January 2026

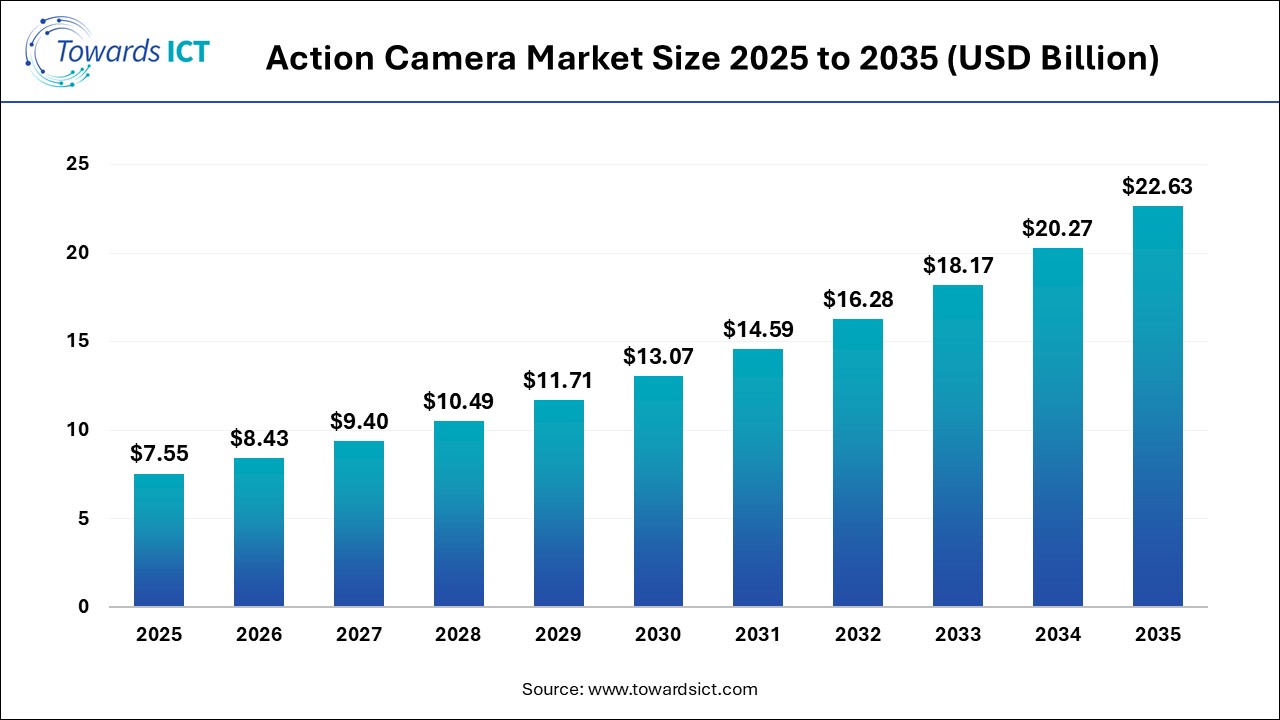

The action camera market size is calculated at USD 7.55 in 2025, grew to USD 8.43 billion in 2026, and is projected to reach around USD 22.63 billion by 2034. The market is expanding at a CAGR of 11.6% between 2025 and 2034. The growing demand for high-quality photos from the adventure tourism sector is expected to drive the growth of the action camera market.

Action cameras are engineered for durability, featuring shockproof, waterproof, and weather-resistant designs, along with wide-angle lenses and advanced stabilization systems to ensure clear footage during high-intensity activities. Technological advancements such as 4K/8K video, image stabilization, waterproof designs, AI-enhanced features, and seamless wireless connectivity are further fueling market expansion. Increasing participation in outdoor and extreme sports, along with the surge in content creation and social media influence, continues to strengthen global demand.

The integration of AI in action cameras has enabled several features such as motion tracking, automatic video editing, scene recognition, and low-light image enhancement.

Numerous market players are partnering with action sports companies to develop a wide range of action cameras. For instance, in November 2025, Insta360 partnered with Swatch Nines. This partnership is done for developing a new action camera for the sports sector.

The camera brands are integrating AI in action cameras for enhancing the imaging capabilities. For instance, in November 2025, GoPro launched MAX2. MAXW is an AI-enabled camera designed for the content creators of India.

Several camera manufacturers are investing heavily for opening new production centres to increase the production of cameras. For instance, in June 2025, Brihaspathi announced to invest around US$10 million. This investment is done for opening up new CCTV manufacturing plant in Hyderabad, India.

The rise in number of content creators in developing nations is expected to create numerous growth opportunities for the market players in the future.

The semiconductor companies are engaged in developing advanced sensors for improving the capabilities of cameras. These sensors will be used in the upcoming action cameras.

| Report Coverage | Details |

| Market Size in 2026 | USD 8.43 Billion |

| Market Size by 2035 | USD 22.63 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 11.6% |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Segments Covered | By Product, By Resolution, By Distribution Channel, By Application |

| Market Analysis (Terms Used) | Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled | DRIFT, Garmin Ltd., GoPro Inc., Nikon Inc., Olympus Corporation, Panasonic Holdings Corporation, SJCAM, Sony Group Corporation, DJI, YI Technology |

Why Box Style Camera Segment Dominated the Market in 2024?

The box style camera segment led the market. The adoption of box style cameras for enhancing security and surveillance has boosted the market expansion. Additionally, numerous advantages of these cameras including flexible mounting, versatility, high-quality imaging, flexible mounting and some others is expected to accelerate the growth of the action camera market.

Why did the SD & Full HD Segment Dominate the Industry in 2024?

