January 2026

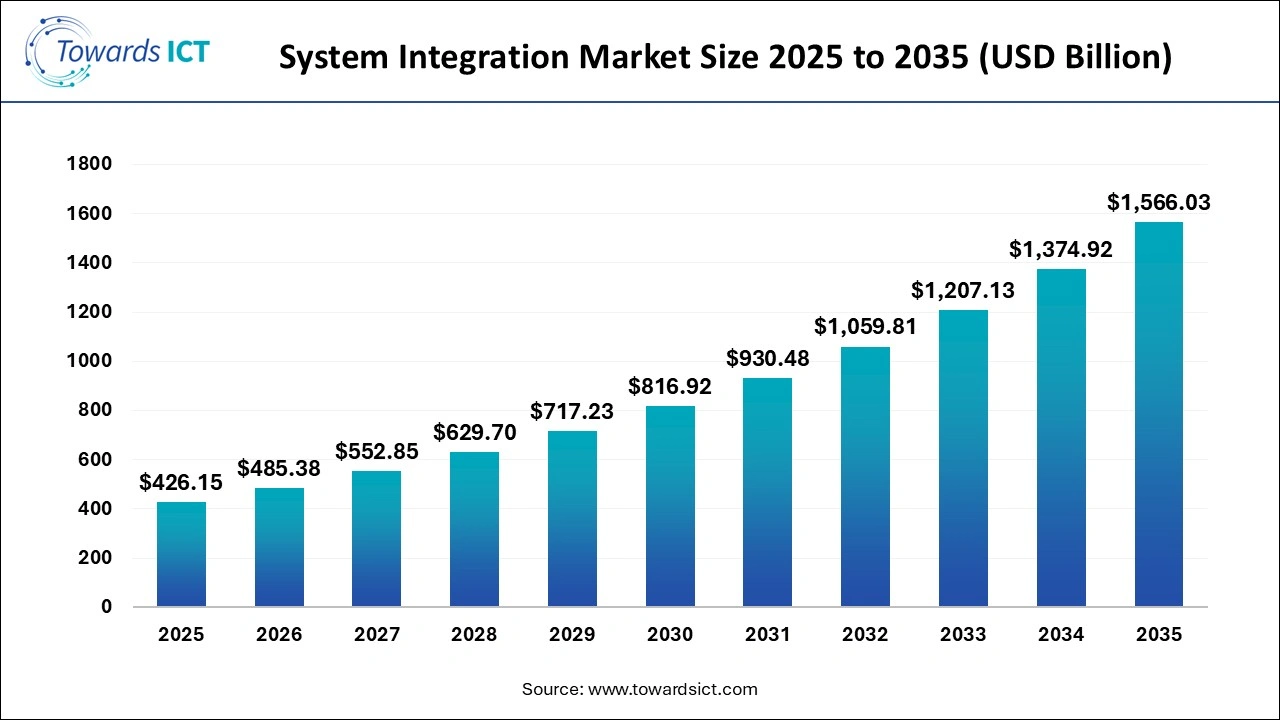

The system integration market size is expected to be worth around USD 1,566.03 billion by 2035, from USD 485.38 billion in 2025, growing at a CAGR of 13.9% during the forecast period from 2026 to 2035. The rapid expansion of the telecom sector in different parts of the world has driven the market expansion.

What is System Integration?

The system integration market is an important branch of the ICT sector. System integration is the method of connecting different software and hardware to a unified platform. There are different types of services delivered by this sector, comprising infrastructure integration, application integration, consulting and others. The end-users of these solutions consist of IT & telecom, defence & security, BFSI, oil & gas, healthcare, transportation, retail, and others.

| Report Coverage | Details |

| Market Size in 2026 | USD 485.38 Billion |

| Market Size by 2035 | USD 1,566.03 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 13.9% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Services, By Enterprise Size, By End-Use |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | Accenture, Computer Sciences Corporation (CSC), Deloitte Touche Tohmatsu Limited, Capgemini, Fujitsu Limited, Oracle Corporation, Infosys Limited, Cisco Systems, Inc., Cognizant, Hewlett Packard Company, |

AI has reshaped the landscape of the system integration industry. The integration of AI in system integration solutions helps in sharing data seamlessly, as well as automating complex tasks. Moreover, AI-based integration systems help in predictive maintenance, issue detection, real-time decision making and others. Thus, AI is playing a vital role in positively shaping the system integration market.

