. |

| Sartorius AG | Göttingen, Germany | Sartorius AG is a leading German supplier for the life science and biopharmaceutical industries, providing lab equipment (balances, pipettes) and bioprocess solutions (bioreactors, filtration, single-use systems) for research, development, and manufacturing of drugs and vaccines. |

| Shimadzu Corporation | Kyoto, Japan | Shimadzu Corporation is a Japanese multinational company, known for manufacturing high-tech precision instruments, medical systems, and aerospace/industrial equipment. It provides analytical tools such as diagnostic imaging and industrial machinery for sectors including pharma, healthcare, food, semiconductors, and aerospace. |

| Thermo Fisher Scientific Inc. | Massachusetts, United States | Thermo Fisher Scientific is a global leader in serving science, providing analytical instruments, lab equipment, software, services, consumables, and reagents to research, clinical, and industrial labs, with a mission to make the world healthier, cleaner, and safer, operating through key brands including Thermo Scientific, Applied Biosystems, Invitrogen, and Patheon, supporting pharma, biotech, hospitals, universities, and government. |

Strengths

Weaknesses

Opportunities

Threats

By Component

By Technology

By Application

By Region

The image recognition market is growing significantly due to the rapid deployment of advanced image recognitio...

January 2026

December 2025

December 2025

December 2025