The SD & Full HD segment dominated the market. The growing adoption of full HD cameras by the automotive sector in several nations including Australia, Netherlands, Canada and some others has boosted the industrial expansion. Moreover, numerous benefits of SD cameras such as reliability, cost-effectiveness, fast access, and some others is expected to propel the growth of the action camera market.

What Made the Sports Segment Dominant in the Action Camera Market in 2024?

The sports segment held the largest share of the action camera industry. The rising popularity of motorsports in numerous countries such as Germany, Japan, Canada and some others has driven the market growth. Moreover, partnerships among camera manufacturers and sport organizations to deploy advanced camera systems in sporting events is expected to boost the growth of the action camera market.

Why did the E-Commerce Segment Led the Action Camera Market in 2024?

The e-commerce segment held the lions share of the action camera market. The rapid expansion of the e-commerce sector in several nations including the U.S., UK, Germany, China and some others has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the online retail industry is expected to drive the growth of the action camera market.

.jpg)

How North America Dominated the Action Camera Market in 2024?

North America held a dominant share of the market. The growing sales of 360-degree cameras in several countries including the U.S. and Canada has driven the market expansion. Also, the availability of action cameras in the e-commerce sector coupled with technological advancements in the camera industry is playing a vital role in shaping the industrial landscape. Moreover, the presence of several market players such as Garmin Ltd, GoPro Inc., FLIR Systems and some others is expected to accelerate the growth of the action camera market in this region.

U.S. is the prominent contributor in this region. The rising demand for high-quality automotive cameras from the car manufacturers coupled with rapid expansion of the electronics industry has boosted the market growth. Moreover, the increasing popularity of moto-sport events along with rise in number of electronics startups is contributing to the industry positively.

Why is Asia Pacific the fastest growing region in the industry?

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The increasing demand for ultra-HD cameras in several nations such as China, India, Japan, South Korea, Singapore and some others has boosted the market growth. Additionally, rise in number of camera startups coupled with rapid investment by market players for opening up new production centres is contributing to the industry in a positive manner. Moreover, the presence of numerous camera manufacturers such as Sony Group Corporation, Nikon Inc., Olympus Corporation and some others is expected to propel the growth of the action camera market in this region.

China is the major contributor in this region. The availability of raw materials at less prices along with rapid expansion of camera manufacturing sector has boosted the market growth. Also, the growing development in the e-commerce industry as well as presence of several electronic brands is playing a vital role is shaping the industrial landscape.

What made Europe to hold a notable share of the market?

Europe held a notable share of the industry. The surging demand for high-quality action cameras from the sporting industry in several nations such as Germany, France, Italy, UK and some others has boosted the market expansion. Also, rapid investment by government for deploying advanced surveillance cameras in isolated areas to enhance border security is contributing to the industry in a positive manner. Moreover, the presence of several market players such as Leica Camera AG, Mobotix AG, Zeiss and some others is expected to drive the growth of the action camera market in this region.

.jpg) Germany is the leading country in this region. The growing popularity of bullet style camera along with rapid expansion of the tourism sector has driven the industrial expansion. Moreover, the rising consumer interest towards water sports activities is contributing to the industry in a positive manner.

Germany is the leading country in this region. The growing popularity of bullet style camera along with rapid expansion of the tourism sector has driven the industrial expansion. Moreover, the rising consumer interest towards water sports activities is contributing to the industry in a positive manner.

| Company | Headquarters | Offerings |

| DRIFT | London, England | Drift is involved in developing action cameras with several features such as rotatable lenses and long battery life. |

| Garmin Ltd. | Kansas, United States | Garmin Ltd. is a global technology company that designs and manufactures a wide range of devices and wearable technology for the automotive, aviation, marine, outdoor, and fitness markets. |

| GoPro Inc. | California, United States | GoPro Inc. is an American technology company founded in 2002. This brand designs and sells action cameras, mounts, accessories, and related software. |

| Nikon Inc. | Tokyo, Japan | Nikon Inc. is a Japanese multinational corporation that specializes in optical products and technologies. Its core businesses include Imaging Products (cameras and lenses), Precision Equipment (semiconductor and FPD lithography systems), Healthcare (microscopes, diagnostic imaging), Components (optical components, encoders, inspection systems), and Digital Manufacturing (3D metal printers). |

| Olympus Corporation | Tokyo, Japan | Olympus Corporation is a Japanese medical technology company headquartered in Tokyo, founded in 1919. This brand manufactures a wide range of digital cameras and voice recorders. |

| Panasonic Holdings Corporation | Tokyo, Japan | Panasonic Holdings Corporation is a Japanese multinational electronics company that develops and manufactures a wide range of products such as home appliances, automotive systems, and energy solutions. |

| SJCAM | Shenzhen, China | SJCAM is a brand that designs, develops, and sells action cameras, sports cameras, and other related products. The company is known for its popular and affordable action cameras. |

| Sony Group Corporation | Tokyo, Japan | Sony is a Japanese multinational conglomerate with a diverse portfolio encompassing consumer electronics, gaming, entertainment, and financial services. This brand has a significant presence in professional products, imaging sensors, and financial services. |

| DJI | Shenzhen, China | DJI, or SZ DJI Technology Co., Ltd., is a Chinese technology company and the worlds largest manufacturer of commercial drones. It produces a wide range of unmanned aerial vehicles (UAVs) and imaging products, including professional and consumer-grade drones, camera stabilizers. |

| YI Technology | Shanghai, China | YI Technology is a company based in Shanghai, China, that develops smart cameras and computer vision technology for consumer electronics. This companys products include action cameras, smart home security cameras, and dashcams. |

Strength

Weakness

Opportunity

Threats

By Product Outlook

By Resolution Outlook

By Distribution Channel Outlook

By Application Outlook

The system integration market is experiencing rapid growth due to the rising demand for advanced security solu...

January 2026

December 2025

December 2025

December 2025