Rapid Investment in the Defence Sector

Governments of several countries, such as France, India, the U.S., Germany, the UAE and some others are investing heavily in deploying advanced system integration solutions for strengthening the defence sector. Thus, the rising defence expenditure in numerous nations is expected to drive the growth of the system integration market.

Lack of Skilled Workforce and Strict Compliance

The system integration market is negatively impacted by several factors. Firstly, the lack of skilled professionals is restraining the market growth. Secondly, the strict government compliance for deploying system integrator solutions in the end-user industries is hampering the industrial expansion.

Surging Adoption of Cloud-Native Solutions

The IT companies and the BFSI sector have started deploying cloud-native solutions to enhance scalability and improve security, as well as deliver real-time analytics to build flexible applications. Thus, the increasing adoption of cloud native solutions in the above-mentioned industries is expected to create ample growth opportunities for the market players in the future.

What made the Infrastructure Integration Segment Dominate the System Integration Market in 2025?

The infrastructure integration segment held the largest share of the market in 2025. The rising use of infrastructure integration solutions in the industrial parks has boosted the market expansion. Moreover, numerous government initiatives aimed at developing smart cities in developed nations are expected to boost the growth of the system integration market.

The consulting segment is expected to rise at a considerable rate during the forecast period. The growing emphasis of system integration companies to enhance customer experience and improve data flow has driven the market growth. Additionally, partnerships among tech providers and consulting companies to develop cloud-based system integration solutions are expected to propel the growth of the system integration market.

How did the Large Enterprises Segment lead the System Integration Market in 2025?

The large enterprises segment dominated the industry. The rise in the number of large IT companies across numerous countries, including China, the U.S., the UAE and others, has boosted the market expansion. Additionally, rapid investment by large retail brands for deploying system integration solutions is expected to drive the growth of the system integration market.

The small & medium enterprises segment is expected to rise with the highest CAGR throughout the forecasted period. The rapid expansion of SMEs in several nations, such as India, Thailand, Qatar and some others, has driven the market growth. Moreover, numerous government initiatives aimed at developing the SME sector are expected to boost the growth of the system integration market.

Why did the BFSI Segment hold the Dominant Share of the System Integration Market in 2025?

The BFSI segment led the industry. The rapid expansion of the BFSI sector in several nations, including the U.S., India, France, UAE and some others, has boosted the market expansion. Also, collaborations among BFSI companies and AI providers to deploy advanced system integration solutions in the BFSI sector are expected to drive the growth of the system integration market.

The IT & telecom segment is expected to expand with the fastest CAGR during the forecast period. The growing adoption of advanced integration systems in the IT sector for boosting efficiency has boosted the market growth. Also, rapid investment by the government for strengthening the telecom sector is expected to propel the growth of the system integration market.

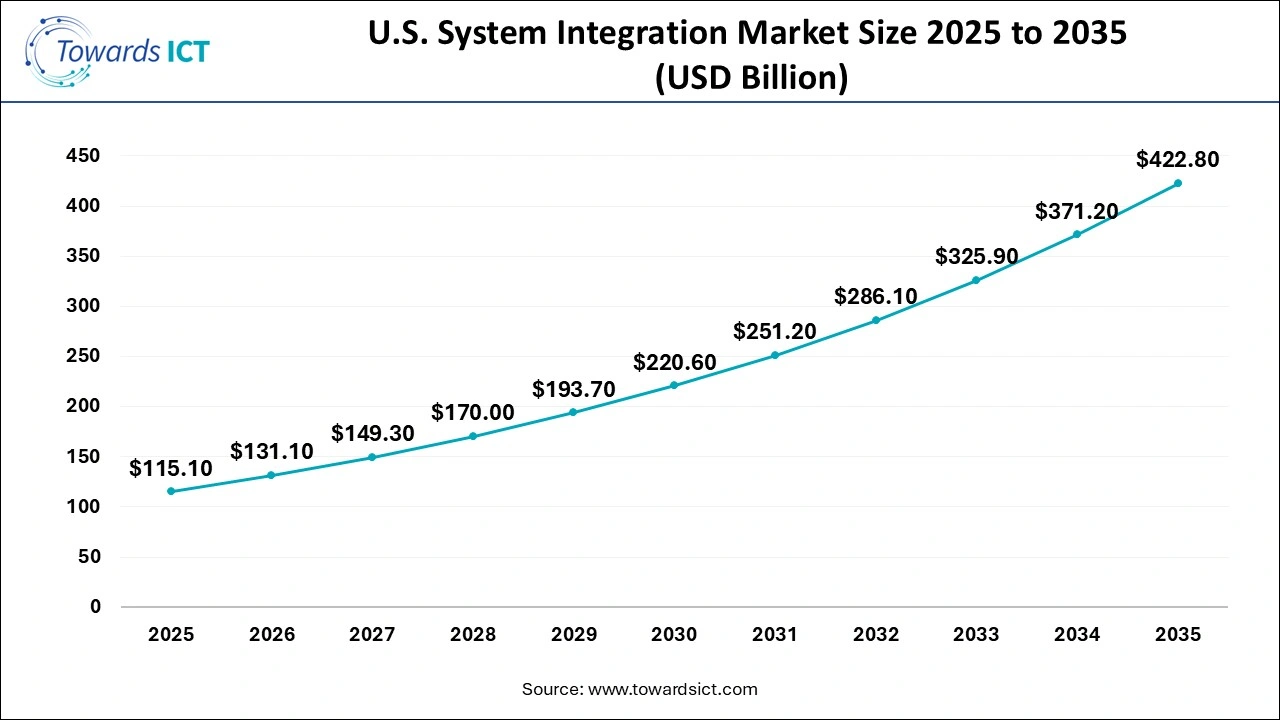

The U.S. System Integration market size is calculated at USD 115.1 billion in 2025 and is expected to reach nearly USD 422.8 billion in 2035, accelerating at a strong CAGR of 12.56% between 2026 and 2035.

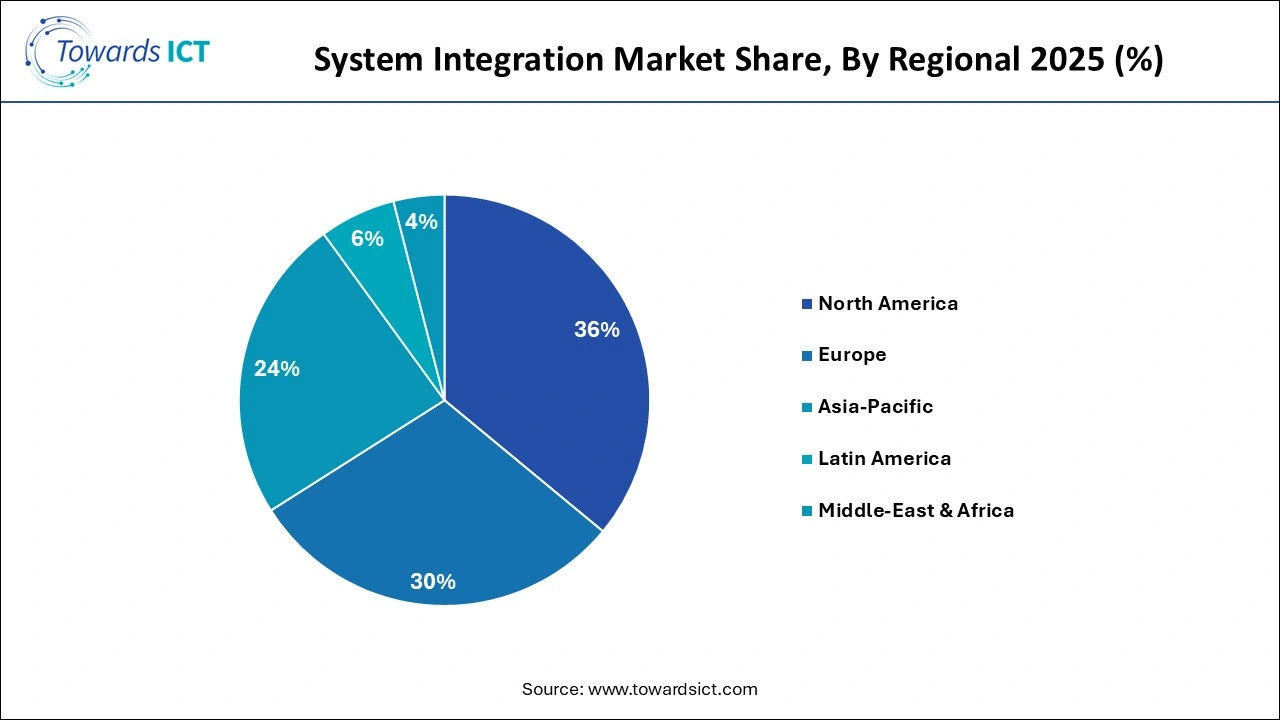

Why did the North America Dominate the System Integration Market?

North America dominated the industry. The rapid expansion of the IT& telecom sector in several countries, such as the U.S., Canada, Mexico, and others, has boosted the market expansion. Additionally, numerous government initiatives aimed at digitalising the defence sector are playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Oracle Corporation, Cognizant, IBM Corporation and others is expected to propel the growth of the system integration market in this region.

Asia Pacific System Integration Market Trends

Asia Pacific is expected to grow with the fastest CAGR during the forecast period. The surging adoption of AI-enabled system integration solutions in the transportation sector across numerous countries, including China, Japan, South Korea, India and others, has driven the market growth. Also, rapid investment by the government for developing the healthcare sector, as well as technological advancements in the BFSI sector, are positively contributing to the industry. Moreover, the presence of numerous market players such as HCL Technologies, Trivitron Digital.AI, Tata Consultancy Services, Tech Mahindra Limited and others is expected to boost the growth of the system integration market in this region.

| Company | Headquarters | Offerings |

| Accenture | Dublin, Ireland | Accenture is a global professional services giant, specialising in IT, consulting, digital, and operations, helping big companies modernise with tech such as AI, cloud, and security, across nearly every industry, known for its vast talent pool, global reach, and focus on innovation and sustainability to deliver tangible business value. |

| NEC Corporation | Tokyo, Japan | NEC Corporation is a Japanese multinational tech company, headquartered in Tokyo, specializing in integrating IT and network technologies to provide solutions for government, enterprises, and carriers, focusing on areas like AI, biometrics, cloud, telecom infrastructure (5G/6G), and social solutions (smart cities, defense), aiming to create a brighter world through technology for safety, security, and efficiency. |

| Atos SE | Bezons, France | Atos SE is a global French IT services firm specialising in digital transformation, offering cloud, cybersecurity, data, AI, and consulting, operating under brands like Atos (services) and Eviden (products/tech), known for critical environments such as HPC and cybersecurity, recently emerging from financial restructuring. |

| Boomi | Pennsylvania, USA | Boomi is a leading cloud-native Integration Platform as a Service (iPaaS) that helps businesses connect diverse applications, data, and devices, both in the cloud and on-premises, using a unified, low-code platform to automate workflows and streamline operations. |

| Capgemini | Paris, France | Capgemini is a French multinational tech consultancy that helps businesses transform digitally using AI, cloud, data, and engineering, offering end-to-end services from strategy to operations for major sectors such as finance, automotive, and energy. |

| Cisco Systems, Inc. | California, USA | Cisco Systems, Inc. is a U.S.-based global tech giant specialising in networking hardware, software, and telecommunications equipment, providing crucial infrastructure for secure connectivity, collaboration (Webex), security (Duo), and observability, powering everything from small businesses to large enterprises and governments, with a recent major focus on integrating AI infrastructure and data analytics. |

| Cognizant | New Jersey, USA | Cognizant Technology Solutions is a major American multinational professional services company, providing IT consulting, digital transformation, and business process outsourcing (BPO) to help clients modernise operations for the digital age, focusing on AI, cloud, digital engineering, and automation across numerous industries like banking, healthcare, and retail, known for its consultative approach and global delivery model. |

| Deloitte Touche Tohmatsu Limited | London, United Kingdom | Deloitte Touche Tohmatsu Limited (DTTL) is a leading professional services organisation offering audit, consulting, financial advisory, risk advisory, and tax services through separate, independent member firms worldwide, focusing on making an impact by helping clients with complex business challenges across various industries. |

| HCL Technologies Limited | Uttar Pradesh, India | HCL Technologies (HCLTech) is a major Indian multinational IT services and consulting company, offering expertise in AI, Cloud, Digital, Engineering, R&D, and Software, serving diverse sectors like finance, manufacturing, and telecom. |

| Infosys Limited | Bangalore, India | Infosys Limited is a global leader in next-gen digital services and consulting, an Indian multinational tech giant offering IT, business process management, and outsourcing services. |

By Services

By Enterprise Size

By End-Use

January 2026

December 2025

December 2025

December 2025